- United States

- /

- Software

- /

- NasdaqGM:RPD

Has Rapid7’s 54% Share Price Drop Created a New Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Rapid7 is priced right for your portfolio? If you are searching for value in a tech stock that has been on the radar, you are in the right place.

- After a tough stretch, Rapid7 shares are down nearly 54% year-to-date, extending their slump to almost 56% over the last year.

- Investors have been reacting to various news headlines, including sector-wide shifts in cybersecurity sentiment and increased competition. Both of these factors have put downward pressure on the stock. Stories about tighter IT budgets and new regulatory developments have added even more complexity to the recent price movement.

- According to our latest checks, Rapid7 scores a 2 out of 6 on core valuation metrics, so it is worth digging deeper into how analysts and the market measure value for this company. We'll explore those valuation approaches next, but stick around until the end because there is a smarter, data-driven way to get the full story on whether Rapid7 is truly undervalued.

Rapid7 scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rapid7 Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to reflect what they are worth today. This method helps investors understand how much those expected future profits are really worth if received now, rather than years down the line.

For Rapid7, the current Free Cash Flow (FCF) stands at $160 million. Analysts provide reliable projections for the next several years, estimating that annual FCF growth will lift Rapid7's FCF to approximately $161 million by 2027. Beyond that, forecasts out to 2035 are extrapolated rather than based on professional analyst consensus, but they suggest a gradual increase in FCF each year, reflecting modest long-term growth.

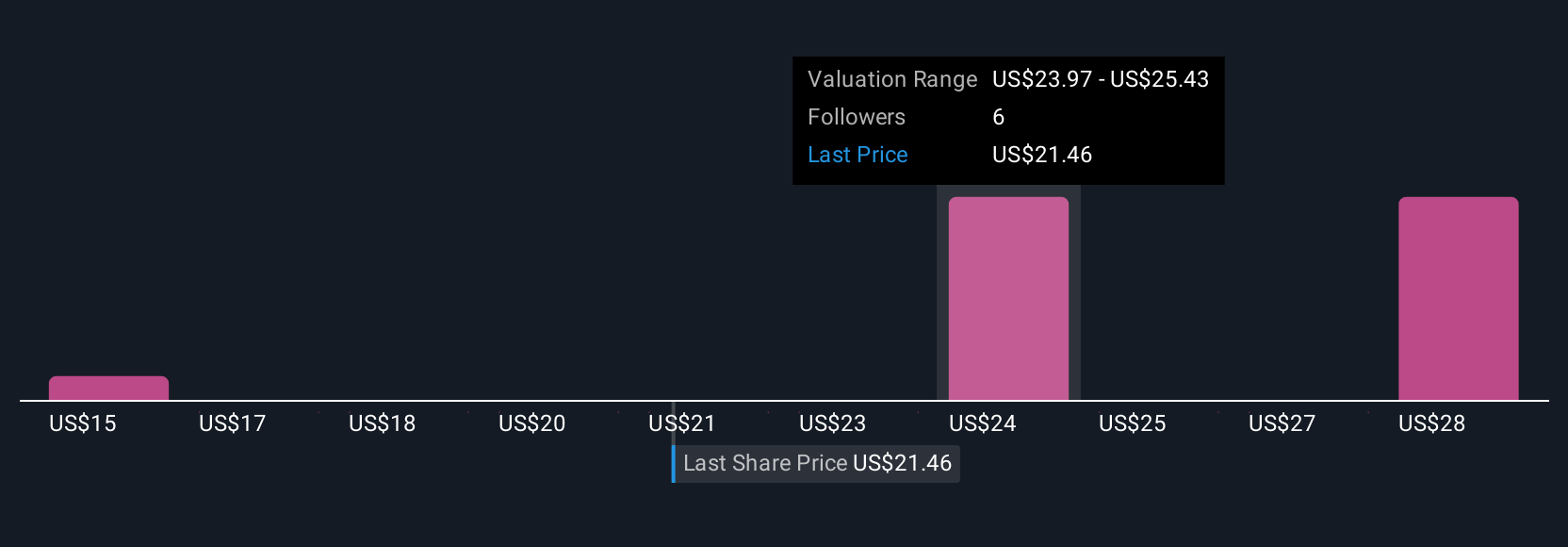

By discounting these cash flows to today's dollars using a two-stage model, the DCF analysis estimates Rapid7's fair value at $31.10 per share. This value is 41.2% above the current share price, which indicates that the stock is meaningfully undervalued if you focus on its future earning potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rapid7 is undervalued by 41.2%. Track this in your watchlist or portfolio, or discover 853 more undervalued stocks based on cash flows.

Approach 2: Rapid7 Price vs Earnings

For profitable companies like Rapid7, the Price-to-Earnings (PE) ratio is a widely-used and informative valuation tool. It shows how much investors are currently willing to pay for each dollar of earnings, helping you gauge if a stock is cheap or expensive compared to its profit stream.

A "normal" or fair PE ratio varies from company to company, depending on how quickly earnings are expected to grow and how risky the business is. Companies with faster growth and lower risk typically command higher PE ratios, as investors expect more earnings in the future.

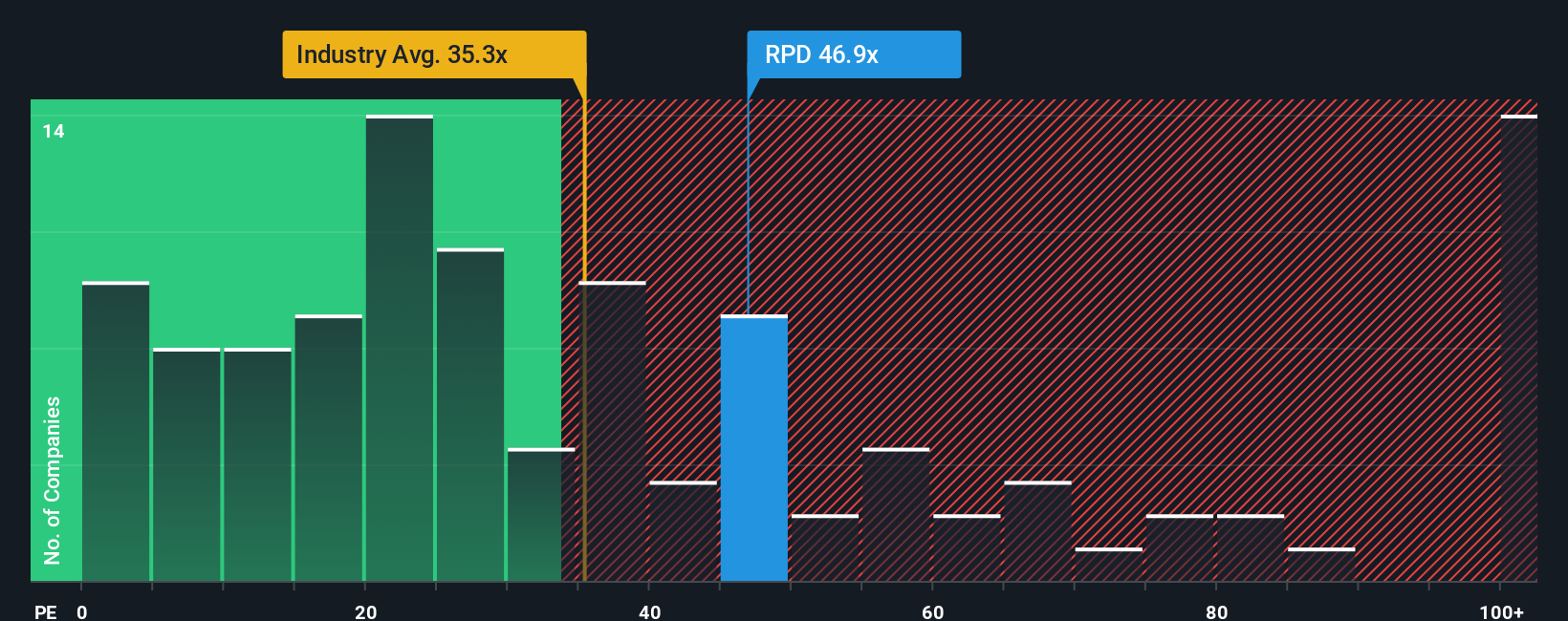

Rapid7's current PE ratio stands at 42.2x, which is slightly higher than the peer average of 40.9x and well above the Software industry average of 34.3x. At first glance, this suggests the market is assigning a premium to Rapid7 relative to many of its peers.

However, instead of relying solely on these broad benchmarks, Simply Wall St’s proprietary "Fair Ratio" offers a more tailored perspective by accounting for factors unique to Rapid7. This includes its earnings growth prospects, profit margins, industry, overall size, and risk profile. In this case, the Fair Ratio for Rapid7 is calculated as 35.3x, which is lower than the company’s current PE of 42.2x.

Because Rapid7’s PE is noticeably above its Fair Ratio, our analysis suggests the stock is currently overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rapid7 Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative allows you to form your unique perspective on a company by combining the story you believe in with your own financial assumptions, such as fair value, expected revenue, earnings, and margins. Rather than just looking at numbers in isolation, Narratives link Rapid7’s real-world story to a financial forecast and then to a calculated fair value, giving your investment decisions far more personal relevance and context.

Narratives make this process simple and accessible right within Simply Wall St’s Community page, where millions of investors already share and discuss their views. With Narratives, you can track how your personal fair value compares to the current market price, helping you better decide when to consider buying or selling. What’s more, Narratives are dynamic and automatically update as soon as important events such as new earnings releases or major news come to light, so your view is always relevant.

For example, one Rapid7 Narrative might focus on opportunities in AI automation and government contracts, leading to an optimistic fair value near $34.00 per share. A more cautious Narrative could emphasize longer sales cycles and competitive risks, placing fair value closer to $16.00. This illustrates how Narratives empower you to make data-driven, story-backed decisions tailored to your own beliefs and research.

Do you think there's more to the story for Rapid7? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion