Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Rekor Systems, Inc. (NASDAQ:REKR) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Rekor Systems

What Is Rekor Systems's Debt?

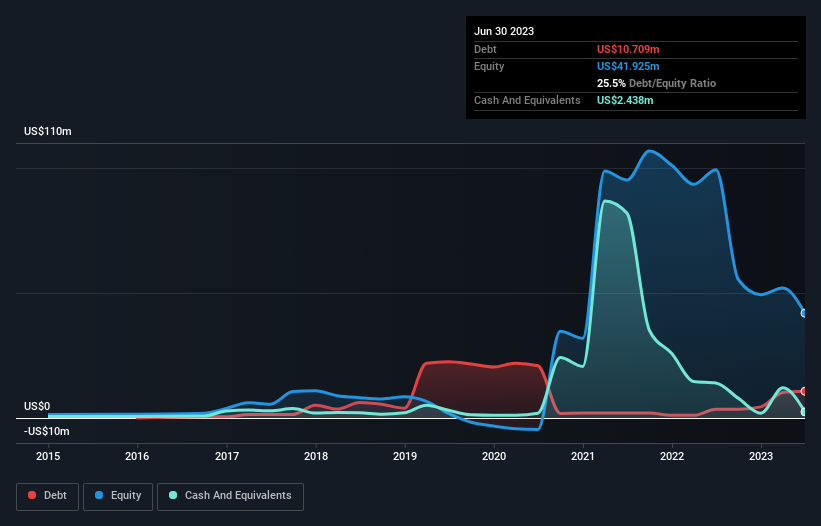

The image below, which you can click on for greater detail, shows that at June 2023 Rekor Systems had debt of US$10.7m, up from US$3.48m in one year. However, it does have US$2.44m in cash offsetting this, leading to net debt of about US$8.27m.

How Healthy Is Rekor Systems' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Rekor Systems had liabilities of US$14.6m due within 12 months and liabilities of US$27.4m due beyond that. Offsetting this, it had US$2.44m in cash and US$6.04m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$33.5m.

Of course, Rekor Systems has a market capitalization of US$224.1m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Rekor Systems's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Rekor Systems reported revenue of US$28m, which is a gain of 187%, although it did not report any earnings before interest and tax. So there's no doubt that shareholders are cheering for growth

Caveat Emptor

While we can certainly appreciate Rekor Systems's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. Its EBIT loss was a whopping US$45m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled US$39m in negative free cash flow over the last twelve months. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Rekor Systems you should be aware of, and 2 of them can't be ignored.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:REKR

Rekor Systems

Provides infrastructure solutions for public safety, urban mobility, and transportation management markets in the United States and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026