- United States

- /

- Software

- /

- NasdaqCM:REKR

Investors bid Rekor Systems (NASDAQ:REKR) up US$25m despite increasing losses YoY, taking five-year CAGR to 34%

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. To wit, the Rekor Systems, Inc. (NASDAQ:REKR) share price has soared 331% over five years. And this is just one example of the epic gains achieved by some long term investors. It's even up 14% in the last week. But this could be related to the buoyant market which is up about 5.9% in a week.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Rekor Systems

Because Rekor Systems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Rekor Systems can boast revenue growth at a rate of 3.2% per year. Put simply, that growth rate fails to impress. Therefore, we're a little surprised to see the share price gain has been so strong, at 34% per year, compound, over the period. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

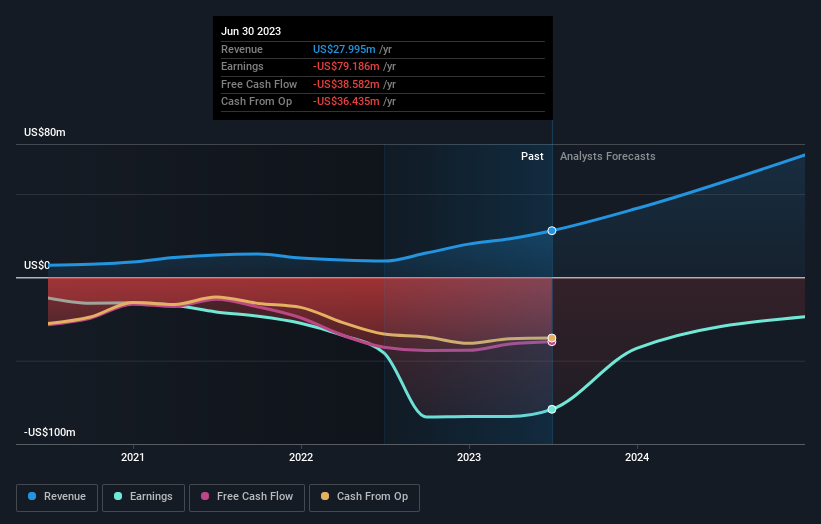

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Rekor Systems

A Different Perspective

It's good to see that Rekor Systems has rewarded shareholders with a total shareholder return of 216% in the last twelve months. That's better than the annualised return of 34% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Rekor Systems (1 is significant!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:REKR

Rekor Systems

A technology company, provides infrastructure solutions for transportation, public safety, and urban mobility markets in the United States and internationally.

Slight with limited growth.