- United States

- /

- Software

- /

- NasdaqGS:OTEX

Assessing Open Text (NasdaqGS:OTEX) Valuation After a 19% Shareholder Return This Year

Reviewed by Kshitija Bhandaru

See our latest analysis for Open Text.

Open Text’s 19% total shareholder return over the past year signals steady momentum. This has caught renewed attention as investors weigh its growth against a shifting tech landscape and evolving valuation expectations. Performance remains sturdy, hinting at underlying confidence in the company’s longer-term strategy.

If you’re curious about what else is building momentum in tech, it’s a great moment to expand your watchlist and explore See the full list for free.

But with shares gaining ground and valuation measures hovering near analyst targets, is Open Text still flying under the radar, or have investors already accounted for its next phase of growth?

Most Popular Narrative: 4.9% Overvalued

Open Text’s narrative-driven fair value sits at $35.90, just below its last close at $37.66. This suggests the market is slightly ahead of forward-looking expectations. Investors now face a turning point: does the story support the current premium?

Strategic partnerships, a strong sales pipeline, and active M&A strategy position the company for diversified growth and increased shareholder returns. Heavy reliance on managing legacy transitions, restructuring efforts, and M&A carries risks that could pressure margins and growth amid uncertain cloud, macroeconomic, and segment-specific headwinds.

Want to discover what big assumptions are fueling this near-fair-value call? Profit margins, organic growth, and an ambitious earnings leap are quietly shaping the calculations. The real narrative hides in the bold projections. Get inside the thesis to see what is driving analyst conviction.

Result: Fair Value of $35.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing leadership changes and uncertainty in cybersecurity growth remain significant wildcards that could challenge Open Text’s current growth story.

Find out about the key risks to this Open Text narrative.

Another View: Is Open Text Really Undervalued?

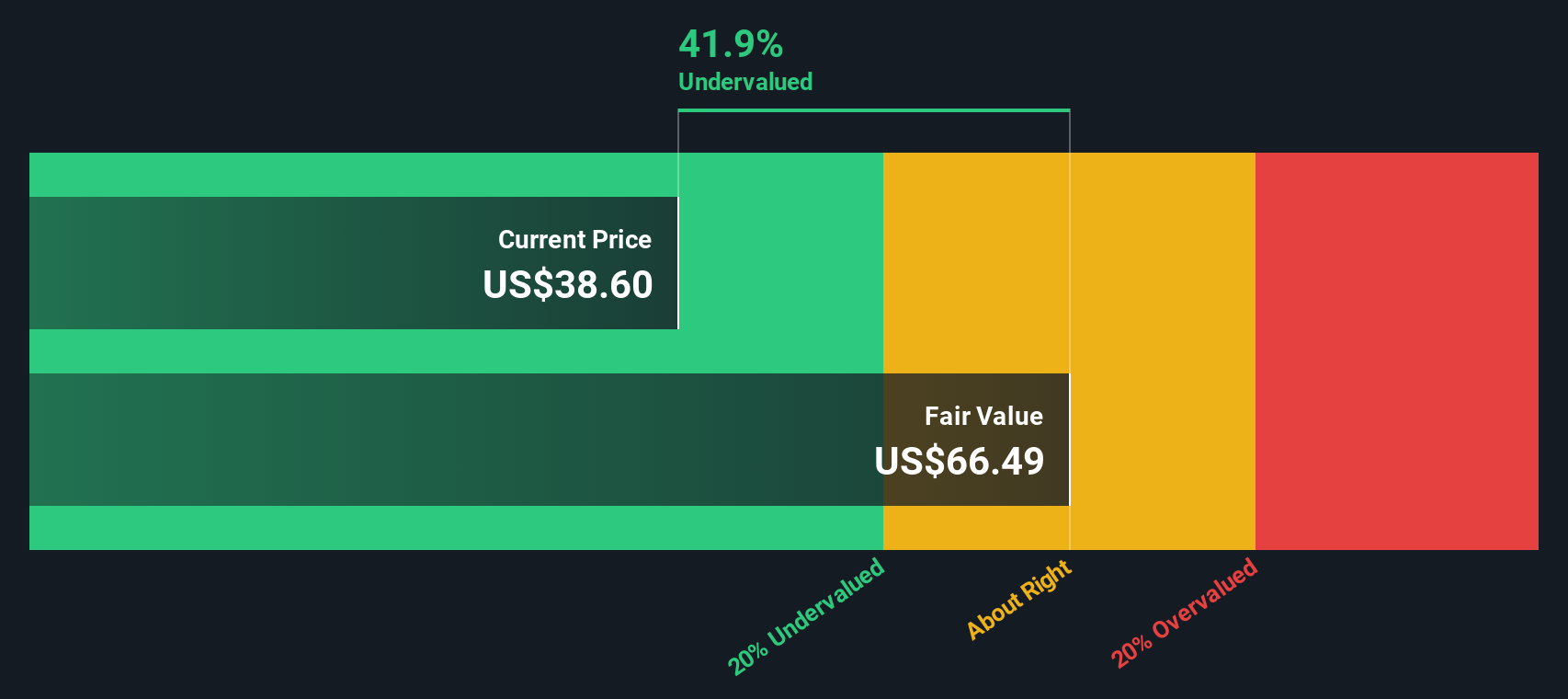

While multiples suggest the market may be pricing Open Text with caution, our DCF model comes to a strikingly different conclusion. The SWS DCF model estimates fair value at $65.12, which is well above the current share price. This sharp disconnect raises the question: Is the market missing something significant, or are the risks justifying the discount?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Open Text Narrative

If you want to dig into the numbers yourself and craft your own take on Open Text’s valuation, you can build a fresh narrative in minutes. Do it your way

A great starting point for your Open Text research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step beyond the obvious and seize new investment opportunities that match your interests. The right insights can help you spot what others are missing.

- Capitalize on the momentum of tomorrow’s innovators by checking out these 24 AI penny stocks set to transform entire industries with real-world artificial intelligence solutions.

- Boost your potential for long-term passive income by browsing these 19 dividend stocks with yields > 3% offering strong yields and resilient business models that withstand market cycles.

- Catch early-stage companies poised for explosive growth by exploring these 3569 penny stocks with strong financials that could be a breakout in the making before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives