- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms, Inc. (NASDAQ:RIOT) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Despite an already strong run, Riot Platforms, Inc. (NASDAQ:RIOT) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

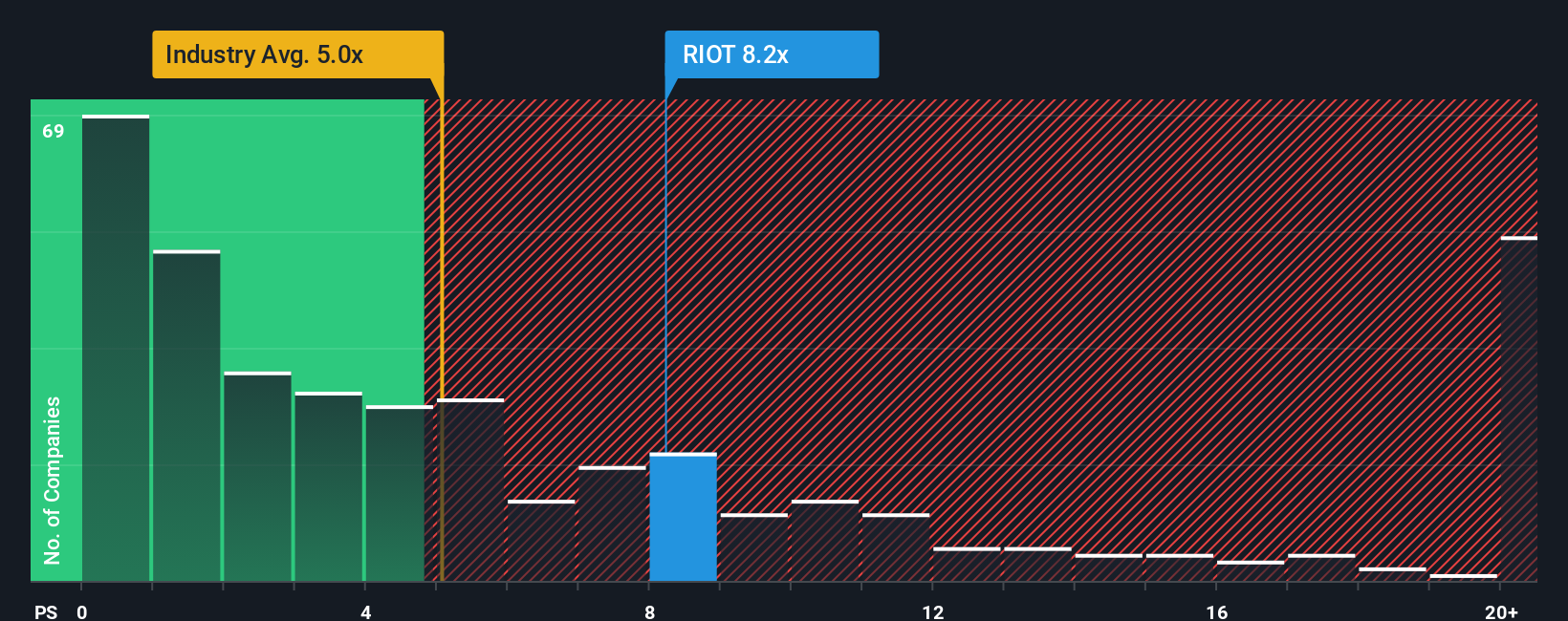

After such a large jump in price, Riot Platforms may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8.2x, when you consider almost half of the companies in the Software industry in the United States have P/S ratios under 5x and even P/S lower than 1.9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Riot Platforms

What Does Riot Platforms' P/S Mean For Shareholders?

Recent times have been advantageous for Riot Platforms as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Riot Platforms' future stacks up against the industry? In that case, our free report is a great place to start.How Is Riot Platforms' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Riot Platforms' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 60% gain to the company's top line. Pleasingly, revenue has also lifted 70% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 28% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 16% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Riot Platforms' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Riot Platforms' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Riot Platforms shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 3 warning signs for Riot Platforms (1 is a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Riot Platforms, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026