- United States

- /

- Software

- /

- NasdaqGS:INTU

Let's Open The Books: Intuit Inc. (NASDAQ:INTU) Beat Earnings, but Insider Selling Gives Pause

- Full year adj. earnings and revenue grew by 22% and 32% respectively. Q4 Free cash flows at $3.66b ex. investment outflows.

- The company is expected to grow revenue by 15% in 2023, while spending around $9b in capex and acquisitions.

- Insider transactions show an absence of buying and consistent selling in the last 12 months.

Intuit Inc., ( NasdaqGS:INTU ) just reported Q4 2022 earnings. The company beat revenue and adjusted EPS expectations, but may have issued weak forward guidance. We look at the earnings results, outlook and insider selling activity in the analysis below.

Earnings Analysis

While it may not be fair to go with GAAP earnings at this time, Intuit's Non-GAAP earnings may not be the best reflection of the returns attributable to investors, as they have invested $5.68b in acquisitions (Q4), which place the free cash flows around $-2.022b - excluding change in working capital and stock based compensation. If investors prefer not to count outflows from investing activities as capital expenditures, then the Non-GAAP free cash flows amount to $3.66b.

The good news for investors is that revenues in the fiscal year 2022 grew by 32%, indicating business resilience and momentum even after the tech boom slowed down.

Check out our latest analysis for Intuit

In the following segments, we will break down the earnings highlights and future estimates:

Q4 Results

- Revenue of $2.414b, down 6% YoY. Beat estimates by 2.9%.

- Non-GAAP operating income of $433m, beat estimates by 9.6%. GAAP operating income at $-75m.

- Adjusted EPS of $1.10, beating estimates by 12.2%. GAAP EPS at $-0.2.

- Cash from operations of $3.889b, up by 19.7%.

- Non GAAP free cash flows of $3.660b, FCF including acquisitions $-2.022b.

Full Year 2022 Results

- Revenue of $12.7b, up 32% YoY.

- Operating income $2.57b, up 3% YoY.

- EPS $7.28, down 4%. Non GAAP EPS at $11.85, up 22% YoY.

Outlook

- Q1 revenue around $2.496b.

- Q1 operating income around $-115.

- Q1 EPS around $0.4, ajd. EPS $1.17.

- 2023 revenue around $14.593b. Implied YoY growth of 15%.

- 2023 operating income around $2.847. Implied YoY growth of 11%.

- 2023 EPS around $7.07, adj. EPS around $13.74. GAAP implied decline of -2.9%. Non-GAAP implied growth of 16%.

Comparing the current results with management's outlook, it seems that revenue growth is expected to decelerate, even after some $9b in capital expenditures (including acquisitions) since 2021. For this amount of new capital invested into the business, we would expect above 20% top line growth, given the success and returns of previous investments.

The operating income is expected to grow, but it will take some time before the free cash flows catch-up to the bottom line. Which is why management needs to impose discipline and make sure that the investments bring the promised growth and cost-cutting synergies.

On that note, it is disheartening to see management failing to back their vision with action, and we find insiders selling at what may have been top ticks for the company. We analyze the last year's insider transactions in the next segment.

Intuit Insider Selling

When looking at insider transactions, we are scanning for consistency and transactions happening from more than one person. The goal is to eliminate individual and personal reasons for which someone may sell, and instead look for a possible pattern of people selling with a good understanding of their business.

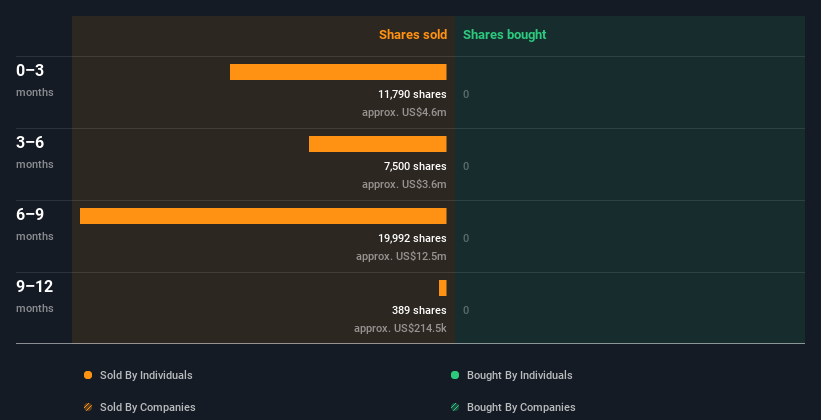

You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

As we can see, selling is consistent through the year, and multiple insiders have been engaged in the activity. You can view the full breakdown in our report . The most recent reported sale was on the 23th of June 2022, by Ms. Laura Fennel and Mr. Raul Vazquez for a combined value of $4.6m.

While insider selling is not a bad thing per se, the lack of any insider buying may indicate a discrepancy in the vision of management versus their real expectations for the long-term future of the company.

If you would like to see some companies with insider buying instead, check out this free list of growing companies with considerable, recent, insider buying.

What This Means For Investors

There are three key points from this analysis. The earnings performance, which is mixed as the cash flows are not expected to reflect rising profitability yet. The large capital expenses made since 2021, which should yield more revenue growth, however management only expects around 15% growth for 2023. Finally, the growth story doesn't seem to be congruent with the recorded activity from the people that are expected to have a deep understanding of the business. Intuit's insider selling has been consistent and done by multiple insiders over the past 12 months, which may signal caution for the current value of the company.

This does not mean that the stock price will decline, rather it is something investors may want to keep in mind when calculating their expected upside.

In terms of investment risks, we've identified 2 warning signs with Intuit and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:INTU

Intuit

Provides financial management, payments and capital, compliance, and marketing products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives