- United States

- /

- Software

- /

- NasdaqGS:MSTR

How Investors May Respond To Strategy (MSTR) Building a US$1.44 Billion Cash Reserve Beside Its Bitcoin Stack

Reviewed by Sasha Jovanovic

- In recent days, Strategy Inc. created a US$1.44 billion cash reserve funded by common stock sales, reaffirmed preferred stock dividends for December 31, 2025, and appointed Thomas C. Chow as Executive Vice President & General Counsel and Corporate Secretary.

- By pairing a large U.S. dollar reserve with ongoing bitcoin accumulation and new legal leadership, Strategy is reshaping how it balances balance-sheet risk, shareholder payouts, and regulatory complexity around its bitcoin-centric business model.

- With the shares up over the past week, we’ll examine how the US$1.44 billion reserve reshapes Strategy’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Strategy's Investment Narrative?

To own Strategy today, you have to believe in its core idea: using a leveraged balance sheet to turn bitcoin exposure into equity returns, while the underlying software business and capital markets access keep the lights on. The new US$1.44 billion dollar reserve goes right to the heart of the near term story, because it buys time on the two biggest pressure points: preferred dividends and debt interest. That reduces the immediate risk of forced bitcoin sales after a steep price drop, even if it came at the cost of fresh dilution and a sharply cut earnings outlook. Chow’s appointment as General Counsel rounds out the picture, signalling a tighter legal and regulatory focus just as index exclusion risk, capital raising uncertainty and bitcoin volatility remain front and center.

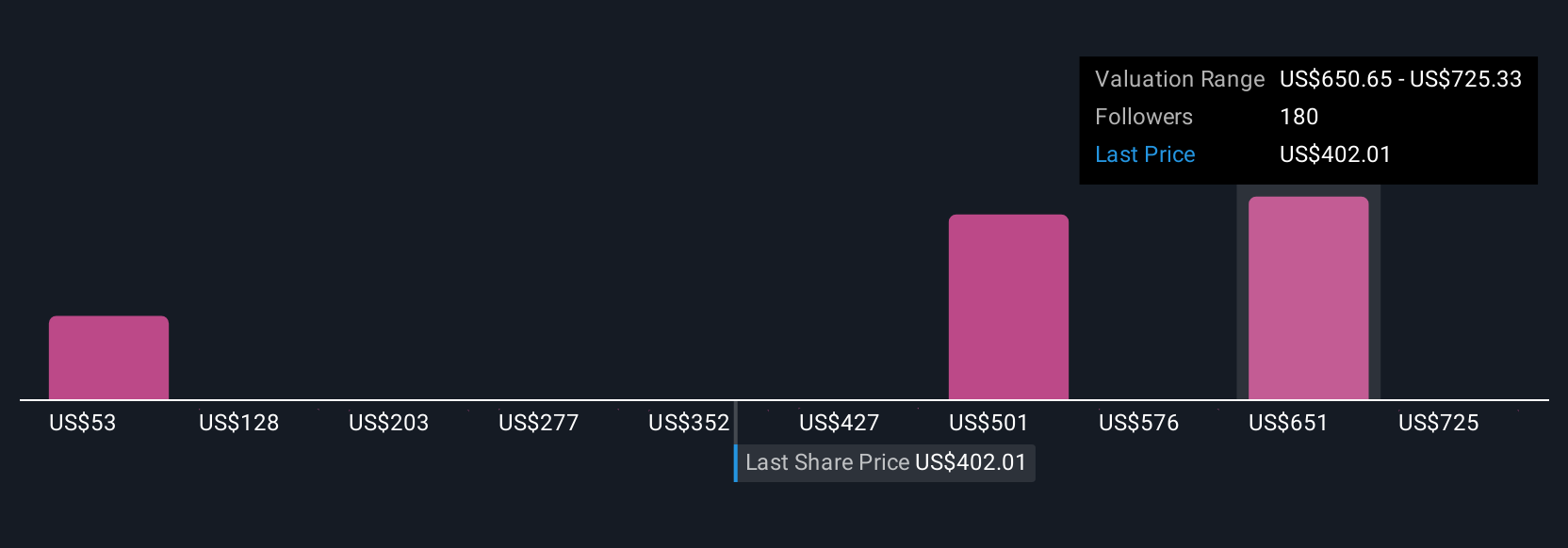

But there is one funding risk in particular that shareholders should not ignore. Our comprehensive valuation report raises the possibility that Strategy is priced lower than what may be justified by its financials.Exploring Other Perspectives

Explore 4 other fair value estimates on Strategy - why the stock might be worth over 3x more than the current price!

Build Your Own Strategy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strategy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Strategy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strategy's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

Strategy

Operates as a bitcoin treasury company in the United States, Europe, the Middle East, Africa, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026