- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (OKTA) Valuation in Focus After Defense Partnership and Upbeat Profit Guidance

Reviewed by Simply Wall St

If you’re holding, watching, or even just curious about Okta (OKTA), this week’s run of headlines probably caught your eye. Okta just announced a partnership with Peraton and the U.S. Department of Defense to launch myAuth, a secure authentication platform set to replace DS Logon for millions of government users. Alongside this, the company dropped earnings that surprised some investors. Okta turned a profit for the last six months and raised its guidance for the coming year, signaling management’s conviction in continued growth.

This string of developments has fed into the momentum Okta has built over the past year, with shares up 31% since last September. While the past three months have seen some pullback, the year-to-date return sits at nearly 18%. The combination of accelerating profits, a multi-million-user federal rollout, and fresh forward-looking confidence is giving investors a lot to consider regarding Okta’s risk-reward balance.

With the market digesting rising earnings and a high-profile government win, investors may be weighing whether Okta is priced for further upside or if future growth is already reflected at these levels.

Most Popular Narrative: 37% Undervalued

The leading narrative suggests that Okta is significantly undervalued, with the company trading at a notable discount to its assessed fair value. This view is underpinned by optimistic projections for the path to sustainable profitability, recurring revenue growth, and future free cash flow.

Okta has a solid foundation: a technically brilliant solution, a strong market position, and a recurring revenue model. However, to be truly successful, Todd McKinnon needs to take strategic risks and further develop the business model. Having a better solution than the competition is not enough. The key is to find a business model that solves a “problem” for customers so elegantly that they are willing to pay for it, and profitably.

Want to unravel the logic behind calling Okta a bargain? The narrative hints at high returns built on upbeat free cash flow projections and a sizable margin that could remake how investors view Okta's future value. Curious how those bullish assumptions stack up—and what pivotal business shift might be the real game changer? The numbers behind this projection might just surprise you.

Result: Fair Value of $147.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing net retention rates and uncertainties around sustainable profitability could quickly shift sentiment and challenge the bullish outlook for Okta’s long-term value.

Find out about the key risks to this Okta narrative.Another View: What Do Earnings Ratios Suggest?

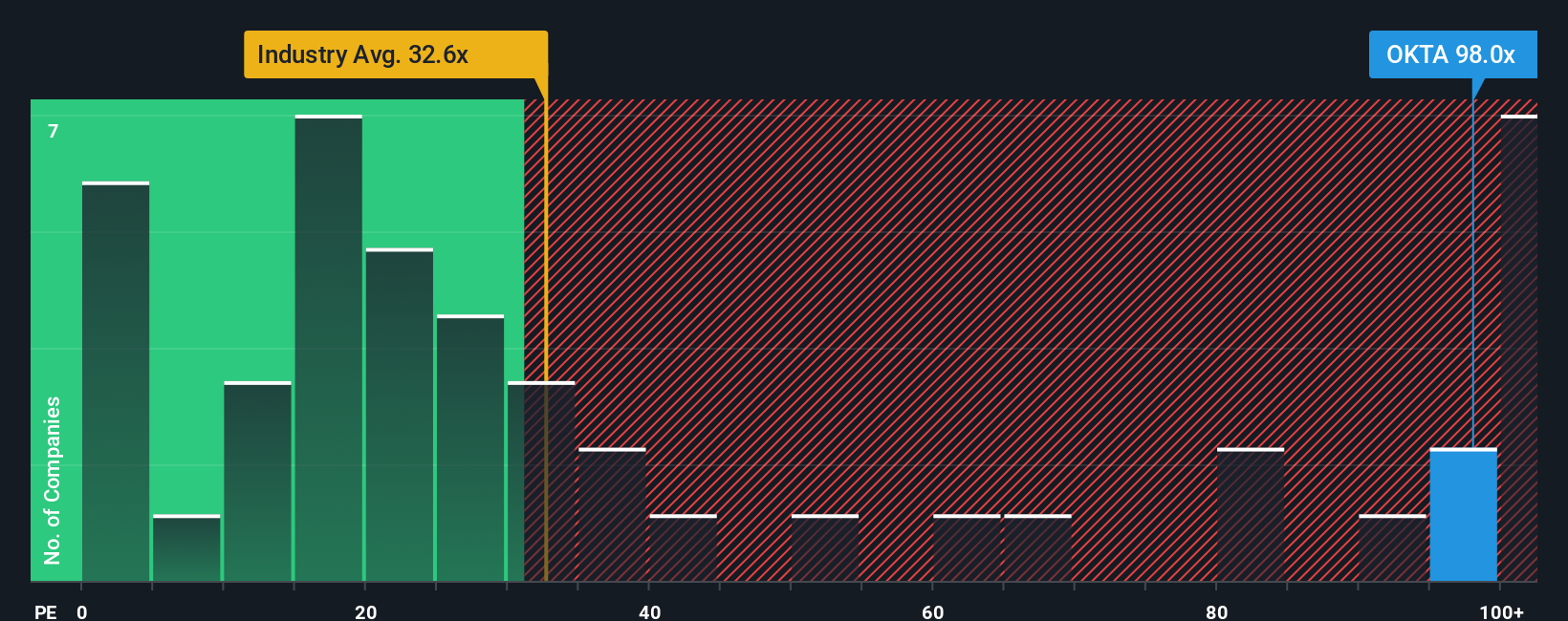

On the flip side, if we look at Okta’s price relative to its current earnings, the company appears much more expensive than the broader US IT sector. This raises questions about whether the recent optimism is already built into the stock price or if the market is expecting even bigger things ahead. Is the market getting carried away, or could the premium be justified?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Okta to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Okta Narrative

If you’re not convinced by the views above or want to investigate Okta from your own perspective, explore the data and piece together your own take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

Ready to fine-tune your portfolio or find the next breakout company? Don’t let these smart investment opportunities pass you by. See what’s out there now:

- Accelerate your returns by targeting established companies offering generous yields using dividend stocks with yields > 3%.

- Unearth technological frontrunners set to benefit from artificial intelligence with AI penny stocks.

- Jump on value plays trading below their potential and tap into growth with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)