- United States

- /

- Software

- /

- NasdaqCM:REKR

Rekor Systems (REKR) Wins Landmark Georgia DOT Deal Will Public Sector Wins Accelerate Adoption?

Reviewed by Sasha Jovanovic

- Rekor Systems recently announced initial deployments of its Rekor Discover® platform with the California and Texas Departments of Transportation, following the award of its largest statewide contract to date, a multi-year agreement with the Georgia Department of Transportation projected to exceed US$100 million in total contract value.

- This momentum reflects accelerated adoption of Rekor’s Data-as-a-Service model by major transportation agencies, highlighting growing demand for non-intrusive, AI-powered traffic data solutions that comply with federal standards.

- We'll explore how Rekor's landmark Georgia contract may influence its investment narrative and prospects for continued public sector adoption.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Rekor Systems Investment Narrative Recap

To back Rekor Systems as a shareholder, you need conviction in the rapid public sector shift toward AI-powered, non-intrusive traffic data and the company's ability to secure and deliver on large-scale, recurring revenue contracts. The Georgia DOT agreement and initial deployments with California and Texas highlight Rekor's progress, but also intensify focus on the pace and reliability of revenue conversion, the key catalyst, while revenue concentration and long procurement cycles continue to weigh as critical risks. The recent news meaningfully supports the near-term growth narrative, but it does not fully resolve the timing and concentration concerns.

Of all Rekor's recent announcements, the multi-year Georgia DOT contract stands out as most relevant: not only is this the largest statewide award in Rekor’s history, but its structure as an opt-in for local governments positions the company for broader exposure and reinforces the shift toward more stable, SaaS-style income. This fits directly with Rekor's ambitions to increase recurring revenue and reduce volatility, potentially offsetting the unpredictable revenue swings typical of hardware-based or one-off deals.

However, on the other side of this momentum, investors should be aware of the heightened customer concentration risk if one of these major contracts were to face delays or...

Read the full narrative on Rekor Systems (it's free!)

Rekor Systems' narrative projects $75.7 million revenue and $9.9 million earnings by 2028. This requires 18.6% yearly revenue growth and a $62.4 million earnings increase from -$52.5 million today.

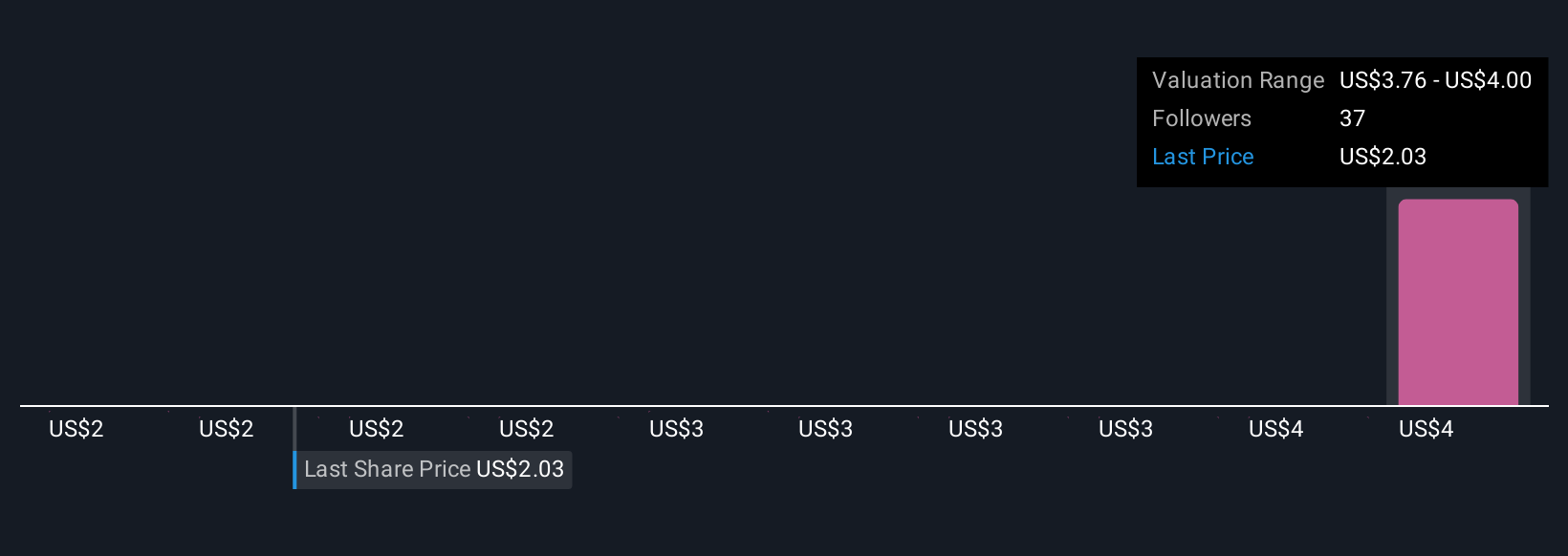

Uncover how Rekor Systems' forecasts yield a $4.00 fair value, a 97% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community provide fair value estimates for Rekor Systems between US$1.60 and US$4.00 per share. With large contracts now in focus, shifting to more recurring revenue is a key watchpoint for the company’s future direction, see how community and analyst expectations can differ.

Explore 5 other fair value estimates on Rekor Systems - why the stock might be worth 21% less than the current price!

Build Your Own Rekor Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rekor Systems research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Rekor Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rekor Systems' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:REKR

Rekor Systems

Provides infrastructure solutions for public safety, urban mobility, and transportation management markets in the United States and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives