- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (NasdaqCM:RIOT) Sees 18% Drop In Last Week Despite Increased Bitcoin Production

Reviewed by Simply Wall St

Riot Platforms (NasdaqCM:RIOT) saw an 18% decline in its share price last week. This drop came on the heels of the company announcing an increase in bitcoin production, with 470 bitcoins produced in February 2025 compared to 418 in the previous year. Despite these operational improvements, the broader market context was challenging. Investors were focused on looming tariffs that fueled economic concerns, resulting in volatile trading across the market. With the S&P 500 and Nasdaq recently showing weak performances and economic factors like job reports creating additional uncertainty, Riot Platforms' share price decline reflects these broader trends impacting investor sentiment.

Riot Platforms has achieved a very large total return over the past five years, marking a period of substantial transformation and capital growth. Throughout these years, the company has leaned into its strengths, notably with increased Bitcoin production capacity. This expansion aligns with their strategic focus on AI and high-performance computing (HPC) projects, leveraging large power assets to potentially provide stable revenue streams. In 2024, the successful energization of the Corsicana Facility's substation was a significant step towards boosting their mining hash rate capacity.

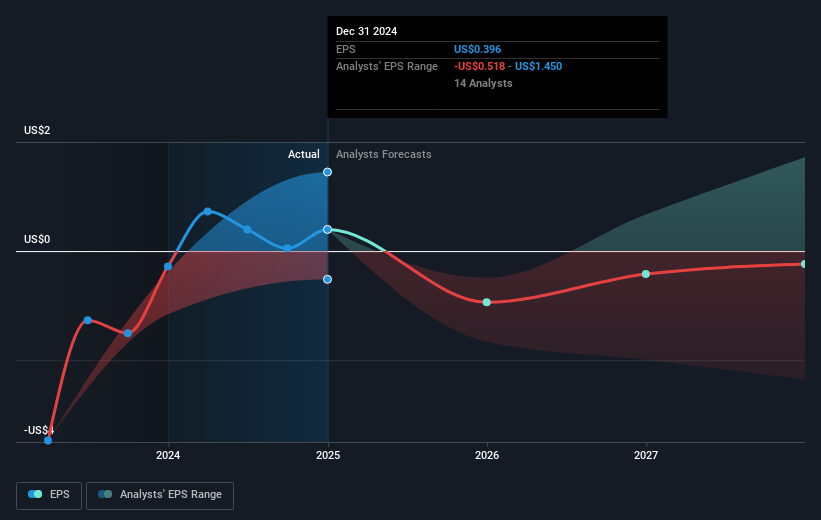

The company has also shored up its financial position by raising capital through equity and debt offerings, as exemplified by their $525 million fixed-income offering in late 2024. Despite experiencing volatility and high capital expenditure demands, Riot Platforms has managed to improve profitability. Over the past year, however, Riot underperformed the broader US market, which highlights current challenges despite its earlier robust growth trajectory.

Our valuation report here indicates Riot Platforms may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Moderate with limited growth.

Similar Companies

Market Insights

Community Narratives