- United States

- /

- Software

- /

- NasdaqGS:MSFT

Microsoft (NasdaqGS:MSFT) To Enhance Data Security With Kyndryl Using Microsoft Purview

Reviewed by Simply Wall St

Microsoft (NasdaqGS:MSFT) saw its share price rise by 5% last week, influenced by its strategic collaboration with Kyndryl on data security initiatives. This development aligns with growing market interest in data protection and AI, crucial in today's digital landscape. While broader market trends also contributed, with the Nasdaq gaining 4% amid optimism around tariff negotiations and positive quarterly earnings from tech peers, Microsoft's news likely enhanced its appeal in juxtaposition to mixed results from other tech giants like Intel and T-Mobile. Thus, the company's collaboration efforts might have bolstered its position amidst favorable market conditions.

Buy, Hold or Sell Microsoft? View our complete analysis and fair value estimate and you decide.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

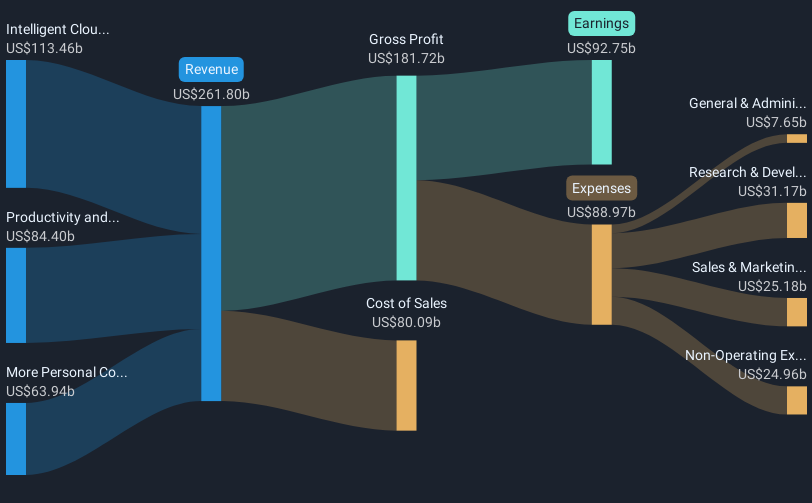

The collaboration with Kyndryl on data security could influence Microsoft's narrative by reinforcing the company's emphasis on AI and data protection. This aligns with its recent revenue boost, highlighting Microsoft's AI business as a critical growth driver with an annual revenue run rate exceeding US$13 billion. Analysts suggest that these initiatives could further improve long-term revenue and margin expansion, as Microsoft's strategic partnerships and growing AI capabilities play a pivotal role in enhancing its market appeal.

Microsoft's total return over the past five years was 125.78%, showing strong long-term performance, although the company's one-year return fell short of the US market's 7.9% gain. This longer-term context underscores the importance of consistent growth initiatives and market positioning, as observed in its collaboration efforts and AI advancements. When compared to the US Software industry, which returned 6.8% over the past year, Microsoft's performance was also less favorable.

In terms of revenue and earnings forecasts, the impact of the recent news appears supportive of analysts' expectations. Revenues are expected to grow by 13.6% annually over the next three years, driven by increased enterprise deployments of AI and the integration of Microsoft Copilot in 365 products. These developments could play a significant role in realizing the price target of US$493.34, which represents a 26.3% potential increase from the current share price of US$366.82. However, investors are encouraged to evaluate these projections based on their understanding of market dynamics and company fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Microsoft, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSFT

Microsoft

Develops and supports software, services, devices and solutions worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives