- United States

- /

- Software

- /

- NasdaqGM:RPD

Rapid7 (RPD): Valuation Check After New HITRUST Compliance Partnership and Cybersecurity Risk Outlook

Reviewed by Simply Wall St

Rapid7 (RPD) just deepened its compliance and security story by teaming up with HITRUST to automate evidence collection and continuous control validation, while also publishing 2026 threat predictions that lean heavily into insider risk and geopolitical cyber fallout.

See our latest analysis for Rapid7.

Despite these moves to sharpen its compliance and threat story, Rapid7’s recent performance is mixed, with a strong 1 month share price return of 16.5% from $16.35 but a much weaker year to date share price return and multi year total shareholder returns. This suggests sentiment is stabilising from a low base rather than surging.

If this kind of security driven rebound has your attention, it could be worth seeing which other names are gaining traction across high growth tech and AI stocks right now.

Yet with shares still down sharply over one and five years, trading below analyst targets and intrinsic value estimates, the real debate now is simple: is Rapid7 a contrarian buy or is the market already pricing in a turnaround?

Most Popular Narrative: 19.7% Undervalued

Rapid7's most followed narrative pegs fair value near $20.37 per share versus a $16.35 last close, framing upside as a function of execution, not hype.

Strategic investments in exposure management and integration of on premise and cloud risk solutions are resulting in larger upgrade deals and higher ASPs than initially forecast, though with longer sales cycles. This indicates an underappreciated upsell and cross sell runway that could drive significant ARR and margin gains once go to market execution matures.

Want to see why modest top line growth assumptions still back a richer valuation? The crux is aggressive earnings scaling and a future multiple usually reserved for sector leaders. Curious which profit trajectory and discount rate make that math work? Read on to unpack the full playbook behind this fair value call.

Result: Fair Value of $20.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, longer deal cycles and intensifying competition could delay ARR momentum, which may force investors to reassess how quickly Rapid7 grows into its assumed premium multiple.

Find out about the key risks to this Rapid7 narrative.

Another Angle on Valuation

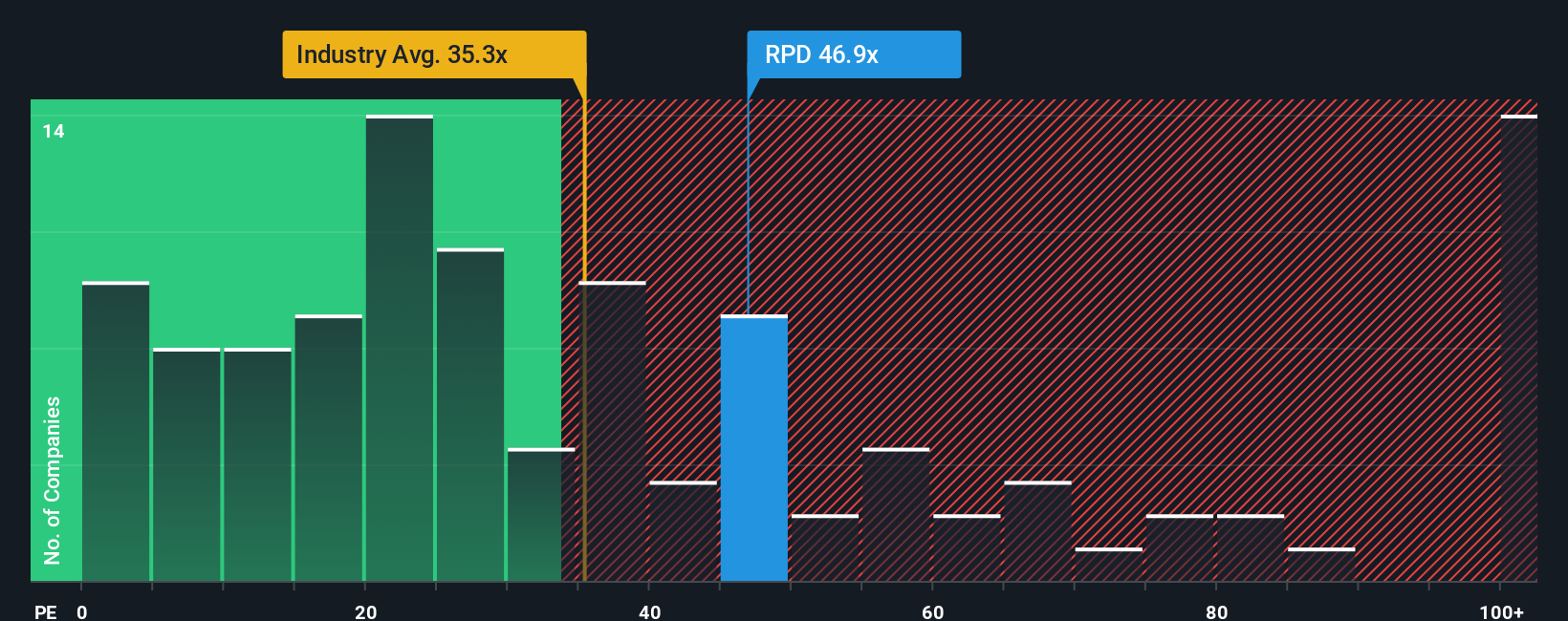

Multiples tell a tougher story. Rapid7 trades on a 47.7x price to earnings ratio versus 32.9x for US software peers and a 34.7x fair ratio, suggesting the market is already paying up despite weak recent returns. If sentiment turns again, how quickly could that premium unwind?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rapid7 Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh take in minutes: Do it your way.

A great starting point for your Rapid7 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s Screener to work so you do not miss high conviction opportunities that match your preferred style and risk profile.

- Capitalize on mispriced opportunities by scanning these 908 undervalued stocks based on cash flows that combine solid cash flows with appealing entry points.

- Ride structural growth trends by targeting innovation focused names across these 26 AI penny stocks powering the next wave of automation and intelligence.

- Boost potential income streams by reviewing these 13 dividend stocks with yields > 3% that may strengthen your portfolio’s yield and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)