- United States

- /

- Software

- /

- NasdaqGS:PEGA

Pegasystems (PEGA): A Fresh Look at Valuation Following Trade Tensions and Supply Chain Concerns

Reviewed by Kshitija Bhandaru

Pegasystems (PEGA) shares moved lower along with many technology names after President Trump’s threat to raise import tariffs on Chinese goods sparked a fresh round of trade war concerns. This development followed China’s announcement of tighter restrictions on rare earth mineral exports, which prompted worries about the supply chain and associated costs for U.S. tech firms.

See our latest analysis for Pegasystems.

Even with this week's dip, Pegasystems has shown impressive resilience. While the share price fell 4.46% in a single day amid trade war jitters, its total shareholder return over the past year hit 45.77%. Momentum has been broadly positive so far in 2024.

If heightened volatility has you curious about what else is performing in tech, now is a smart time to explore the broader landscape with our See the full list for free.

With shares still trading at a notable discount to analyst targets and solid growth numbers on the books, should investors see recent volatility as an entry point? Or is the market already anticipating further upside?

Most Popular Narrative: 17% Undervalued

Pegasystems closed at $53.72, noticeably below the fair value set in the most-followed expert narrative. Analyst projections highlight a valuation gap that has caught the attention of growth-oriented investors, especially as momentum builds around AI-driven transformation.

Pega's focus on AI and the Pega Gen AI Blueprint is transforming client engagement by accelerating digital and legacy transformations. This potentially drives revenue growth through faster and more effective solution implementation. The adoption of agentic workflows and integration with AI models in Pega Blueprint, enabling predictable and streamlined processes, could enhance client satisfaction and retention, thereby improving net margins.

Want to know what's fueling this projected upside? This fair value leans on bold assumptions about recurring revenue and margin expansion, plus a profit multiple that rivals top tech names. Analysts are betting on specific catalysts. Which ones? Dive in to see the hidden levers behind this bullish calculation.

Result: Fair Value of $64.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting market dynamics and unpredictable term license revenue could still challenge these optimistic forecasts if investor and customer sentiment changes abruptly.

Find out about the key risks to this Pegasystems narrative.

Another View: What Do Multiples Say?

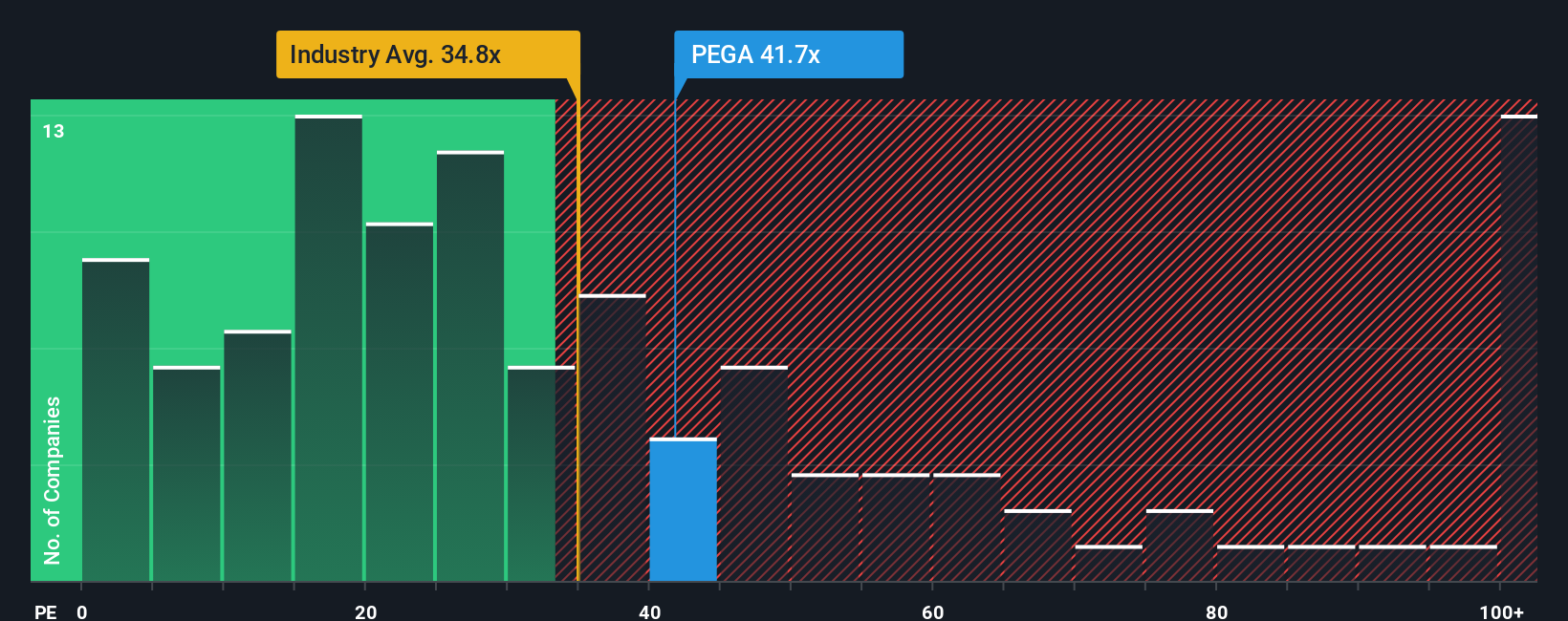

While analyst narratives highlight upside, a quick look at Pegasystems’ price-to-earnings ratio raises questions. At 41.7x, it is notably more expensive than the US Software industry average of 34.8x, the peer average of 27.7x, and its own fair ratio of 30.6x. This premium means investors are banking on outsized growth. Is the optimism justified, or could there be risk in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pegasystems Narrative

If you see the numbers differently or feel compelled to reach your own conclusions, you can dig into the facts and shape a narrative in just a few minutes: Do it your way

A great starting point for your Pegasystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your research count by tapping into unique angles the market overlooks. Gain the upper hand on emerging trends by using these powerful stock lists below.

- Unlock the potential of tomorrow with these 24 AI penny stocks, focused on artificial intelligence breakthroughs and promising next-gen applications.

- Capitalize on strong income opportunities by seeking out these 19 dividend stocks with yields > 3% that consistently deliver yields above 3% and provide attractive cash returns.

- Position yourself for exponential gains with these 79 cryptocurrency and blockchain stocks, capturing companies at the forefront of blockchain adoption and digital innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEGA

Pegasystems

Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives