- United States

- /

- Software

- /

- NasdaqGS:MNDY

Does the Recent Share Price Slump Signal Opportunity in monday.com for 2025?

Reviewed by Simply Wall St

Trying to figure out what to do next with monday.com stock? You are definitely not alone. This workflow software leader has given investors plenty to talk about lately, both for its rollercoaster ride on the charts and for what its numbers suggest might come next. Over the past month, shares dipped sharply, dropping nearly 39%, and they are still down more than 32% over the last year. But here is the twist: in the last day and week, there have been glimmers of green, hinting that risk perceptions may be shifting again or that some nimble investors see potential for a turnaround.

Underneath those moves are some big signals. monday.com is showing a healthy growth engine, with annual revenue up about 18% and net income surging more than 35%. Wall Street has been paying attention, and the stock trades at a striking discount to its average analyst price target, close to 59%. Still, the so-called “value score” clocks in at 3 out of 6 based on standard valuation checks, meaning there are clear areas where the market might remain cautious.

So how does the story take shape when you look at monday.com through classic valuation methods? And more importantly, is there a smarter way to cut through the noise and judge if the current price really is a bargain? That is exactly where we are headed next.

monday.com delivered -32.5% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: monday.com Cash Flows

A Discounted Cash Flow (DCF) model estimates what a company is worth by extrapolating future cash flows and bringing those values back to today, reflecting the time value of money. It is a core tool for separating short-term noise from long-term value.

For monday.com, the latest reported Free Cash Flow is approximately $322 million, and analyst models suggest this could reach about $1.16 billion by 2035. This steady growth, based on projections from multiple analysts and estimation methods, paints a picture of a business with notable financial momentum.

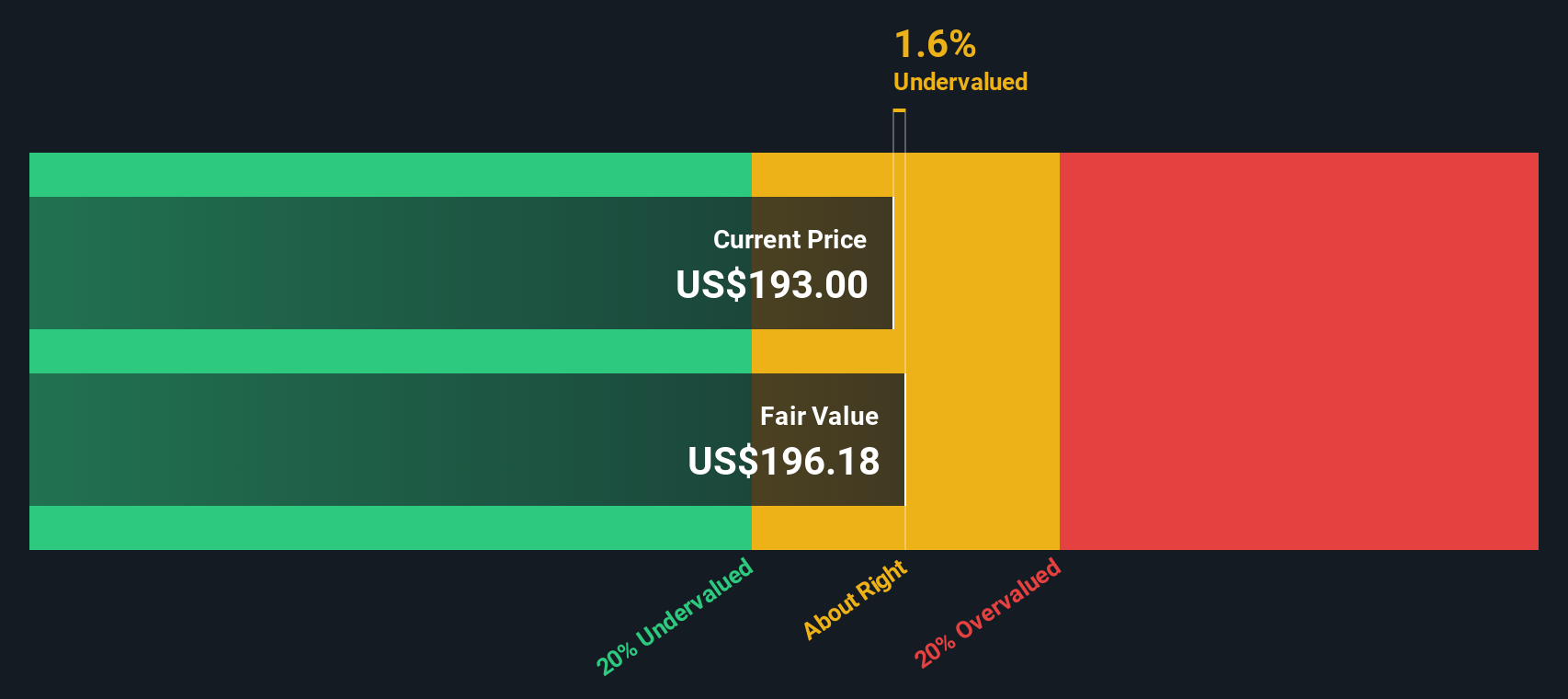

With these forecasts, the DCF approach assigns an intrinsic value of $196.39 per share. Comparing this to the current price, monday.com appears about 9.4% undervalued. This indicates it might be trading just beneath what fundamental cash flows justify, but not dramatically so.

In summary, the numbers suggest monday.com’s valuation is somewhere in line with its underlying business expectations, with only a mild disconnect from the market price.

Result: ABOUT RIGHT

Approach 2: monday.com Price vs Sales

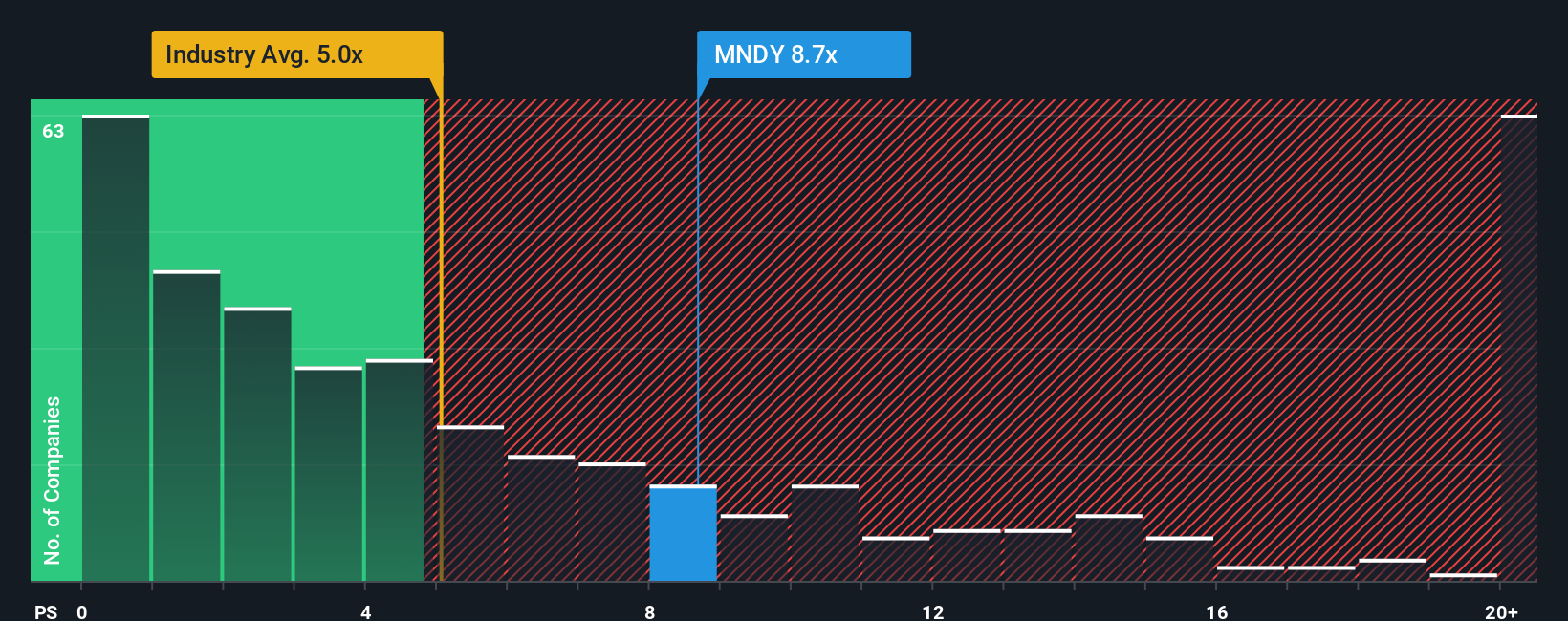

The Price-to-Sales (PS) multiple is often the go-to metric for valuing software companies like monday.com, especially when profits are still scaling or when revenue growth is a major driver of value. For businesses in high-growth sectors, the PS ratio does a good job of normalizing differences in profit margins and highlighting how the market is pricing future growth, scaling potential, and risk.

When it comes to monday.com, its current PS multiple sits at 8.33x. To put this in perspective, that figure is slightly below the industry average of 5.23x, but also comfortably in range of direct peer averages at 8.75x. This suggests that despite strong growth, the market is not bidding up the stock to exuberant levels compared to similar businesses.

But is the current PS ratio in line with what monday.com really deserves? Simply Wall St’s proprietary “Fair Ratio” metric, which considers the company’s specific growth profile, margins, risks, and size, sits at 12.43x. Because monday.com’s actual PS multiple is somewhat below this figure, the numbers suggest the market is underestimating its growth outlook and balance of risks relative to peers.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your monday.com Narrative

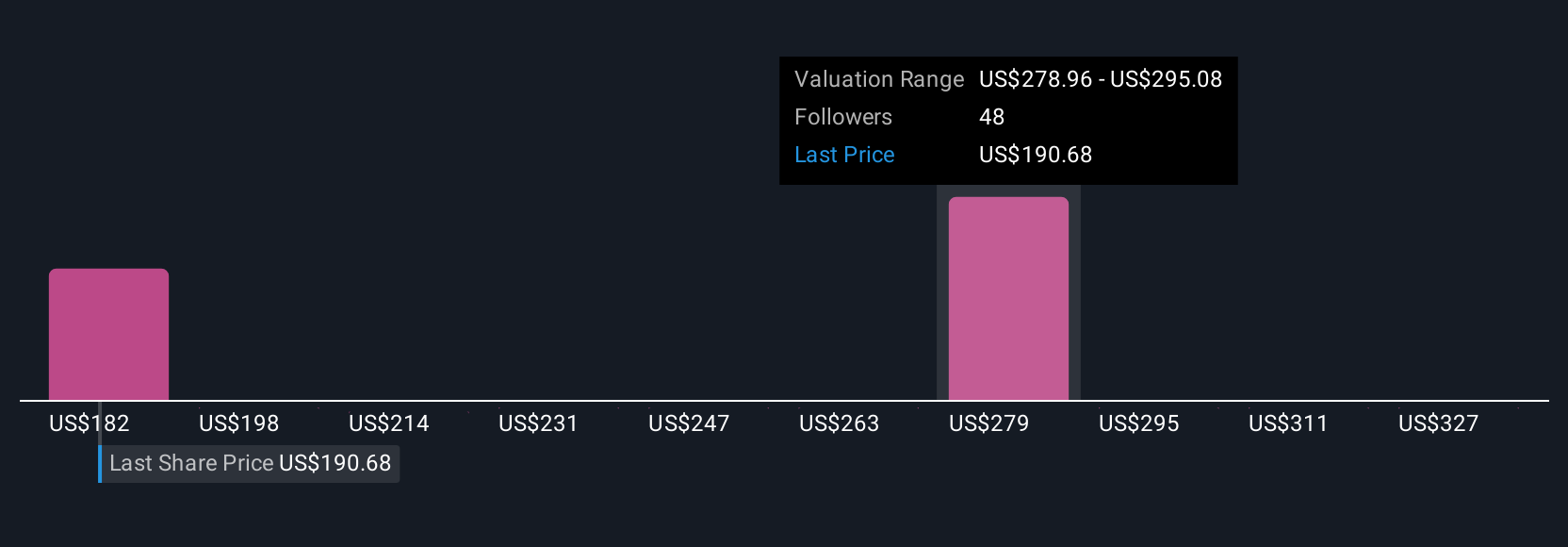

Narratives provide a powerful, approachable way to invest by letting you connect your perspective on a company’s future—its story, potential, and challenges—to your own financial forecasts and fair value estimates.

With Narratives, you can easily link what you know or believe about a company like monday.com directly to the numbers, building a custom fair value that reflects your view of its future revenue, earnings, and margins.

On Simply Wall St, millions of investors use Narratives as an accessible tool to guide their buy or sell decisions. They compare their calculated Fair Value to the current Price and see how their thinking stacks up against the community’s range of perspectives.

Narratives are updated automatically whenever important news or earnings come in, so your fair value and confidence always stay in sync with the latest facts.

For example, one investor’s Narrative might be optimistic, leading to a fair value for monday.com near $450. Another’s more cautious view could result in a fair value closer to $215.

Do you think there's more to the story for monday.com? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives