- United States

- /

- Software

- /

- NasdaqGS:PEGA

What Pegasystems (PEGA)'s Exposure to Renewed US-China Trade Tensions Means for Shareholders

Reviewed by Sasha Jovanovic

- Recently, investor sentiment toward technology stocks shifted following President Trump's renewed threat to increase import taxes on Chinese goods after China imposed restrictions on rare earth mineral exports.

- This reignited trade-related concerns about global supply chain disruptions and cost pressures that are particularly relevant for US software and tech companies such as Pegasystems.

- We'll assess how these heightened trade tensions and sector-wide worries could impact Pegasystems' investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Pegasystems Investment Narrative Recap

To hold Pegasystems stock, you would need to have confidence in the company's ability to grow its cloud and AI-driven workflows amid sector volatility and rising costs. The recent trade tension news may add some short-term uncertainty, but it does not appear to materially alter the most important catalyst right now: accelerating client adoption of Pega Cloud and AI-powered automation. The key risk in the current environment remains slowing demand and higher customer acquisition costs influencing near-term growth.

The most relevant announcement in light of heightened trade worries is the September 2025 launch of Pega Infinity '25, their advanced enterprise transformation platform built to streamline automation using AI. This aligns with the core growth catalyst by targeting more effective client engagement and workload optimization, which could help offset some headwinds posed by global supply concerns and cost pressures.

On the other hand, potential volatility in term license revenue is something investors should watch closely, especially as...

Read the full narrative on Pegasystems (it's free!)

Pegasystems' narrative projects $1.9 billion in revenue and $292.2 million in earnings by 2028. This requires 4.2% yearly revenue growth and a $72 million earnings increase from $220.2 million.

Uncover how Pegasystems' forecasts yield a $64.73 fair value, a 18% upside to its current price.

Exploring Other Perspectives

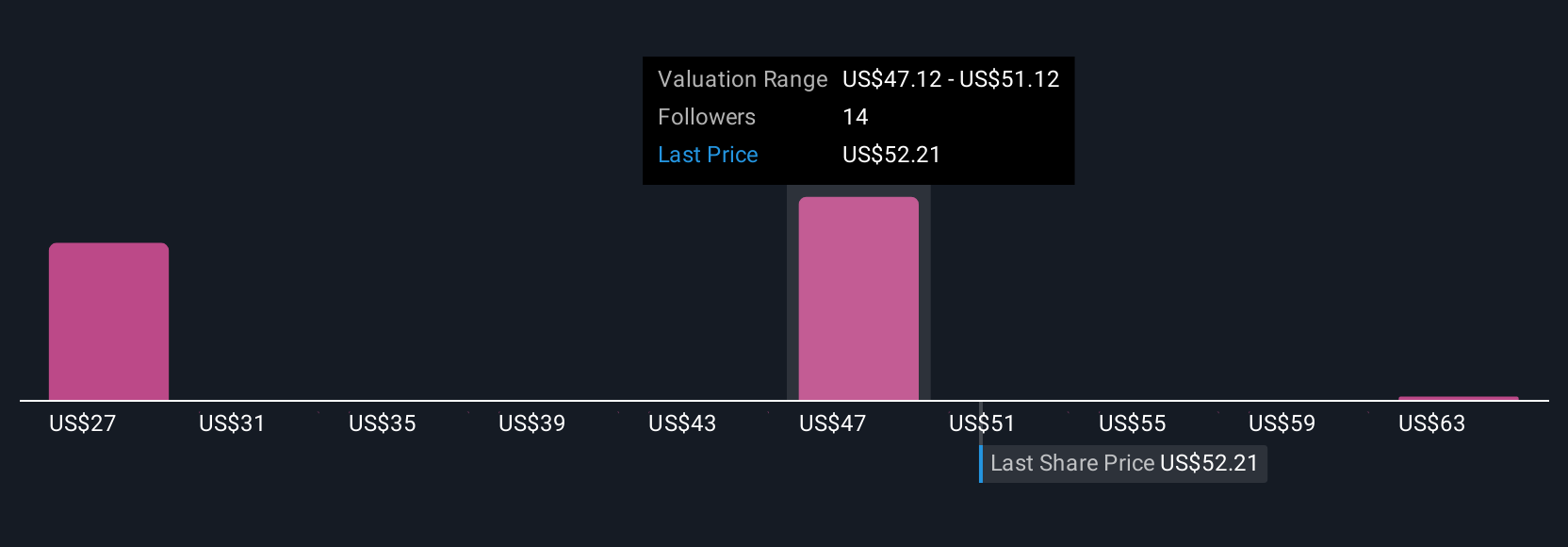

Fair value estimates for Pegasystems from five Simply Wall St Community members range from US$25.08 to US$78, with a spectrum of views on the company. While adoption of Pega Cloud and AI solutions appears central to the investment case, recent trade-related risks leave plenty of room for debate about future revenue stability.

Explore 5 other fair value estimates on Pegasystems - why the stock might be worth less than half the current price!

Build Your Own Pegasystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pegasystems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pegasystems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pegasystems' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives