- United States

- /

- Software

- /

- NasdaqGS:INTA

Could Intapp's (INTA) Lexsoft Alliance Reveal Its Real Strategy for Global Market Expansion?

Reviewed by Sasha Jovanovic

- On September 23, Lexsoft announced a partnership with Intapp to expand Intapp’s sales and implementation capabilities across Europe and Latin America, focusing on Spanish-speaking professional markets and AI-powered solutions.

- This collaboration marks an important step in Intapp’s international growth strategy, signaling increased efforts to reach new clients and support broader adoption overseas.

- We’ll explore how this new partnership with Lexsoft could influence Intapp’s addressable market and inform its evolving investment thesis.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Intapp Investment Narrative Recap

To invest in Intapp, you need to believe in the company's ability to scale its industry-focused, AI-powered SaaS solutions globally, especially through partnerships that strengthen reach and local expertise. The Lexsoft partnership looks set to support client acquisition in new international markets, a key catalyst for near-term growth. However, it also highlights the ongoing risk that an expanding partner ecosystem could make cost control more complex, potentially affecting net margins if implementation falls short.

Looking at the bigger picture, Intapp’s June 2025 partnership with Snowflake stands out, adding further analytical capabilities to its DealCloud solution. This announcement is relevant because it demonstrates Intapp’s continued investment in product innovation, which could drive both partner and client adoption, critical to the company's stated growth ambitions.

By contrast, there is also the risk that outsourcing critical elements to partners adds layers of operational complexity that investors should be aware of...

Read the full narrative on Intapp (it's free!)

Intapp's narrative projects $701.6 million in revenue and $34.2 million in earnings by 2028. This requires 13.2% yearly revenue growth and a $52.5 million increase in earnings from the current -$18.3 million.

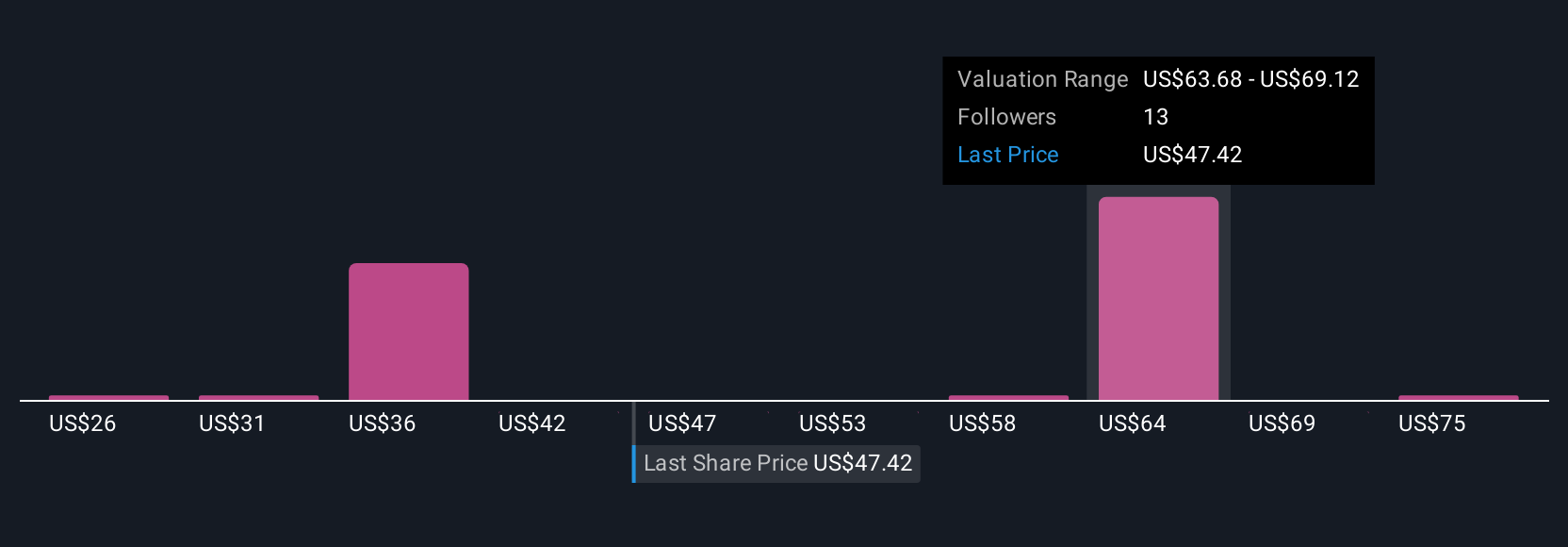

Uncover how Intapp's forecasts yield a $64.75 fair value, a 63% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range from US$25.60 to US$80, reflecting a wide spectrum of investor views. Against this diversity, the growth in Intapp's partner ecosystem reminds us that expanding reach can create new opportunities as well as operational challenges, so there are several different perspectives worth exploring.

Explore 6 other fair value estimates on Intapp - why the stock might be worth 36% less than the current price!

Build Your Own Intapp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intapp research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Intapp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intapp's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTA

Intapp

Through its subsidiary, Integration Appliance, Inc., provides AI-powered solutions in the United States, the United Kingdom, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives