- United States

- /

- Software

- /

- NasdaqGS:NTSK

Netskope (NTSK) Q3: Deepening $453M Net Loss Tests High-Growth Bullish Narrative

Reviewed by Simply Wall St

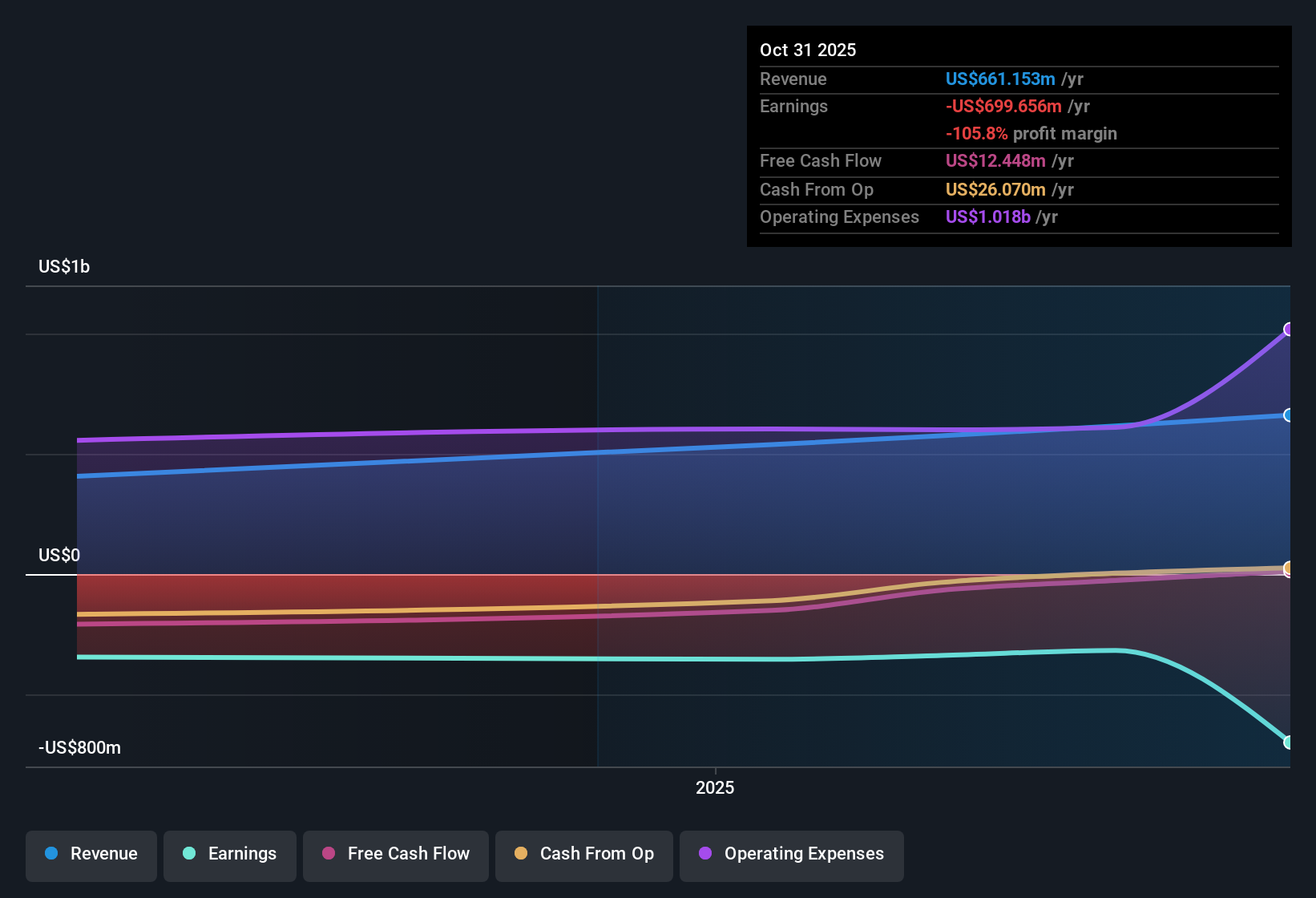

Netskope (NTSK) just posted another heavy investing quarter for Q3 2026, with revenue at about $184 million and basic EPS at roughly -$1.85, while trailing 12 month revenue reached about $661 million and EPS sat near -$4.98.

The company has seen quarterly revenue move from about $130 million in Q2 2025 to around $184 million in Q3 2026, as EPS shifted from roughly -$1.17 to -$1.85 over the same stretch. This has left investors firmly focused on when this top line traction will start easing the pressure on margins.

See our full analysis for Netskope.With the headline numbers on the table, the next step is to compare these results with the key narratives around Netskope, highlighting where the growth story holds up and where persistent margin pressure may challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM losses near $700 million despite $661 million revenue base

- Over the last 12 months, Netskope generated about $661 million in revenue but recorded roughly $700 million in net losses, showing that current scale has not yet translated into positive earnings.

- Bears argue that staying unprofitable for at least the next three years is a key weakness, and the trailing net loss of about $700 million alongside a trailing EPS of around -$4.98 reinforces that concern, while revenue growth of 30.9 percent year over year adds pressure for better cost discipline.

- Critics highlight that quarterly net income swung from a loss of about $90 million in Q2 2026 to roughly $453 million in losses in Q3 2026, which is a sharp step up in red ink even as revenue rose only modestly.

- What stands out for bearish investors is that each of the last five trailing periods shows negative net income, from around -$345 million at the end of 2024 to about -$700 million now, supporting the view that profitability remains distant.

30.9 percent growth meets 21.4 percent forecast pace

- On a trailing basis, revenue grew 30.9 percent year over year and is projected to grow about 21.41 percent annually, so expected growth is slower than the recent run rate but still meaningfully above the broader market cited in the analysis.

- Bullish investors see this revenue profile as the core of the story. The combination of a $661 million trailing revenue base and a 21.41 percent annual growth forecast heavily supports the idea that Netskope can keep expanding its footprint even while it works through losses.

- Supporters point out that quarterly revenue stepped from about $130 million in Q2 2025 to roughly $184 million by Q3 2026, consistent with the strong trailing growth figure of 30.9 percent.

- At the same time, the shift in trailing revenue from around $407 million at the end of 2024 to about $661 million now shows that the business is materially larger than it was just a year ago, which underpins the bullish focus on long term scale.

Price to sales at 12 times with DCF fair value far below

- At a share price of $20.72, Netskope trades at about 12 times trailing sales, above the US Software industry average of 4.9 times and peer average of 8.8 times, and also above the DCF fair value of roughly $7.25 per share.

- Consensus narrative notes a mixed setup where analysts see roughly 31.7 percent upside to a target of about $27.29. At the same time, the premium versus both industry multiples and the DCF fair value suggests the stock already bakes in strong execution and margin improvement that have not yet appeared in the trailing loss of about $700 million.

- What is notable is that the 12 times sales multiple is more than double the sector level of 4.9 times, meaning investors are paying a higher price for each dollar of Netskope revenue than for many other software names despite its negative EPS of around -$4.98 on a trailing basis.

- On the other side of the ledger, the analyst target implying upside from $20.72 to about $27.29 leans on the same growth profile that produced 30.9 percent revenue expansion in the last year, so any slowdown relative to the 21.41 percent forecast could challenge that view.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Netskope's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Netskope is growing quickly but remains deeply unprofitable, with substantial net losses, rich valuation multiples, and no clear path to sustainable earnings.

If you are uneasy about paying a premium for ongoing losses and uncertain profitability, use our these 907 undervalued stocks based on cash flows to explore companies that currently combine stronger fundamentals with more moderate pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Netskope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTSK

Netskope

A cybersecurity company, provides security, networking, and analytics solutions to largest enterprises to mid-sized companies worldwide.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)