- United States

- /

- Software

- /

- NasdaqGS:OTEX

Will OTEX’s AI Data Platform Partnerships Reshape Its Competitive Edge in Enterprise Software?

- OpenText has introduced its AI Data Platform (AIDP), aiming to redefine enterprise AI with secure, scalable management of proprietary data and expanded integration capabilities through partnerships with SAP, Databricks, and others.

- This launch highlights the increasing importance of information governance and contextual data foundations as organizations seek reliable, AI-powered solutions that align with complex compliance and business requirements.

- We'll examine how OpenText's enterprise AI platform launch and partnership expansion could influence its position in the evolving AI-driven business software landscape.

Find companies with promising cash flow potential yet trading below their fair value.

Open Text Investment Narrative Recap

To be a shareholder in OpenText, you need to believe in the company's ability to lead secure, AI-driven enterprise information management as unstructured data volumes surge. The recent launch of the OpenText AI Data Platform strengthens this long-term story by expanding the role of cloud-native AI and augmenting integration partnerships, though it does not materially shift the biggest short-term catalyst, accelerating cloud and AI adoption, or fully address the most pressing risk: persistent declines in legacy maintenance revenue if cloud growth underperforms. One relevant announcement is the official certification of OpenText Core Content Management for SAP S/4HANA Cloud Public Edition. This deepens OpenText’s access to SAP’s cloud ERP customer base, supporting the near-term catalyst for cloud-driven revenue growth and reinforcing the importance of vertical integration partnerships as a lever for business expansion. However, contrasted against these positive shifts, investors should remain aware of persistent exposure to legacy revenue headwinds and the risk that...

Read the full narrative on Open Text (it's free!)

Open Text's narrative projects $5.4 billion in revenue and $862.6 million in earnings by 2028. This requires 1.4% yearly revenue growth and an increase in earnings of about $426.7 million from the current $435.9 million level.

Uncover how Open Text's forecasts yield a $40.45 fair value, a 23% upside to its current price.

Exploring Other Perspectives

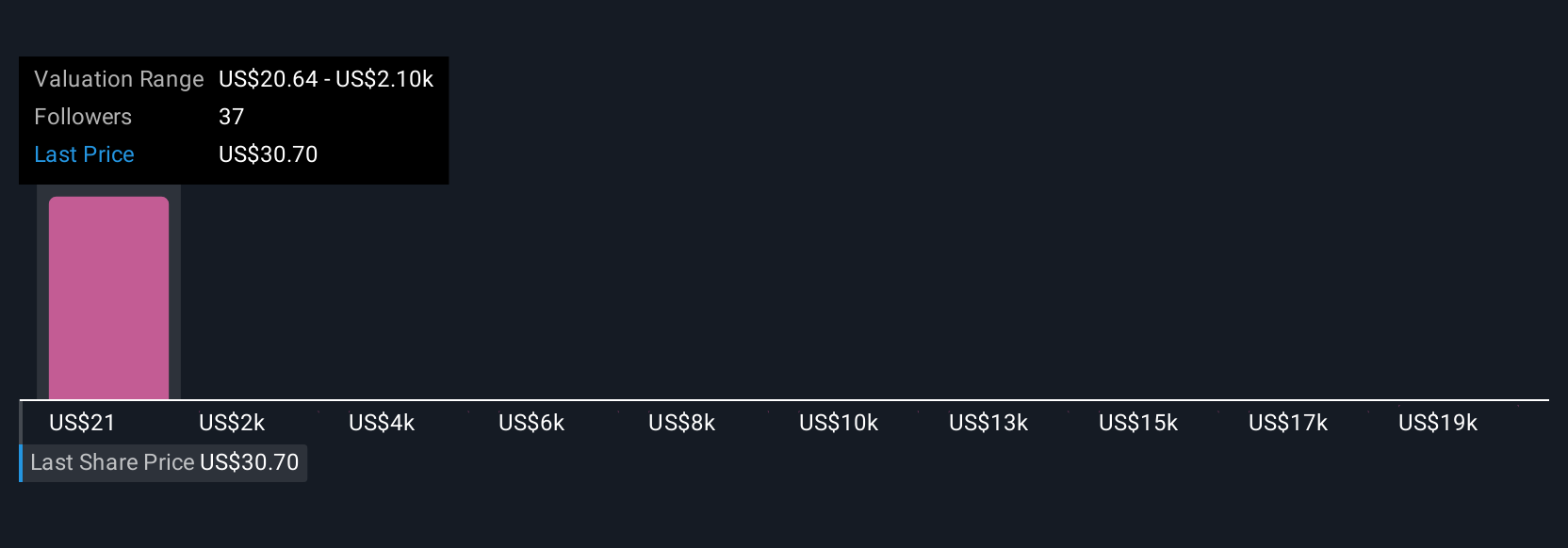

Simply Wall St Community members produced six fair value estimates for OpenText ranging from US$21.43 to US$67.73 per share. While most see significant undervaluation relative to current pricing, persistent declines in legacy maintenance revenue continue to be a focal point for many, adding another angle to the company’s outlook.

Explore 6 other fair value estimates on Open Text - why the stock might be worth over 2x more than the current price!

Build Your Own Open Text Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Open Text research is our analysis highlighting 6 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Open Text research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Open Text's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.