- United States

- /

- Software

- /

- NasdaqGS:PANW

A Fresh Look at Palo Alto Networks (PANW) Valuation Following Earnings Beat and Innovative SASE 4.0 Launch

Reviewed by Simply Wall St

Palo Alto Networks (PANW) just reported quarterly earnings that beat expectations and raised its outlook for the year, adding another strong quarter to its track record. To top it off, the company rolled out Prisma SASE 4.0, which promises smarter, AI-powered security designed for the modern enterprise browser. Together, these moves suggest Palo Alto Networks is doubling down as a leader in the cybersecurity space, something investors have been watching closely given the increasing sophistication of digital threats and the growing importance of secure cloud solutions.

These latest highlights come on the heels of steady progress for Palo Alto Networks over the past year. The stock is up 13% during this period, with a noticeable boost in the past month. Alongside this momentum, industry demand remains high and recent sector news has been largely positive as other cybersecurity players also post encouraging results. Palo Alto Networks’ long-term returns remain particularly strong, reflecting years of aggressive growth and strategic pivots.

With shares pushing higher, the real question now is whether the market is giving Palo Alto Networks too much credit for its future growth, or if there is still value left for investors willing to buy in today.

Most Popular Narrative: 7.8% Undervalued

The prevailing market narrative suggests Palo Alto Networks is trading below its fair value, signaling analyst optimism for continued growth supported by robust fundamentals and recurring revenues.

The proliferation of multi-cloud and hybrid environments, along with the rapid increase in connected devices, is fueling enterprise need for unified, cloud-native security solutions. Palo Alto Networks' deep integration with all major public clouds and shift to software and SaaS-based offerings provide clear visibility and predictability on recurring revenues and cash flows.

Curious what’s powering this bullish fair value? The narrative hints at rapid top-line growth, higher margins, and bold future profit multiples, driven by a unique mix of tangible forecasts and industry-leading integration. Want to find out which quantitative levers could justify this premium? The full narrative unpacks the specific assumptions behind its high conviction target and may surprise you with what’s behind the numbers.

Result: Fair Value of $213.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained high R&D costs or integration challenges from acquisitions could hinder Palo Alto Networks’ growth and put pressure on future margins.

Find out about the key risks to this Palo Alto Networks narrative.Another View: Valuation Based on Market Multiples

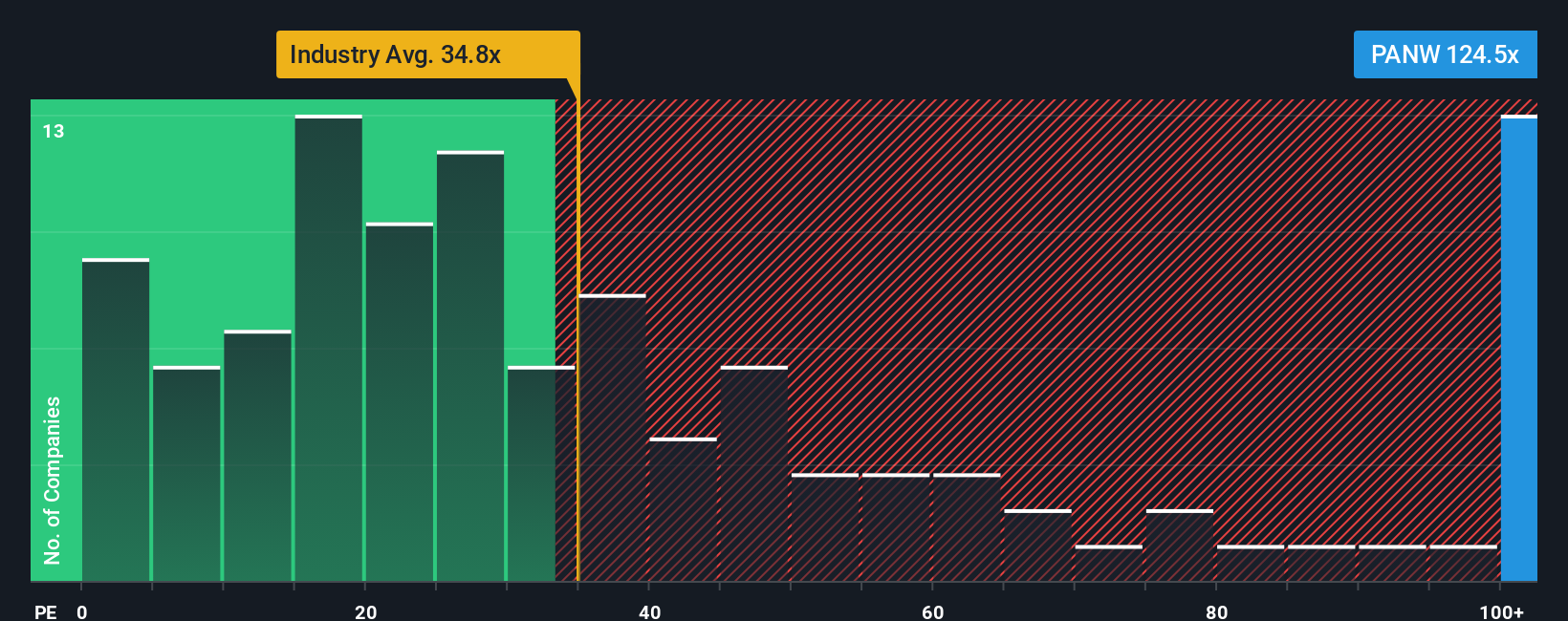

Another perspective involves examining what the broader software industry typically pays for comparable companies. On these metrics, Palo Alto Networks appears expensive compared to its peers. Could market optimism be somewhat excessive in this case?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palo Alto Networks Narrative

If you'd rather form your own perspective or dig into the numbers independently, you can craft your own take in just a few minutes. Do it your way.

A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their edge by staying ahead of the crowd. Expand your search and seize fresh opportunities that others may overlook using these handpicked themes from the Simply Wall Street Screener.

- Unlock the potential of tomorrow’s healthcare with breakthrough companies in medical technology and innovation using our healthcare AI stocks.

- Capture value hidden in plain sight by zeroing in on stocks trading below their true worth through our undervalued stocks based on cash flows.

- Boost your income stream with reliable picks offering robust and above-average yields found inside our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)