- United States

- /

- Software

- /

- NasdaqGS:NCNO

Assessing nCino (NCNO): Is the Current Valuation a Long-Term Opportunity for Investors?

Reviewed by Kshitija Bhandaru

If you’ve been watching nCino (NCNO) lately and wondering if it’s worth a place in your portfolio, you’re not alone. After a stretch of modest gains and some up-and-down trading this year, nCino’s latest move might have investors questioning what’s driving sentiment around this cloud banking software provider. With no headline-grabbing events or big product unveilings, the recent trading action may simply be catching investor attention. This could be a signal to reassess the company’s story and its prospects in a market where growth names have gone both ways in 2024.

Looking at a wider timeframe, nCino’s share price has seen small positives this month but remains in negative territory for the year, continuing a much longer-term slide since its early days as a public company. Momentum picked up slightly over the past three months, providing a touch of optimism. However, broader results and profitability still seem to be weighing on the stock’s narrative. The company’s latest financial reports showed steady revenue growth and improving net results, though these gains haven’t yet translated into a sustained stock recovery.

So, after a year marked by modest improvements alongside longer-term underperformance, is nCino poised for a rebound, or is the current price already factoring in all of its growth potential?

Most Popular Narrative: 16.6% Undervalued

The most widely followed analyst narrative sees nCino as meaningfully undervalued, with upside potential based on ambitious growth and margin expansion projections. Analysts are confident in the company’s rebound potential, even with a higher risk profile and ongoing investment needs.

Early success in underpenetrated international markets (notably Continental Europe, including first wins and successful go-lives) and the full integration of acquired assets (FullCircl, Sandbox Banking) are expected to accelerate international growth rates and diversify revenue streams. This may improve growth visibility and reduce market concentration risk.

Want to know what powers this bold upside call? Analysts are wagering on a future where revenue and profit margins reach heights rarely seen for a banking software company. What are their ambitious targets, and how do the expected profitability gains reshape the company’s price multiple? Find out which financial milestones the narrative says could send nCino’s value sharply higher from here.

Result: Fair Value of $35.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from global tech giants or slower than expected international adoption could quickly undermine the optimism surrounding nCino’s growth prospects.

Find out about the key risks to this nCino narrative.Another View: Market-Based Comparison

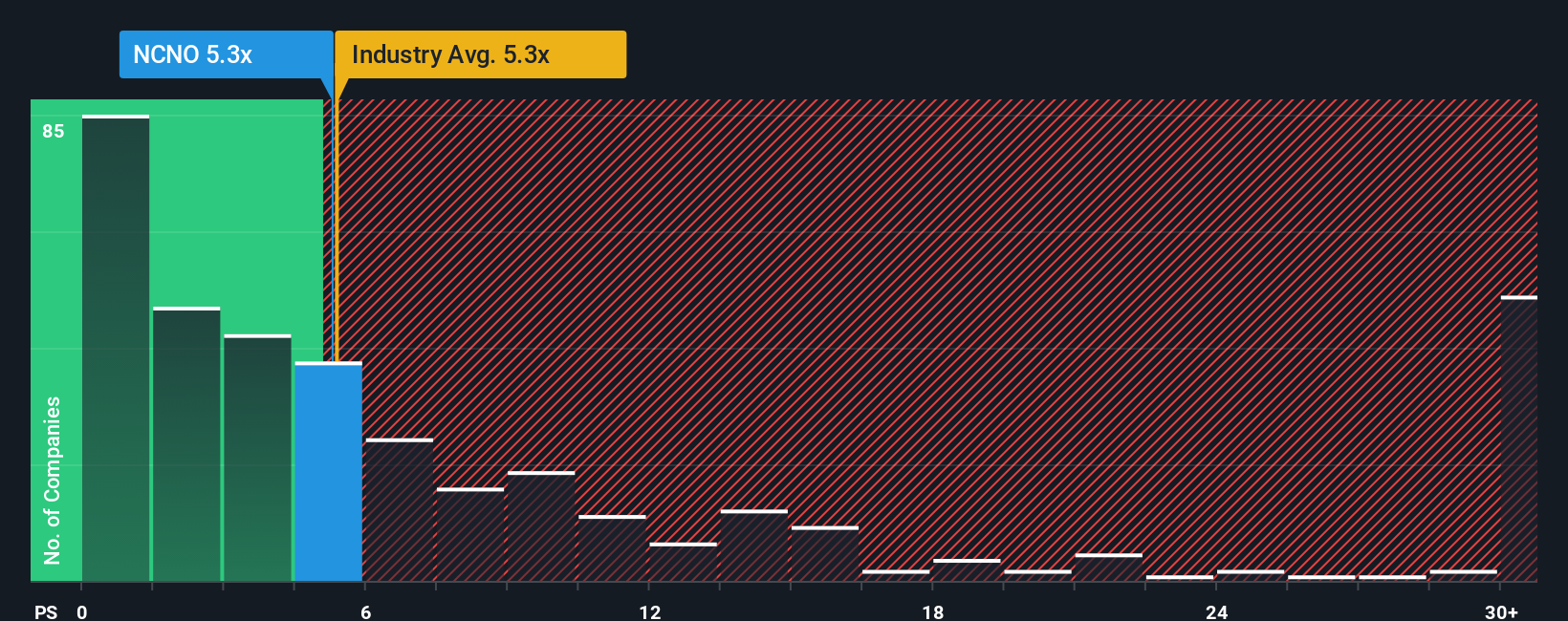

Looking at nCino from a different angle, the company's current valuation appears high compared to the wider software sector, based on industry-standard ratios. Does this mean the growth optimism is fully priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding nCino to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own nCino Narrative

If you’re interested in digging into the details and want to shape your own perspective around nCino, you can review the numbers and craft a personalized take in under three minutes. Do it your way

A great starting point for your nCino research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunity to just one stock when there are so many paths to growth and value. With the Simply Wall Street Screener, you can confidently find other high-potential companies and fresh ideas built around what matters most to you. You never want to be the one who noticed the trend too late.

- Supercharge your search for tomorrow’s tech leaders by tapping into AI penny stocks to see which AI companies have the potential to transform entire industries.

- Capture reliable income streams with dividend stocks with yields > 3% so your portfolio keeps working for you even in uncertain times.

- Identify stocks the market is overlooking by targeting undervalued stocks based on cash flows, where value meets opportunity for smart investors ready to get ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NCNO

nCino

A software-as-a-service company, provides software solutions to financial institutions in the United States, the United Kingdom, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives