- United States

- /

- Software

- /

- NasdaqGM:RZLV

Rezolve AI (RZLV): Losses Worsen by 38.9% Annually Despite Strong Growth Forecasts Challenging Bull Narratives

Reviewed by Simply Wall St

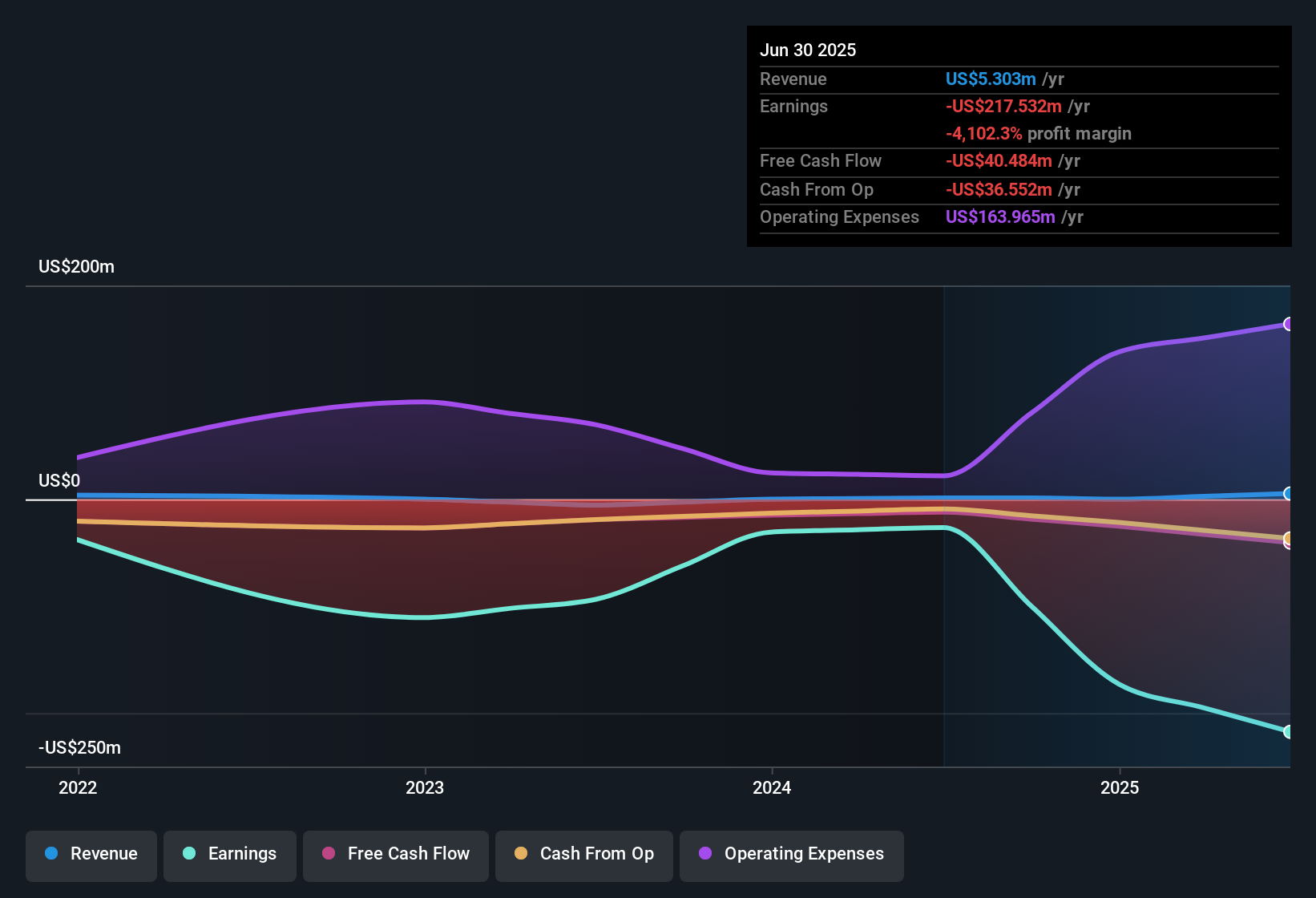

Rezolve AI (RZLV) continues to operate at a loss, with net losses accelerating by 38.9% annually over the past five years. Despite negative equity, signaled by a deeply negative Price-To-Book Ratio of -127.6x compared to both peer and industry averages, the company’s earnings are forecast to surge 117.9% per year while revenue is expected to climb 95% annually. These projections are both well ahead of market norms. Shares currently trade at $6.28, notably below an estimated fair value of $10.85, giving investors reasons to consider the stock’s outsized growth forecasts alongside financial risks and share price volatility.

See our full analysis for Rezolve AI.Next, we’ll put these headline numbers in context by weighing them against the dominant narratives and expectations shaping Rezolve AI’s story in the market.

Curious how numbers become stories that shape markets? Explore Community Narratives

Book Value Deep in Negative Territory

- Rezolve AI’s Price-To-Book Ratio stands at -127.6x, an extreme negative position not only compared to the peer average of 17.3x but also well below the broader US software industry average of 4x. This demonstrates that the company’s liabilities significantly outweigh its assets on paper.

- Despite the sharply negative equity, market perspective notes that sector momentum and attention on AI-driven automation could amplify both upside and downside swings for companies with unusual financial profiles.

- This deeply negative Price-To-Book Ratio highlights that Rezolve AI remains an outlier in the sector. Cautious investors may watch to see whether rapid projected growth can lead to a turnaround in the company’s balance sheet health.

- Although industry momentum often rewards fast growers, any further deterioration in equity or asset base could quickly trigger valuation concerns and increase volatility. This remains an important risk factor for current and prospective shareholders.

Losses Accelerate Even as Growth Forecasts Climb

- Annual net losses have increased at an average rate of 38.9% over the last five years. This underscores that Rezolve AI is still a long way from break-even, even as projections call for 117.9% earnings growth per year ahead.

- Prevailing analysis highlights the tension between surging losses and aggressive forward growth forecasts.

- Even with rapid projected revenue and earnings growth, Rezolve AI’s expanding losses draw attention to execution risk. The company must dramatically reverse its track record before investors can meaningfully benefit from long-term AI sector tailwinds.

- The imbalance between accelerating losses and high growth targets serves as a double-edged sword, appealing to growth seekers but demanding extra scrutiny around when, or if, improving fundamentals will actually show up in future results.

Trading at a Deep Discount to DCF Fair Value

- Shares currently trade at $6.28, which is significantly below the DCF fair value estimate of $10.85 and well under the peer Price-To-Book average. This positions Rezolve AI as optically cheap by traditional valuation methods but with outsized risk due to its negative equity.

- According to market view, the sizable gap between trading price and DCF fair value may attract bargain hunters but comes with caveats.

- While some investors may see the current discount as an opportunity, any negative surprises in execution, share price instability, or further balance sheet deterioration could quickly overshadow potential upside.

- The apparent value gap highlights why financial risks and sector volatility must be considered in tandem with headline discounts, as even deep dislocations to fair value are not always a clear buying signal in the AI innovation space.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Rezolve AI's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Rezolve AI’s deeply negative equity and accelerating net losses highlight ongoing concerns about its financial stability and the question of whether rapid growth will ultimately restore balance sheet health.

If you want more peace of mind about a company’s finances, browse solid balance sheet and fundamentals stocks screener where you’ll find businesses with stronger reserves and lower debt risk now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RZLV

Rezolve AI

Provides generative AI solutions for the retail and e-commerce sectors in the United Kingdom and the United States.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion