- United States

- /

- Software

- /

- NasdaqGS:IREN

IREN (IREN) Reports August Bitcoin Revenue of US$77M, New CFO Appointed

Reviewed by Simply Wall St

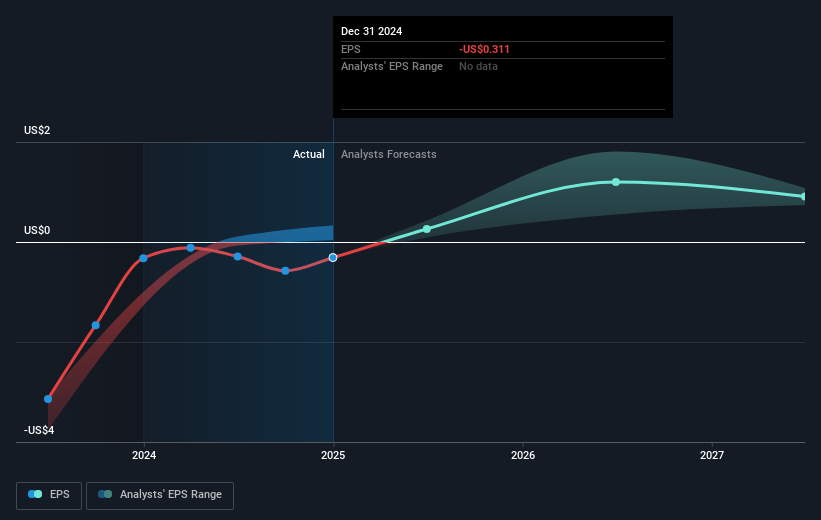

On September 8, 2025, IREN (IREN) announced a key appointment, bringing Anthony Lewis on board as CFO, succeeding Belinda Nucifora. This executive change coincided with a robust reported Bitcoin mining revenue of USD 76.7 million for August. Over the last quarter, the company's stock experienced a remarkable price increase of 149%, contrasting with a relatively flat overall market. Factors such as improved Q4 earnings results and strategic leadership transitions likely influenced this significant share price movement, potentially highlighting investor confidence amidst broader market trends and economic conditions.

We've identified 3 possible red flags for IREN (2 are concerning) that you should be aware of.

The recent executive transition at IREN, with Anthony Lewis stepping in as CFO, coupled with robust Bitcoin mining revenue, could reinforce the company's strategic narrative focused on expanding AI cloud and data center operations. By strengthening leadership, IREN might enhance financial management and investor confidence, providing momentum for anticipated shifts towards higher-margin sectors and supporting revenue initiatives. The news aligns with IREN’s strategy of leveraging growth in AI services to bolster financial prospects, possibly impacting future revenue and earnings positively.

Over a three-year period, IREN shareholders have witnessed remarkable total returns of nearly 460%, reflecting strong market performance. This significant growth contrasts with the company’s recent one-year return that also surpassed both the US market and the relevant industry benchmarks. As of today, IREN shares are priced at $26.15, showing a slight discount to the consensus price target of $28.73, suggesting that while investor optimism exists, market pricing still presents a cautious gap. Despite increased volatility in recent months, broad market conditions and strategic initiatives could influence this valuation gap.

Unlock comprehensive insights into our analysis of IREN stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IREN

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives