- United States

- /

- Capital Markets

- /

- NasdaqGS:DHIL

3 Undervalued Small Caps In US With Insider Action To Consider

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.2% drop, yet it remains up by 18% over the past year with earnings forecasted to grow by 14% annually. In this fluctuating environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider activity can provide potential opportunities for investors seeking growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| McEwen Mining | 3.7x | 1.9x | 49.31% | ★★★★★☆ |

| Shore Bancshares | 11.6x | 2.6x | -2.60% | ★★★★☆☆ |

| German American Bancorp | 13.9x | 4.7x | 47.60% | ★★★★☆☆ |

| First United | 11.8x | 3.2x | 36.97% | ★★★★☆☆ |

| Quanex Building Products | 29.1x | 0.8x | 41.39% | ★★★★☆☆ |

| Eagle Financial Services | 7.4x | 1.6x | 37.43% | ★★★★☆☆ |

| Citizens & Northern | 12.5x | 3.0x | 41.34% | ★★★☆☆☆ |

| West Bancorporation | 15.8x | 4.8x | 35.37% | ★★★☆☆☆ |

| Franklin Financial Services | 14.9x | 2.4x | 23.67% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -64.60% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Diamond Hill Investment Group (NasdaqGS:DHIL)

Simply Wall St Value Rating: ★★★★☆☆

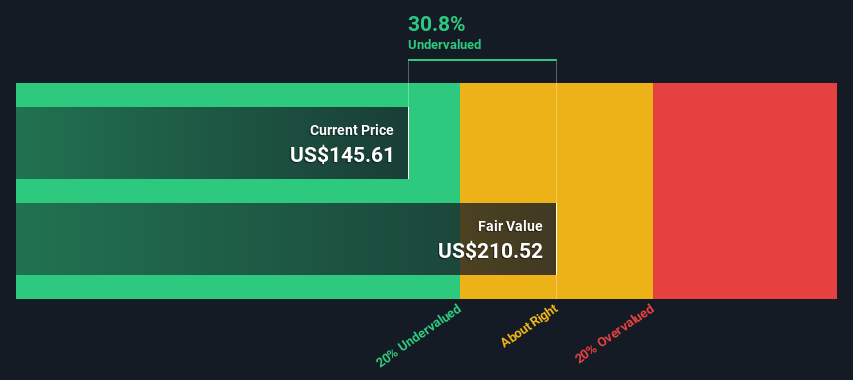

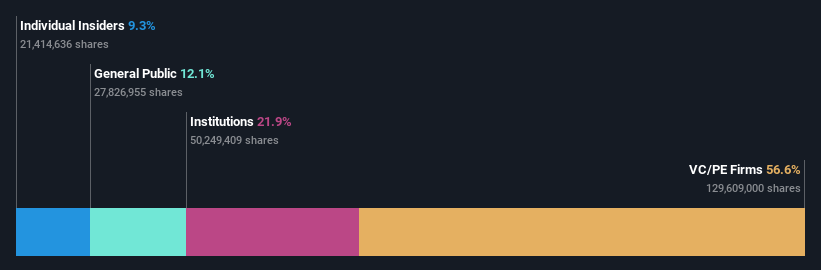

Overview: Diamond Hill Investment Group operates by providing investment advisory and related services, with a market capitalization of approximately $0.52 billion.

Operations: The primary revenue stream is from investment advisory and related services, with a recent quarterly revenue of $145.80 million. The company's cost structure includes significant costs of goods sold, which recently amounted to $86.84 million, impacting the gross profit margin that has shown variability, most recently recorded at 40.44%. Operating expenses are substantial as well, with general and administrative expenses being a notable component. Net income for the latest quarter was $49.40 million, resulting in a net income margin of 33.88%.

PE: 8.1x

Diamond Hill Investment Group, a smaller U.S. company, is potentially undervalued. Despite a 1.1% annual earnings decline over the last five years, insider confidence is evident with share purchases in Q4 2024. The firm relies solely on external borrowing for funding, which poses higher risk compared to customer deposits. However, this financial structure might offer opportunities if managed well amidst market dynamics and strategic growth initiatives in the investment management sector.

- Navigate through the intricacies of Diamond Hill Investment Group with our comprehensive valuation report here.

Learn about Diamond Hill Investment Group's historical performance.

Rackspace Technology (NasdaqGS:RXT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Rackspace Technology is a cloud computing company that provides managed services across public and private cloud environments, with a market cap of approximately $1.33 billion.

Operations: The company's revenue is primarily generated from its Public Cloud and Private Cloud segments. Over recent periods, the gross profit margin has shown a declining trend, reaching 20.21% in the latest report. Operating expenses have consistently been a significant portion of costs, with General & Administrative Expenses being a notable component.

PE: -0.8x

Rackspace Technology, a smaller player in the tech industry, faces challenges with its current unprofitability and reliance on external borrowing. Despite this, they have formed a significant 10-year partnership with Seattle Children's Hospital to modernize their IT infrastructure, showcasing their expertise in managed cloud solutions. Recent leadership changes bring fresh perspectives to the board. Although no insider confidence through share purchases has been reported recently, Rackspace's strategic initiatives could potentially enhance its market position over time.

Cooper-Standard Holdings (NYSE:CPS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Cooper-Standard Holdings is a company that specializes in manufacturing and supplying systems such as sealing and fluid handling for the automotive industry, with a market cap of $1.25 billion.

Operations: Sealing Systems and Fluid Handling Systems are key revenue streams, contributing significantly to the overall revenue. The company's gross profit margin has shown variability, reaching 11.09% by the end of 2024. Operating expenses have consistently impacted profitability, with recent figures around $217 million to $232 million.

PE: -3.2x

Cooper-Standard Holdings, a smaller player in the automotive parts industry, recently reported Q4 2024 earnings with sales of US$660.75 million and net income of US$40.21 million, turning around from a loss last year. Despite its reliance on external borrowing for funding, which poses higher risk, insider confidence is evident as they have been purchasing shares over recent months. The company forecasts 2025 sales between US$2.7 billion and US$2.8 billion, suggesting potential growth despite current unprofitability expectations over the next three years.

- Click here to discover the nuances of Cooper-Standard Holdings with our detailed analytical valuation report.

Understand Cooper-Standard Holdings' track record by examining our Past report.

Key Takeaways

- Navigate through the entire inventory of 51 Undervalued US Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DHIL

Diamond Hill Investment Group

Through its subsidiary, Diamond Hill Capital Management, Inc., provides investment advisory and fund administration services in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives