- United States

- /

- Software

- /

- NasdaqGS:NTNX

Is Red Hat’s Rise Forcing Nutanix (NTNX) to Rethink Its Competitive Edge With Legacy Clients?

Reviewed by Sasha Jovanovic

- Earlier this week, Northland Securities downgraded Nutanix, citing concerns that increased competition from Red Hat is limiting Nutanix’s ability to attract VMware customers transitioning platforms.

- This analyst action underscores the risks associated with Nutanix’s concentration on traditional application clients as newer, modern workloads shift the industry landscape.

- We’ll now assess how heightened competitive threats, particularly from Red Hat, could influence Nutanix’s future growth outlook and current analyst assumptions.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Nutanix Investment Narrative Recap

To own Nutanix stock, you need to believe in the company’s ability to capture spending on hybrid and multi-cloud solutions as enterprises modernize IT infrastructure. The recent downgrade from Northland Securities highlights heightened competition from Red Hat, which could slow Nutanix's push to attract VMware migrations, a catalyst for short-term growth, but does not fundamentally alter the bigger risk tied to broader industry shifts toward public cloud providers.

One of the most relevant company announcements is Nutanix’s strategic collaboration with Finanz Informatik, showcasing its ongoing traction with major enterprise customers. While such deals underscore Nutanix’s growth pipeline, competitive pressures and traditional workload concentration remain key factors influencing the impact of these wins in the coming quarters.

However, investors should be aware that while the VMware migration opportunity receives attention, the real risk may actually lie in...

Read the full narrative on Nutanix (it's free!)

Nutanix's narrative projects $3.9 billion in revenue and $513.0 million in earnings by 2028. This requires 15.3% yearly revenue growth and a $324.6 million increase in earnings from $188.4 million today.

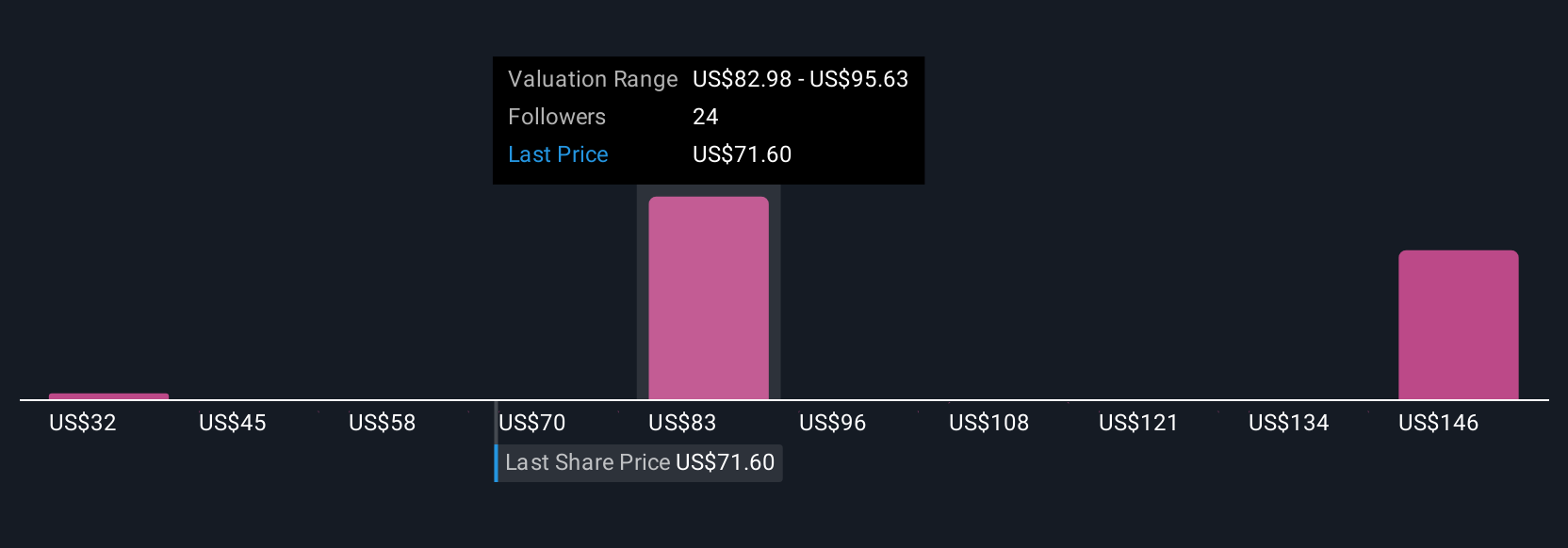

Uncover how Nutanix's forecasts yield a $87.03 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members gave fair value targets for Nutanix ranging from US$32.34 to US$118.13. With industry-wide competition intensifying, your view on Nutanix’s future role is more important than ever, see what others are forecasting and why opinions vary so much.

Explore 7 other fair value estimates on Nutanix - why the stock might be worth less than half the current price!

Build Your Own Nutanix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutanix research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nutanix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutanix's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)