- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Assessing Valuation After Recent Pullback and Flat 1-Year Share Performance

Reviewed by Simply Wall St

Riot Platforms (RIOT) has quietly pulled back, with the stock down around 13% over the past week and roughly flat over the past year, even as its long term, Bitcoin linked story remains intact.

See our latest analysis for Riot Platforms.

That pullback reflects fading near term momentum, with a 90 day share price return of negative 23.6 percent, but the stock still sits on a hefty three year total shareholder return above 250 percent. This suggests investors are reassessing risk rather than abandoning the long term Bitcoin mining story.

If Riot’s volatility has you thinking more broadly about growth themes, this could be a good moment to explore other high growth tech and AI names through high growth tech and AI stocks.

With shares drifting despite strong multi year returns and analysts seeing upside from here, is Riot now trading below its true potential, or are investors already factoring in the next leg of Bitcoin driven growth?

Most Popular Narrative: 51% Undervalued

With Riot Platforms last closing at $13.47 against a narrative fair value of $27.50, the valuation framework implies substantial upside if its thesis plays out.

The ability to monetize megawatts flexibly, by shifting power use between mining and data centers depending on market conditions, maximizes asset utilization and provides a natural margin hedge, underpinning higher and more stable net margins.

Curious how a power heavy bitcoin miner justifies a premium style valuation on future earnings and margins while analysts still see huge dispersion in outcomes? Unpack the revenue ramp, margin shift, and bold profit multiple assumptions driving this fair value narrative.

Result: Fair Value of $27.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on Riot successfully filling new AI data centers and navigating Bitcoin price volatility, which could quickly undermine those bullish assumptions.

Find out about the key risks to this Riot Platforms narrative.

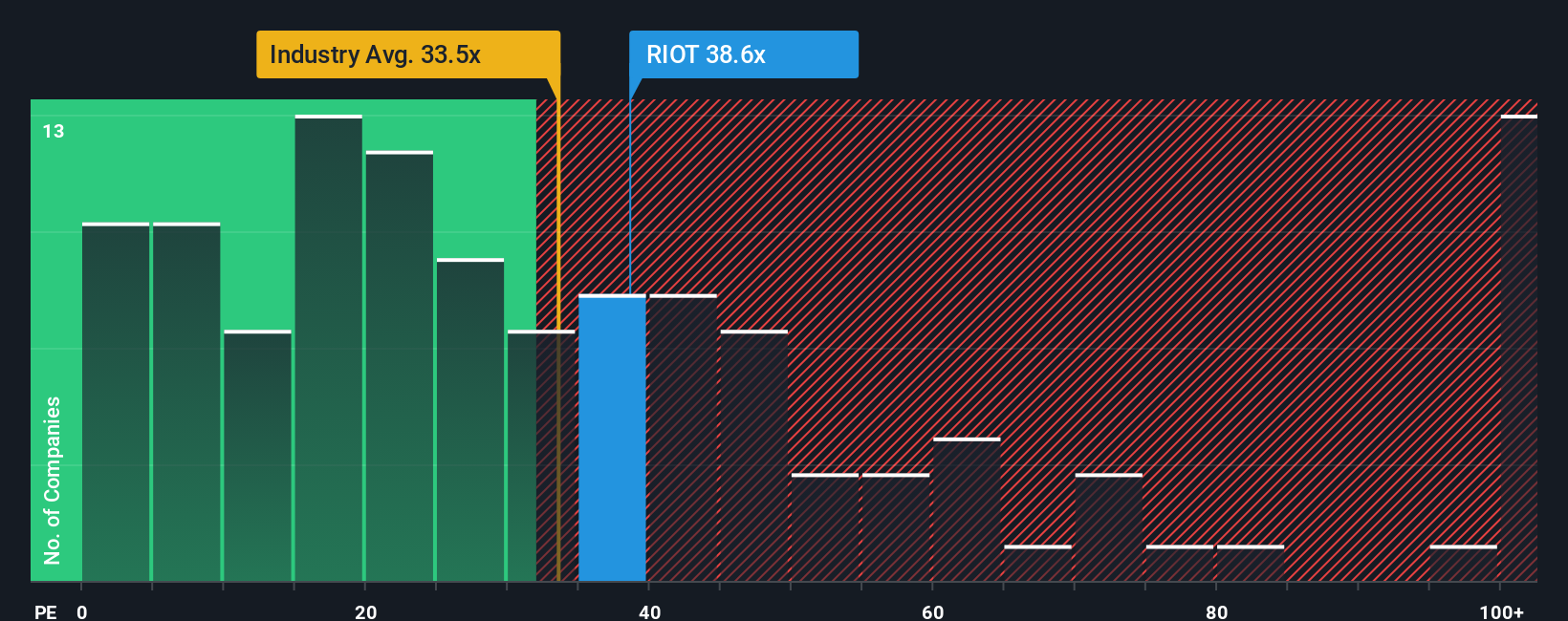

Another View: Earnings Multiple Sends a Different Signal

While the fair value narrative points to more than 50 percent upside, Riot currently trades at about 30.5 times earnings versus a fair ratio of 7.5 times and a peer average of 22 times. That premium suggests meaningful valuation risk if the AI and Bitcoin story stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you see Riot’s story differently or simply want to test your own assumptions, you can quickly build a complete narrative yourself: Do it your way.

A great starting point for your Riot Platforms research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity; use the Simply Wall St Screener now to uncover focused ideas that match your strategy before the market prices them in.

- Capture early stage growth potential by targeting these 3625 penny stocks with strong financials that already boast resilient balance sheets and credible fundamentals.

- Capitalize on the AI wave by zeroing in on these 25 AI penny stocks that blend innovation, scale, and accelerating revenue momentum.

- Lock in quality income streams by scanning these 13 dividend stocks with yields > 3% that can support reliable cash payouts through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)