- United States

- /

- Real Estate

- /

- NasdaqCM:REAX

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The U.S. stock market has been on a notable upswing, with the S&P 500 reaching record highs amid investor optimism fueled by strong corporate earnings and positive economic policies. Penny stocks, though often seen as a relic of past trading days, continue to offer intriguing opportunities for investors looking beyond the major indices. These smaller or newer companies can present significant growth potential when they are underpinned by solid financials and strong fundamentals, making them an area worth exploring for those seeking hidden value in quality investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $111.94M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.93 | $6.36M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.80 | $11.61M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.94 | $2.18B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2899 | $10.66M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.38 | $54.13M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.26 | $22.7M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.92 | $83.39M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.41 | $353.43M | ★★★★☆☆ |

Click here to see the full list of 707 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Real Brokerage (NasdaqCM:REAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Real Brokerage Inc. operates as a real estate technology company in the United States and Canada, with a market cap of approximately $932.48 million.

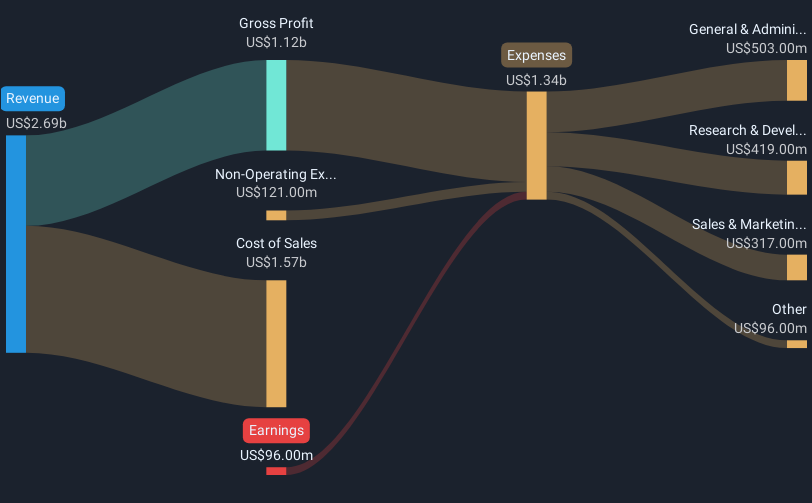

Operations: The company generates revenue primarily from its North American Brokerage segment, which accounted for $1.09 billion.

Market Cap: $932.48M

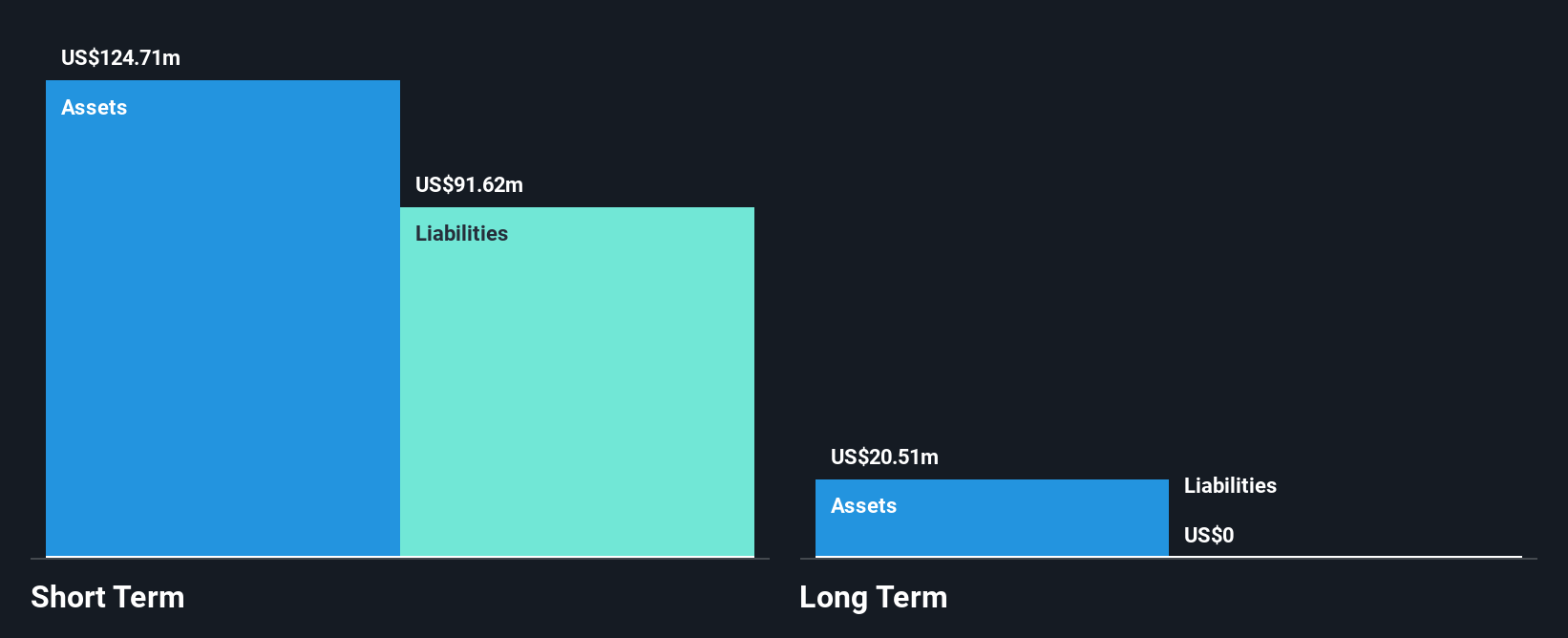

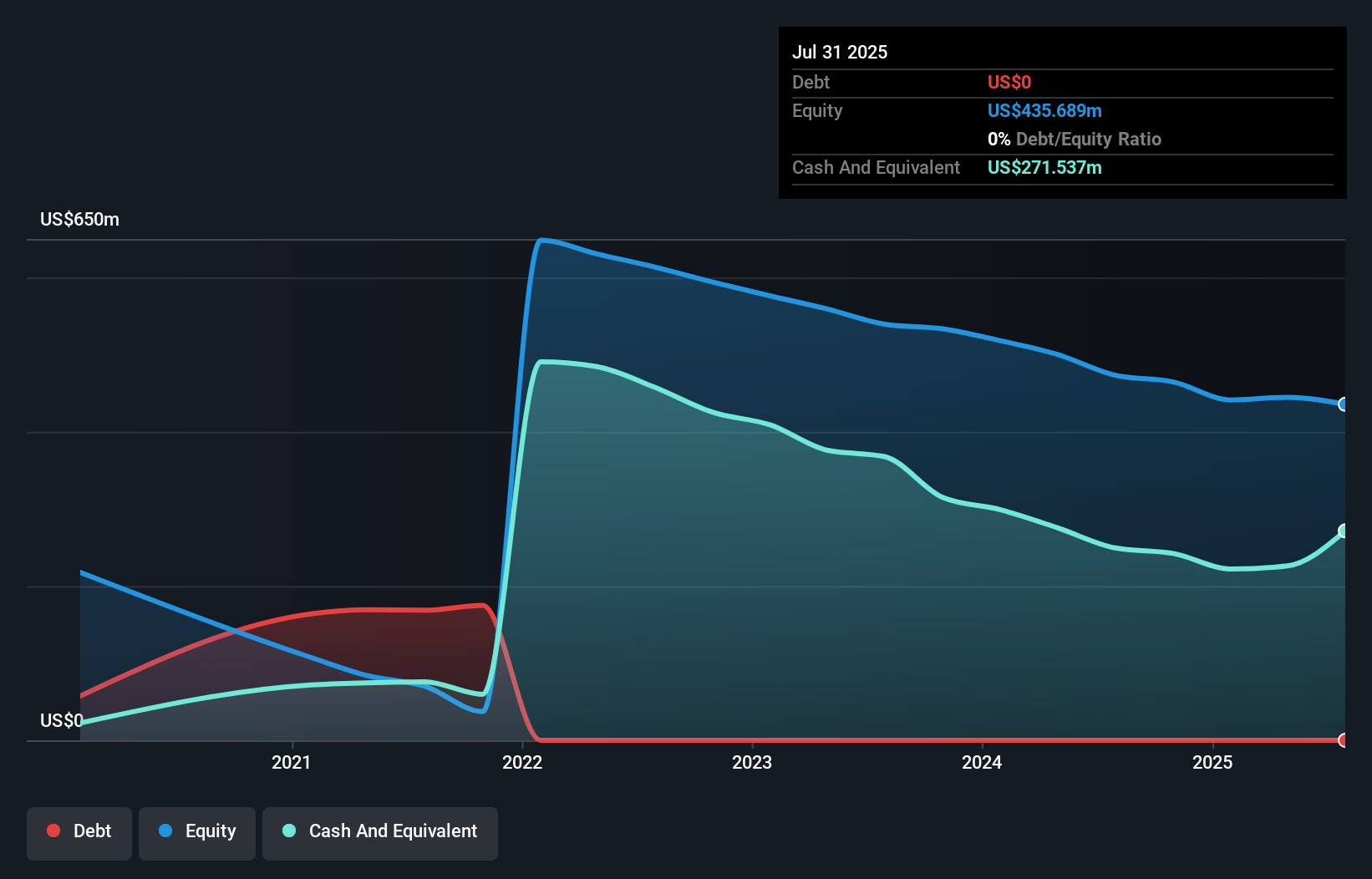

The Real Brokerage Inc. is a real estate technology company with a market cap of US$932.48 million and significant revenue from its North American Brokerage segment, generating US$1.09 billion. Despite being unprofitable, the company has no debt and maintains a positive free cash flow, providing it with more than three years of cash runway. Recent strategic expansions include partnerships like The Burgman Group in Florida and ROVI Homes in New England, enhancing its agent base to over 23,000. However, insider selling has been significant recently, which may be a concern for potential investors.

- Click here to discover the nuances of Real Brokerage with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Real Brokerage's future.

Grab Holdings (NasdaqGS:GRAB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grab Holdings Limited operates as a superapp provider across Southeast Asia, offering services in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam with a market capitalization of approximately $18.77 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: $18.77B

Grab Holdings Limited, with a market cap of US$18.77 billion, remains unprofitable but has a robust financial position due to its positive and growing free cash flow. The company has more cash than debt and possesses short-term assets of US$6.5 billion that exceed both its short-term (US$2.4 billion) and long-term liabilities (US$321 million). Recent developments include an earnings guidance increase for 2024, projecting revenue between US$2.76 billion and US$2.78 billion, reflecting improved business prospects despite ongoing losses. Additionally, Grab completed a significant share buyback program worth US$189.4 million, signaling confidence in its future performance.

- Get an in-depth perspective on Grab Holdings' performance by reading our balance sheet health report here.

- Gain insights into Grab Holdings' future direction by reviewing our growth report.

Planet Labs PBC (NYSE:PL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planet Labs PBC designs, constructs, and launches satellite constellations to provide high cadence geospatial data via an online platform globally, with a market cap of approximately $1.32 billion.

Operations: The company generates revenue from its Data Processing segment, which amounts to $241.65 million.

Market Cap: $1.32B

Planet Labs PBC, with a market cap of US$1.32 billion, remains unprofitable but shows potential through its revenue growth and strategic contracts. The company recently secured a spot as a vendor for the US$200 million Luno B contract with the National Geospatial-Intelligence Agency, enhancing its position in geospatial intelligence. Despite high volatility and negative return on equity, Planet Labs is debt-free and has sufficient cash runway for over three years. Its innovative satellite launches, like Pelican-2 equipped with NVIDIA technology, aim to deliver rapid insights across various sectors including defense and environmental monitoring.

- Jump into the full analysis health report here for a deeper understanding of Planet Labs PBC.

- Evaluate Planet Labs PBC's prospects by accessing our earnings growth report.

Make It Happen

- Get an in-depth perspective on all 707 US Penny Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:REAX

Real Brokerage

Operates as a real estate technology company in the United States and Canada.

Flawless balance sheet and good value.