- United States

- /

- Software

- /

- NasdaqGS:PANW

3 Stocks That Could Be Trading At A Discount

Reviewed by Simply Wall St

As the U.S. stock market experiences a slight pullback following a recent rally, investors are closely monitoring economic indicators and policy changes that could impact future growth. With major indices like the S&P 500 and Nasdaq Composite showing mixed performance amid concerns about tariffs and government spending cuts, there may be opportunities to identify stocks trading at a discount. In these uncertain times, a good stock is often characterized by strong fundamentals, resilience in challenging environments, and potential for growth despite broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | $28.24 | $56.26 | 49.8% |

| MINISO Group Holding (NYSE:MNSO) | $20.79 | $41.15 | 49.5% |

| Associated Banc-Corp (NYSE:ASB) | $22.77 | $44.96 | 49.4% |

| German American Bancorp (NasdaqGS:GABC) | $38.34 | $75.38 | 49.1% |

| Smurfit Westrock (NYSE:SW) | $45.71 | $90.35 | 49.4% |

| Datadog (NasdaqGS:DDOG) | $103.17 | $206.24 | 50% |

| Midland States Bancorp (NasdaqGS:MSBI) | $18.03 | $35.69 | 49.5% |

| Coastal Financial (NasdaqGS:CCB) | $85.03 | $167.69 | 49.3% |

| Viking Holdings (NYSE:VIK) | $39.97 | $78.51 | 49.1% |

| Albemarle (NYSE:ALB) | $77.03 | $153.21 | 49.7% |

Let's dive into some prime choices out of the screener.

Expand Energy (NasdaqGS:EXE)

Overview: Expand Energy Corporation is an independent natural gas production company in the United States with a market cap of $25.26 billion.

Operations: The company generates revenue from its exploration and production segment, totaling $4.26 billion.

Estimated Discount To Fair Value: 41.9%

Expand Energy's stock appears highly undervalued, trading at US$109.25, significantly below its estimated fair value of US$187.97. Despite a challenging year with a net loss of US$714 million and reduced revenues, the company forecasts substantial revenue growth at 35.6% annually, outpacing the market average. While profitability is anticipated within three years, dividend sustainability remains questionable due to insufficient earnings coverage. Recent executive changes and strategic production investments might influence future cash flow positively.

- Upon reviewing our latest growth report, Expand Energy's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Expand Energy stock in this financial health report.

LPL Financial Holdings (NasdaqGS:LPLA)

Overview: LPL Financial Holdings Inc. offers a comprehensive platform of brokerage and investment advisory services to independent financial advisors and institutional advisors in the U.S., with a market cap of approximately $24.77 billion.

Operations: The company's revenue is primarily derived from its brokerage segment, amounting to $12.11 billion.

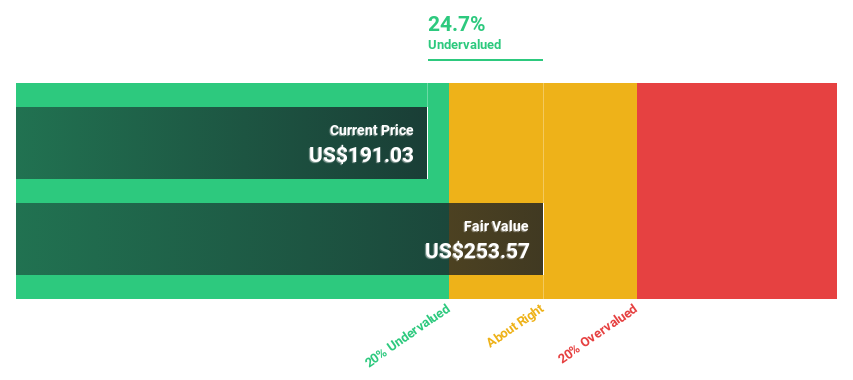

Estimated Discount To Fair Value: 31.1%

LPL Financial Holdings is trading at US$334.45, significantly below its estimated fair value of US$485.32, suggesting it may be undervalued based on discounted cash flow analysis. Recent revenue growth to US$3.51 billion for Q4 2024 and strategic initiatives like the LPL Alts Connect platform enhance client offerings and operational efficiency. However, debt coverage by operating cash flow remains a concern despite high non-cash earnings quality and robust analyst price target consensus indicating potential stock appreciation.

- The growth report we've compiled suggests that LPL Financial Holdings' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of LPL Financial Holdings.

Palo Alto Networks (NasdaqGS:PANW)

Overview: Palo Alto Networks, Inc. is a global provider of cybersecurity solutions with a market capitalization of approximately $124.17 billion.

Operations: The company generates revenue primarily from its Security Software & Services segment, which accounts for $8.57 billion.

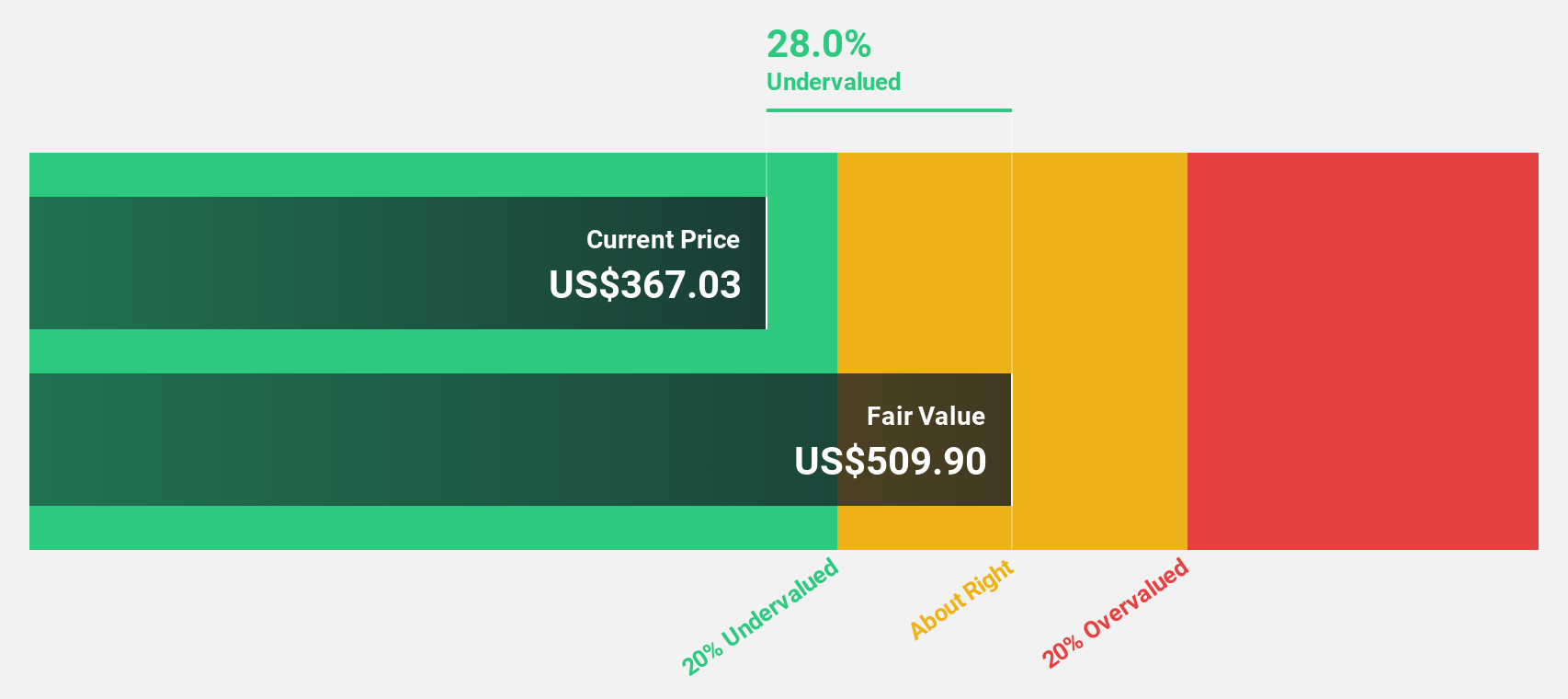

Estimated Discount To Fair Value: 27.3%

Palo Alto Networks is trading at US$184.01, well below its estimated fair value of US$252.95, indicating potential undervaluation based on cash flow analysis. Despite a drop in profit margins to 14.6% from 30.2% last year, earnings are expected to grow annually by 17.8%, outpacing the broader market's growth rate of 13.9%. Recent strategic expansions into cloud infrastructure and partnerships enhance its competitive positioning in cybersecurity solutions for evolving digital landscapes.

- According our earnings growth report, there's an indication that Palo Alto Networks might be ready to expand.

- Get an in-depth perspective on Palo Alto Networks' balance sheet by reading our health report here.

Key Takeaways

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 198 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives