- United States

- /

- Software

- /

- NasdaqCM:PGY

Pagaya Technologies (NasdaqCM:PGY) Rises 44% As 2025 Guidance Projects Revenue Up To US$1.275 Billion

Reviewed by Simply Wall St

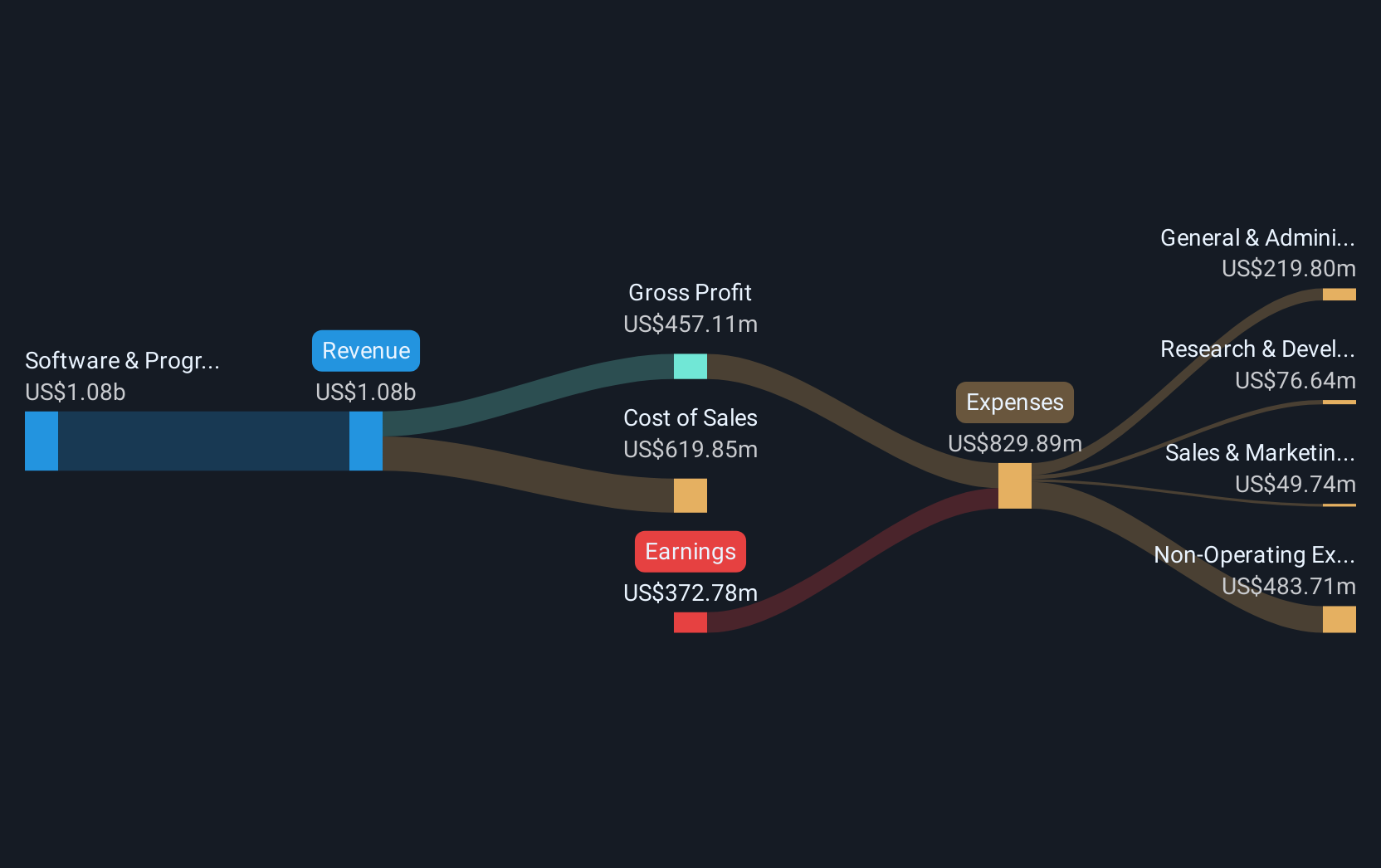

Pagaya Technologies (NasdaqCM:PGY) has recently seen a notable 44% increase in its stock price over the last month. This price movement coincides with the company's release of detailed guidance for 2025, which includes anticipated profitability by Q2 and full-year revenue estimates ranging from $1.15 billion to $1.275 billion. Despite the company's Q4 2024 earnings report highlighting a concerning increase in net losses, the guidance appears to have provided investors with confidence in Pagaya's potential turnaround. In a broader market context, the general U.S. stock market exhibited mixed signals, with variations in major indices such as the Dow Jones, which rose 0.7%, and the tech-focused Nasdaq Composite, which fell 0.6%. Given the current economic uncertainties and geopolitical developments influencing the markets, the upward trend in Pagaya's stock could reflect investor optimism around its future financial performance amid challenging conditions.

Take a closer look at Pagaya Technologies's potential here.

Over the last year, Pagaya Technologies experienced a total shareholder return of 20.92% decline, underperforming both the US Software industry, which returned 6.7%, and the broader US market, which appreciated 16.7%. This disparity indicates challenges that Pagaya faced amid rising losses despite increasing revenues. Throughout 2024, the company consistently reported escalating net losses, as seen in its Q4 results where net loss swelled to US$237.92 million from US$14.42 million the previous year.

Moreover, corporate changes, including new board members in December 2024 and a new Chief Accounting Officer, signaled an organizational shift that might have been perceived as an attempt to stabilize operations. Furthermore, Pagaya's successful US$600 million ABS transaction in December helped secure funding, potentially mitigating investor concerns. However, while these changes provide context to investor sentiment, the overarching negative returns suggest that the market remained cautious about Pagaya's path to profitability.

- See whether Pagaya Technologies' current market price aligns with its intrinsic value in our detailed report

- Explore the potential challenges for Pagaya Technologies in our thorough risk analysis report.

- Is Pagaya Technologies part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial institutions and investors in the United States, Israel, the Cayman Islands, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives