- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Assessing Valuation After Record Bitcoin Production and Strong Cost Control in August 2025

Reviewed by Simply Wall St

Riot Platforms (RIOT) just posted its highest-ever monthly Bitcoin production, cranking out 477 BTC in August 2025. This marks a jump of 48% over last year’s August numbers. The company not only increased its output but did so while holding power costs steady at just 2.6 cents per kilowatt hour. For investors watching the mining space, this combination of record production and disciplined costs is stirring up plenty of fresh debate about where Riot stands in the ever-challenging world of Bitcoin mining.

This milestone comes after a year of steady momentum for Riot. The stock is up nearly 97% over the past twelve months, and almost 29% in the past three months alone, signaling a clear shift in how the market is digesting Riot’s operational consistency and scale-up strategy. Recent gains have been supported by steady revenue growth, operational updates, and Riot’s growing Bitcoin reserves. The company’s disciplined approach appears to be earning investor trust for now, even as the sector continues to face swings in Bitcoin’s price and regulatory headlines.

But here is the big question for anyone eyeing the stock today: is Riot Platforms actually undervalued after this year’s run, or is the market already looking ahead and pricing in more growth?

Most Popular Narrative: 22.7% Undervalued

According to the most widely followed narrative, Riot Platforms stock is seen as undervalued. Current prices are viewed as reflecting a significant discount compared to future earnings expectations, which are based on aggressive expansion and operational scale.

The company's expansion of vertically integrated mining operations, along with ongoing deployment of new, more efficient hardware and a continued focus on operational efficiency, supports increased hash rate and lower unit costs. This enhances Bitcoin production and potential gross profit even as mining difficulty rises.

Eager to understand what is fueling this bullish outlook? The narrative points to surging growth ambitions, operational pivots, and several notable financial projections. Which key assumptions shape that fair value target, and do they defy the norm for typical miners? Explore the full narrative to uncover the specific profit assumptions and cash flow estimates behind this intriguing valuation.

Result: Fair Value of $17.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting Bitcoin prices or delays in data center leasing could quickly undermine Riot’s optimism and put pressure on the company’s ambitious growth outlook.

Find out about the key risks to this Riot Platforms narrative.Another View: High Revenue, But Shares Look Pricey

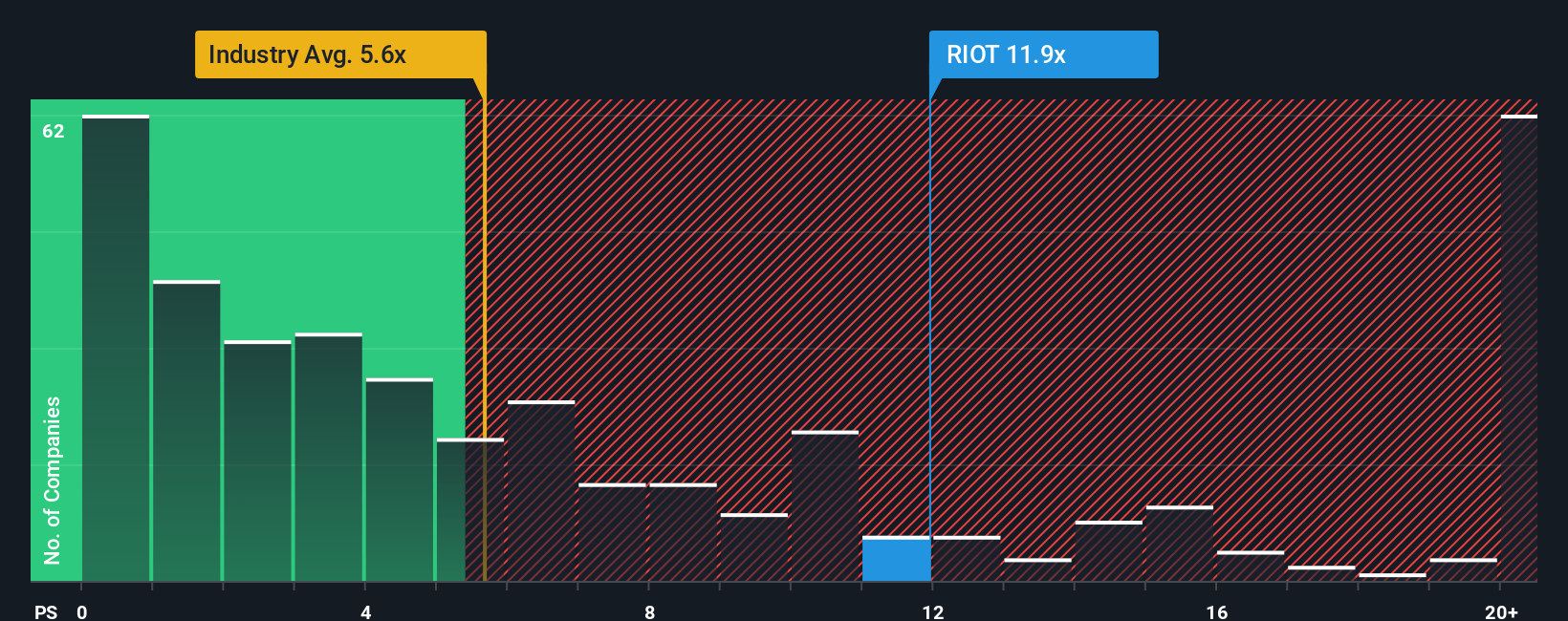

Looking at things another way, valuation based on sales suggests the stock is expensive compared to the industry average. This view challenges the bullish earnings assumptions. Which side of the debate will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you think there might be more to the story or prefer to dive into the numbers yourself, it is simple to create your own take on Riot Platforms in just a few minutes. Do it your way.

A great starting point for your Riot Platforms research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Take your portfolio beyond a single stock and seize new opportunities with our handpicked investment ideas. Your next winning strategy could be just a click away.

- Capture tomorrow's tech breakthroughs by searching for quantum innovators who are leading advances in computation and real-world applications with quantum computing stocks.

- Pursue strong long-term income by targeting companies delivering reliable yields via dividend stocks with yields > 3%.

- Accelerate your returns by tracking undervalued businesses that the market may be overlooking, all thanks to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion