- United States

- /

- Software

- /

- NasdaqGS:QLYS

Does the Recent Cybersecurity Partnership Make Qualys an Attractive Prospect in 2025?

Reviewed by Bailey Pemberton

- Wondering if Qualys is really worth its current price tag? You are not alone. It pays to dig into what drives the stock’s value before making any decisions.

- The stock has had a choppy ride lately, down 4.6% over the past week and dropping 12.7% so far this year. This has changed the mood on growth potential and risk.

- Recent headlines around Qualys have focused on the company's evolving cybersecurity offerings and new partnerships with industry leaders. These developments have attracted attention from both investors and analysts. These strategic moves could explain some of the recent swings in stock price as the market reacts to the company's strengthened competitive position.

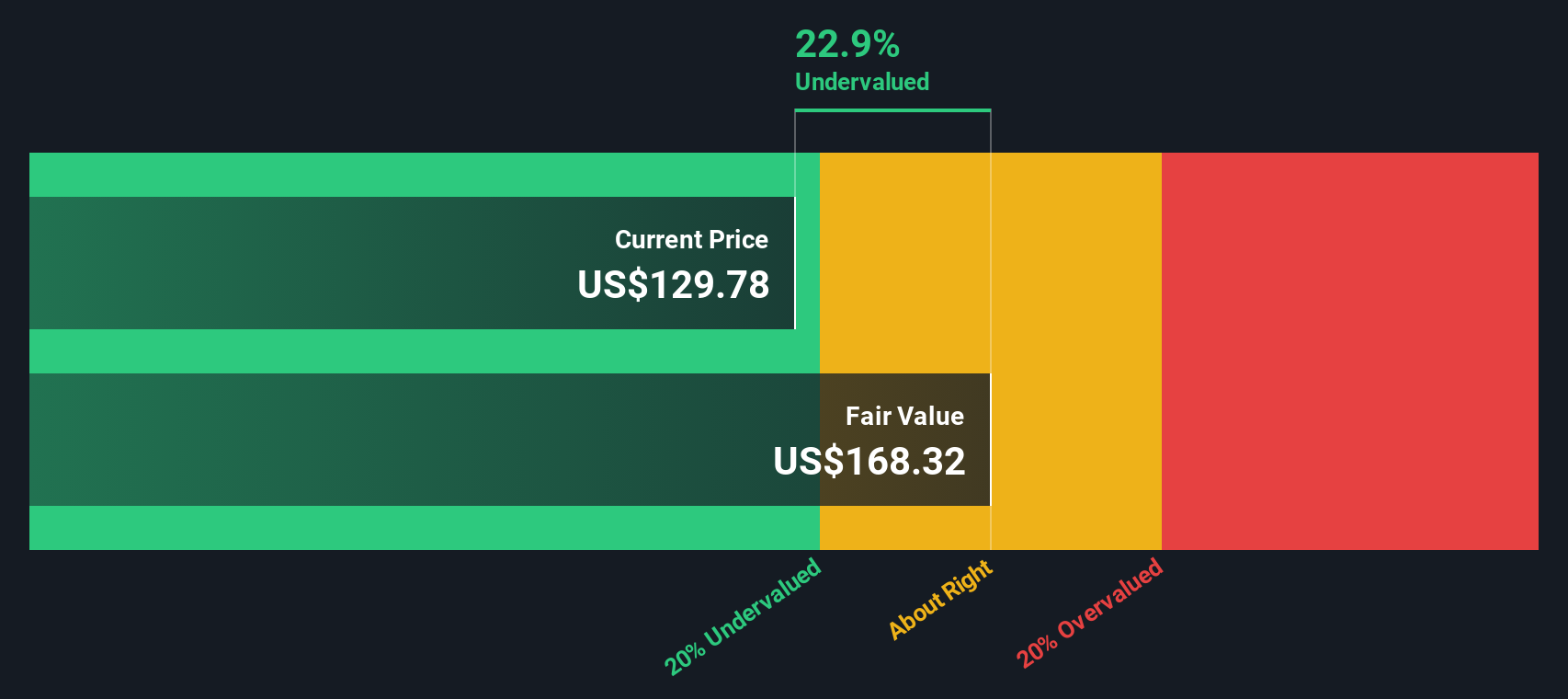

- On our valuation tracker, Qualys scores a solid 5 out of 6, showing it is undervalued in almost every check we run. We will walk through how different models approach valuing Qualys, and see if there is a smarter way of thinking about value that could uncover even more opportunities.

Find out why Qualys's -5.5% return over the last year is lagging behind its peers.

Approach 1: Qualys Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s value. This approach aims to answer what Qualys is truly worth by looking at how much cash the business can generate in the years to come.

For Qualys, the current Free Cash Flow sits at $241.63 million. Analysts project steady growth, with Free Cash Flow expected to rise to $325.65 million by 2029. Beyond the first five years, further projections are extrapolated to keep the long-term picture in focus. All cash flow figures are represented in US dollars.

Applying the two-stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic value of $167.64 per share. This value is 27.7% higher than the current market price, suggesting a significant undervaluation based on today’s trading levels.

The numbers show that, at current prices, Qualys offers an attractive discount compared to its estimated true worth according to cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Qualys is undervalued by 27.7%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Qualys Price vs Earnings

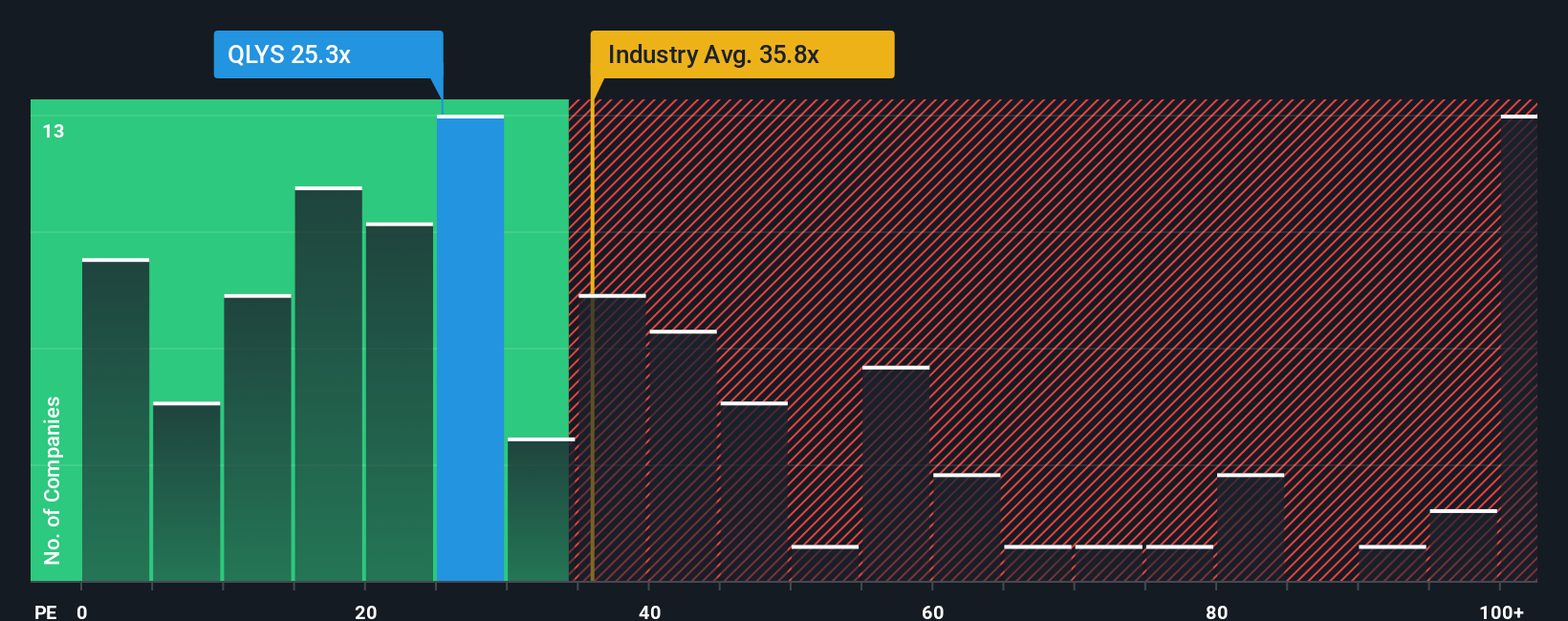

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Qualys, as it provides a direct measure of how much investors are willing to pay for each dollar of earnings. For businesses generating consistent profits, PE is often a reliable indicator of market sentiment and company performance.

Several factors drive what counts as a fair PE ratio, including expectations for future growth and the level of risk investors are willing to accept. Higher growth prospects or lower risk typically justify higher PE multiples, while slower growth or higher risk pull the ratio down.

Currently, Qualys is trading at a PE ratio of 23.6x. This is well below both the software industry average of 35.2x and the average of its peers at 38.6x. On the surface, this may point to an undervalued stock, but raw comparisons do not always tell the full story.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio, calculated as 24.8x for Qualys, adjusts for the company’s earnings growth, profit margins, risk profile, industry dynamics, and market cap. Unlike broad industry or peer averages, the Fair Ratio creates a more tailored benchmark and reflects what investors should be paying for Qualys based on its specific fundamentals.

With Qualys’ actual PE of 23.6x almost matching the Fair Ratio of 24.8x, the stock appears to be trading at roughly a fair value relative to its underlying qualities and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Qualys Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story behind the numbers. It lets you explain how you see Qualys’ business evolving, what you expect in terms of future revenue, profit margins, and other assumptions, and why that leads you to your estimate of fair value.

With Narratives, you connect a company’s strategic story directly to a financial forecast and then to a fair value, making your investment view crystal clear and personally relevant. This approach is easy and completely accessible for all users within the Community page on Simply Wall St, which is trusted by millions of investors.

Narratives empower you to quickly see whether you think Qualys is a buy or a sell, by highlighting exactly how your fair value compares to the latest market price. And because these Narratives are automatically updated when fresh information arrives, such as new earnings releases or news, your perspective stays current without extra effort.

For example, with Qualys, one investor’s upbeat Narrative might argue for a price target as high as $160, while a more cautious view could put fair value closer to $97, all based on their unique expectations for Qualys’ growth, margins, and market risks.

Do you think there's more to the story for Qualys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Qualys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QLYS

Qualys

Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion