- United States

- /

- Software

- /

- NasdaqGS:OPRA

Did Opera Neon’s AI-Powered Browser Just Shift Opera’s (OPRA) Growth Narrative?

Reviewed by Sasha Jovanovic

- Opera Limited recently launched Opera Neon, a premium AI-powered browser with agentic features that allow users to automate complex tasks and coding directly within the browser, all managed through context-aware workspaces and reusable prompts known as Cards.

- This product sets Opera apart by delivering real-time, local execution of AI functions within the browser session, emphasizing privacy and control for professionals who handle multifaceted web projects.

- To assess what this means for Opera, we’ll examine how Neon’s AI-driven, subscription-based approach could reshape its future growth narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Opera Investment Narrative Recap

To own Opera stock, you have to believe in Opera's ability to transition from a niche browser to a premium software provider, increasing its share of high-value, subscription-based users. The Opera Neon launch is key to this narrative, serving as the near-term catalyst that could accelerate revenue growth if adoption gains traction among professionals; however, reliance on third-party AI carries ongoing risks to margin stability, which remain material for the outlook.

Of the recent announcements, the July 2025 reveal of Opera Neon as an AI-first browser for knowledge workers stands out as most relevant. That preview set the stage for this week's broader launch, reinforcing the company’s focus on productivity features as its main avenue for driving higher ARPU and diversification away from advertising-led revenues.

In contrast, investors should be aware that Opera’s dependence on external AI models exposes it to...

Read the full narrative on Opera (it's free!)

Opera's outlook anticipates $813.6 million in revenue and $135.8 million in earnings by 2028. This assumes annual revenue growth of 13.6% and a $55.2 million increase in earnings from the current $80.6 million level.

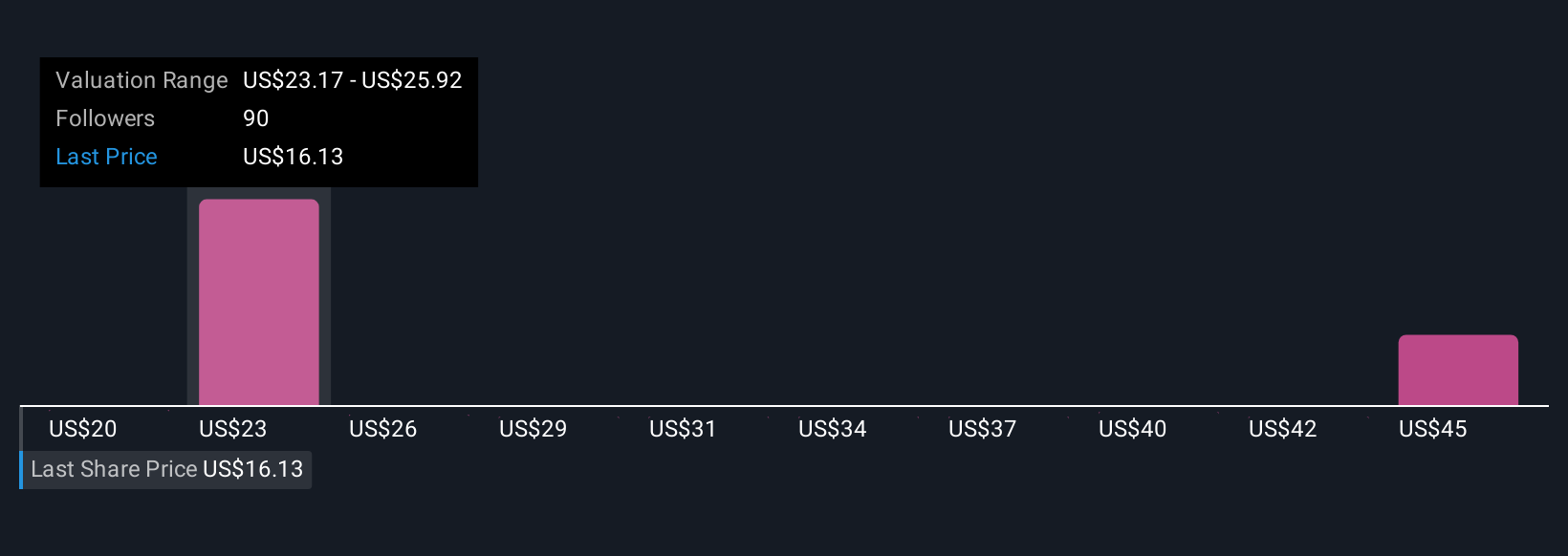

Uncover how Opera's forecasts yield a $25.50 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members estimate Opera’s fair value between US$20.41 and US$47.69, showing wide variance. While many see opportunity, others caution that margin pressure from AI licensing costs could impact Opera’s performance in coming years, review multiple viewpoints to inform your decisions.

Explore 7 other fair value estimates on Opera - why the stock might be worth just $20.41!

Build Your Own Opera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opera research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Opera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opera's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives