- United States

- /

- IT

- /

- NasdaqGM:MDB

MongoDB (MDB) Reports Q2 Revenue Growth With Lower Net Losses Compared To Last Year

Reviewed by Simply Wall St

MongoDB (MDB) recently reported a 13.74% increase in its share price over the last quarter, reflecting several key developments. The company showed notable revenue growth, with Q2 2025 revenue at USD 591.4 million, up from USD 478.11 million a year ago, indicating a positive trajectory despite ongoing net losses. MongoDB's updated guidance, projecting steady revenue growth, likely bolstered market confidence. Additionally, advancements in AI application development and its inclusion in several Russell benchmarks may have further strengthened investor sentiment. These elements, against the backdrop of a broader market increase, likely supported the company's positive share price movement.

Every company has risks, and we've spotted 2 possible red flags for MongoDB you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

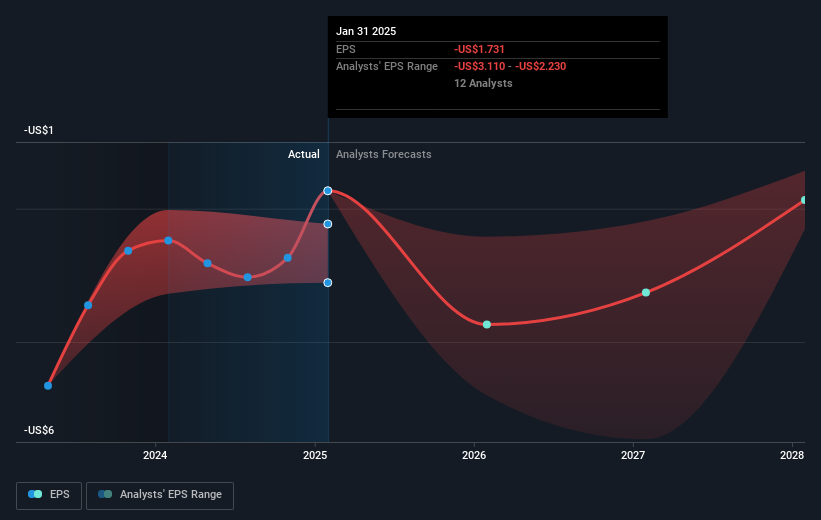

The recent developments in MongoDB (MDB), including a 13.74% quarterly share price increase, may influence its revenue and earnings forecasts positively. The company's emphasis on AI application development and steady revenue growth guidance are integral to this outlook. However, any immediate financial gains from AI and app modernization might take more time to materialize, potentially impacting short-term revenue growth. Though analysts predict annual revenue growth of 15.5%, achieving profitability remains a longer-term challenge.

Over the past year, MongoDB's total shareholder return, including dividends and share price changes, was a 10.26% decline. This underperformance compared to the broader US market's 16.2% return indicates challenges in maintaining investor confidence amid broader market conditions. As of now, MongoDB is trading at US$214.34, approximately 27% below the consensus analyst price target of US$272.21, suggesting potential upside if the company meets growth expectations. However, differing analyst views, with price targets ranging from US$170.0 to US$395.0, highlight uncertainty regarding future share price movements.

Assess MongoDB's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)