- United States

- /

- Software

- /

- NasdaqGS:MAPS

Performance Shipping And 2 Other Promising Penny Stocks For Your Consideration

Reviewed by Simply Wall St

U.S. stock indexes have recently ticked higher following key inflation data, suggesting cautious optimism among investors as they anticipate upcoming Federal Reserve policy decisions. In the context of this market environment, penny stocks remain a notable area for investors seeking potential growth opportunities outside of traditional blue-chip companies. Though the term "penny stocks" may seem outdated, these smaller or newer companies can still offer significant value and growth potential when supported by strong financials and strategic positioning.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.95 | $392.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.82 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9086 | $155.08M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.24 | $545.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.375 | $1.43B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.86 | $621.82M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.56 | $376.37M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8699 | $6.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.30 | $96.74M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Performance Shipping (PSHG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Performance Shipping Inc. offers global shipping transportation services using its tanker vessels, with a market cap of $30.83 million.

Operations: The company's revenue is primarily derived from its container vessels, totaling $79.69 million.

Market Cap: $30.83M

Performance Shipping Inc., with a market cap of US$30.83 million, has shown volatility in its earnings, reporting decreased third-quarter sales and net income compared to the previous year. Despite this, the company has secured long-term time charter contracts for two newly acquired Suezmax tankers with Repsol Trading S.A., expected to generate approximately US$78 million in gross revenue over three years. The company's short-term assets comfortably exceed short-term liabilities, although they fall short of covering long-term liabilities. While debt levels have increased over five years, interest coverage remains strong at 80 times EBIT.

- Get an in-depth perspective on Performance Shipping's performance by reading our balance sheet health report here.

- Evaluate Performance Shipping's prospects by accessing our earnings growth report.

Caribou Biosciences (CRBU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Caribou Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing genome-edited allogeneic cell therapies for treating hematologic malignancies and autoimmune diseases, with a market cap of approximately $173.85 million.

Operations: Caribou Biosciences generates revenue primarily from developing a pipeline of allogeneic CAR-T and CAR-NK cell therapies, amounting to $9.30 million.

Market Cap: $173.85M

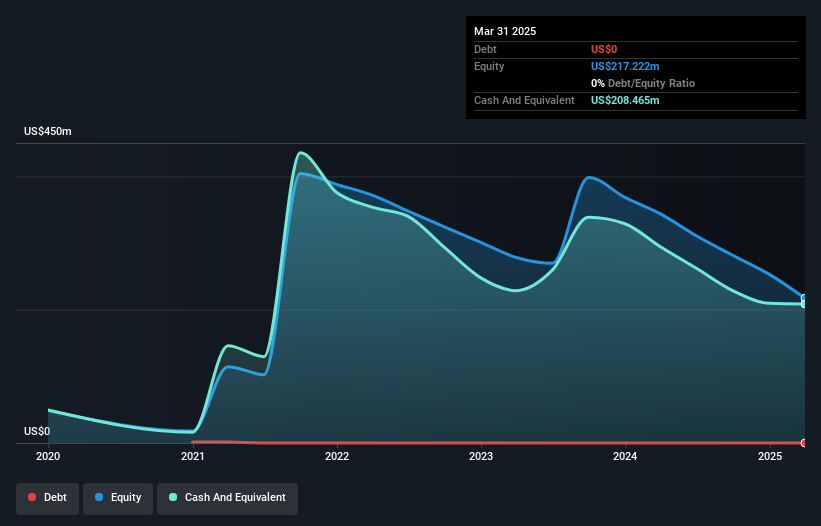

Caribou Biosciences, Inc., with a market cap of US$173.85 million, remains unprofitable and faces challenges in achieving profitability over the next three years. Despite this, it is advancing its clinical programs with promising developments in its CaMMouflage phase 1 trial for CB-011, an allogeneic CAR-T cell therapy for multiple myeloma. The company reported a net loss of US$27.55 million in Q3 2025 but has shown progress by reducing losses compared to the previous year. Caribou's short-term assets exceed both short-term and long-term liabilities, providing some financial stability amid high share price volatility.

- Click to explore a detailed breakdown of our findings in Caribou Biosciences' financial health report.

- Learn about Caribou Biosciences' future growth trajectory here.

WM Technology (MAPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WM Technology, Inc. operates as an online cannabis marketplace offering ecommerce and compliance software solutions to retailers and brands in the cannabis industry both in the United States and internationally, with a market cap of $155.08 million.

Operations: The company generates revenue primarily from its Software & Programming segment, totaling $179.31 million.

Market Cap: $155.08M

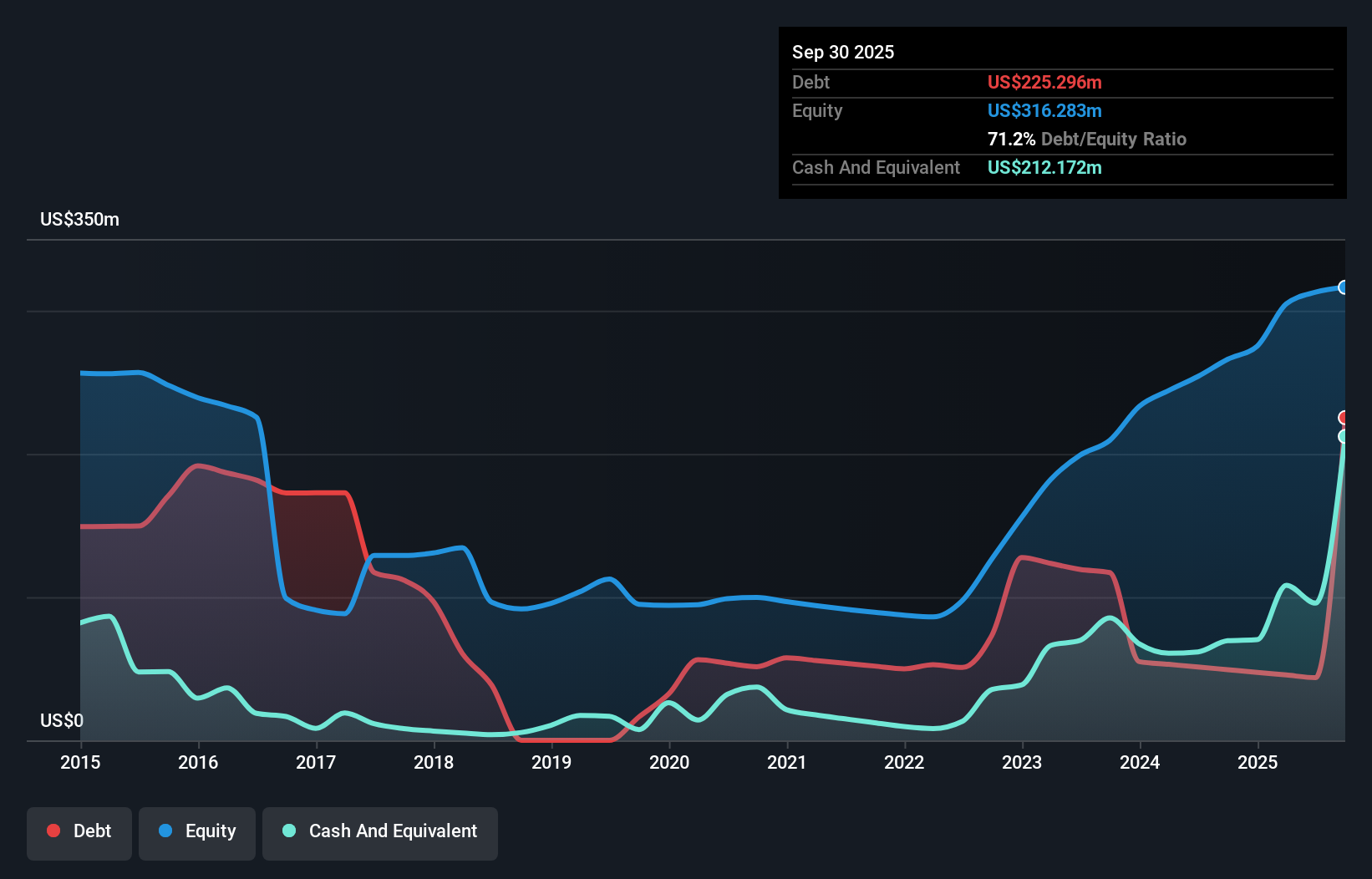

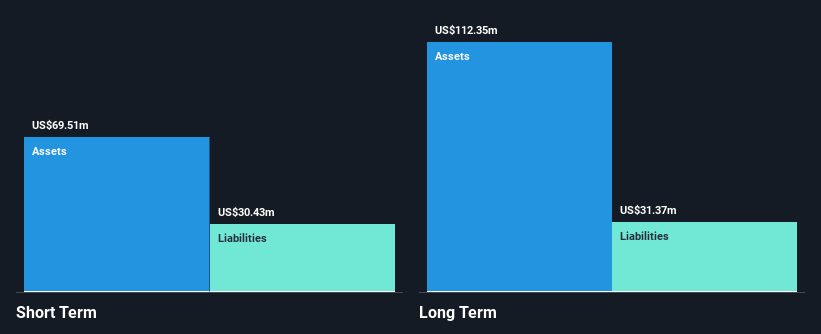

WM Technology, Inc., with a market cap of US$155.08 million, recently reported a decline in Q3 2025 sales to US$42.18 million from US$46.55 million the previous year, while net income fell to US$2.46 million from US$3.33 million. Despite this, the company remains debt-free and is trading at 34.4% below its estimated fair value, suggesting potential undervaluation compared to peers and industry standards. The company's short-term assets of US$81.6 million comfortably cover both its short-term and long-term liabilities, although significant insider selling in recent months warrants caution for investors considering this penny stock opportunity.

- Jump into the full analysis health report here for a deeper understanding of WM Technology.

- Gain insights into WM Technology's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Explore the 342 names from our US Penny Stocks screener here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WM Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MAPS

WM Technology

An online cannabis marketplace, provides ecommerce and compliance software solutions to retailers and brands in cannabis market in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026