- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Evaluating Valuation After Bitcoin’s Drop Drives Recent Stock Pullback

Reviewed by Simply Wall St

Most Popular Narrative: 24% Undervalued

According to the community narrative, RIOT is currently trading below what analysts consider its fair value. The main reasons for this assessment are the company's aggressive investment strategy and the anticipated potential from its expanding data center and Bitcoin mining operations.

The company's expansion of vertically integrated mining operations, coupled with the ongoing deployment of new, more efficient hardware and a continued focus on operational efficiency, supports increased hash rate and lower unit costs. This enhances Bitcoin production and potential gross profit even as mining difficulty rises.

How much could an ambitious business blueprint be worth? There is a game-changing strategy at the center of this projection, with high expectations for significant gains in revenue and future profitability. Want to know what drives such a bold valuation? Here are the numbers and assumptions influencing analysts toward this price target.

Result: Fair Value of $17.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a significant Bitcoin price drop or delays in fully utilizing new data center capacity could quickly undermine these bullish expectations for Riot.

Find out about the key risks to this Riot Platforms narrative.Another View: Multiples Tell a Different Story

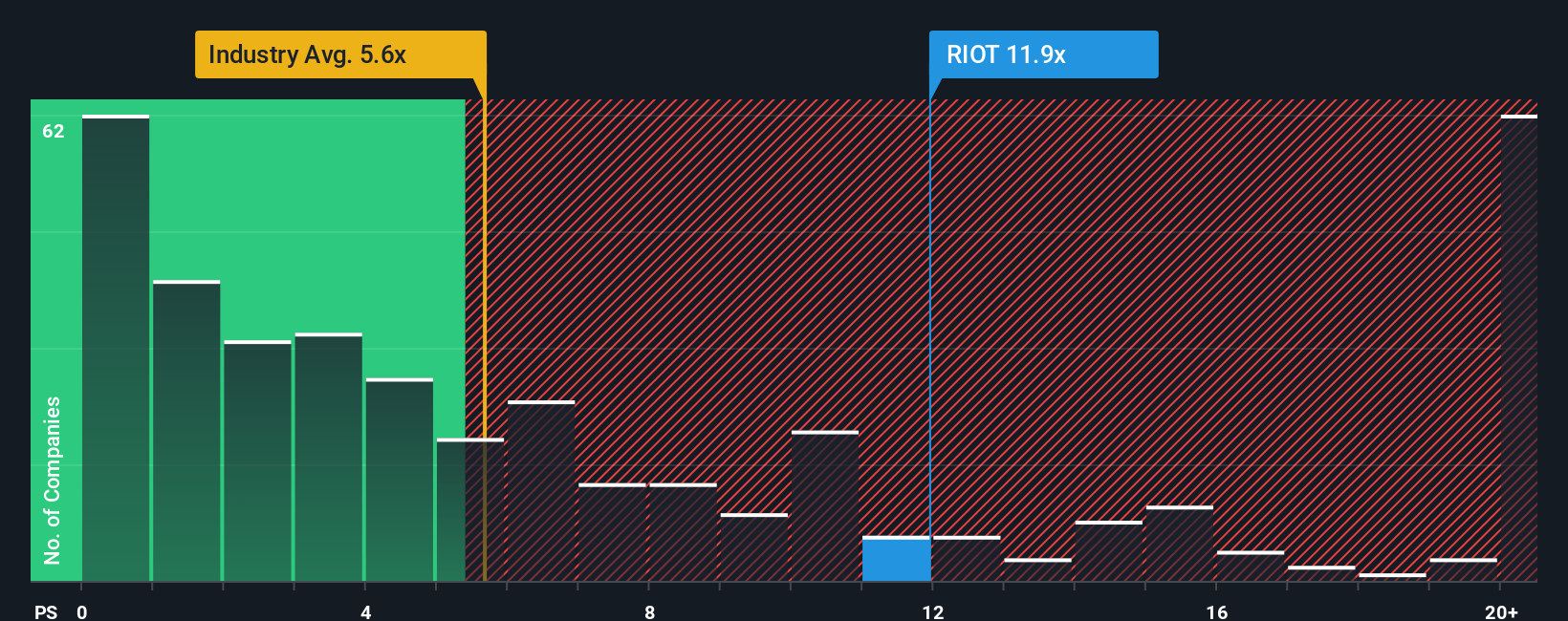

While the community sees Riot as undervalued, the standard price-to-sales ratio draws a different conclusion. This ratio shows the shares look expensive compared to the broader US Software industry. Which method best captures Riot’s real potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you have your own take or want to dive deeper into the numbers, creating your own narrative takes just a few minutes. So why not do it your way?

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Why settle for just one opportunity when there are so many powerful ways to strengthen your portfolio right now? Make sure you do not miss out on these standout market ideas that could give your next investing decision an edge:

- Target strong income by scouting companies offering reliable yields greater than 3% with dividend stocks with yields > 3%. This can provide a steady approach to long-term returns.

- Uncover the latest advancements at the intersection of healthcare and technology through healthcare AI stocks, where innovation aligns with medical breakthroughs.

- Accelerate your search for stocks with the most attractive prices using undervalued stocks based on cash flows to seize undervalued gems others might overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives