- United States

- /

- Professional Services

- /

- NasdaqGS:CNDT

3 Promising US Penny Stocks With At Least $90M Market Cap

Reviewed by Simply Wall St

On November 7, 2024, U.S. markets continued their upward trajectory following a post-election rally, with the S&P 500 and Nasdaq reaching record highs as the Federal Reserve announced a rate cut. In such buoyant market conditions, investors often look beyond established giants to explore opportunities in lesser-known areas like penny stocks. Although the term "penny stocks" may seem outdated, these smaller or newer companies still offer potential for growth when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8479 | $5.86M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $161.01M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.65 | $2.03B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.91 | $590.24M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.10 | $4.09M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.21 | $49.31M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.50 | $131.24M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $97.13M | ★★★★★☆ |

Click here to see the full list of 747 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

BioAtla (NasdaqGM:BCAB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BioAtla, Inc. is a clinical-stage biopharmaceutical company focused on developing specific and selective antibody-based therapeutics for treating solid tumor cancer, with a market cap of approximately $99.57 million.

Operations: BioAtla, Inc. has not reported any revenue segments.

Market Cap: $99.57M

BioAtla, Inc., with a market cap of approximately US$99.57 million, is a pre-revenue clinical-stage biopharmaceutical company focused on antibody-based cancer therapeutics. Despite its unprofitable status and high share price volatility, the company maintains a debt-free position with short-term assets exceeding liabilities. Recent developments include promising Phase 2 trial data for ozuriftamab vedotin in squamous cell carcinoma and a licensing agreement with Context Therapeutics potentially worth up to US$133.5 million in milestone payments and royalties. However, BioAtla faces challenges with less than one year of cash runway at current burn rates.

- Unlock comprehensive insights into our analysis of BioAtla stock in this financial health report.

- Review our growth performance report to gain insights into BioAtla's future.

Information Services Group (NasdaqGM:III)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Information Services Group, Inc. operates as a technology research and advisory company across the Americas, Europe, and the Asia Pacific with a market cap of $163.79 million.

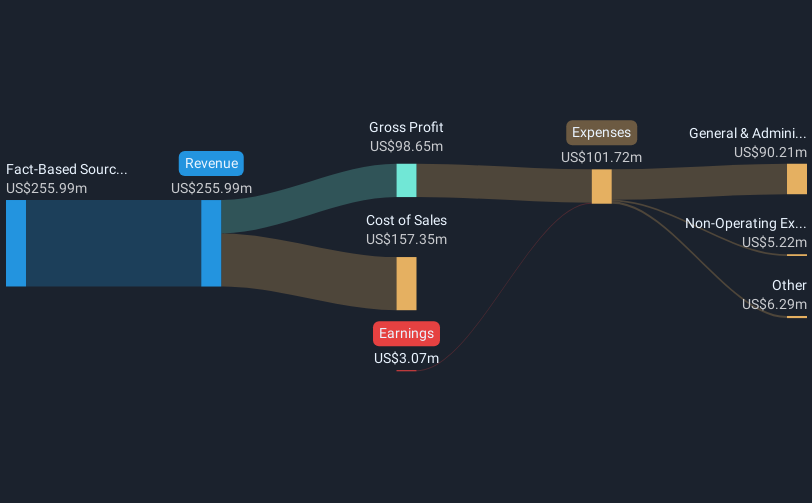

Operations: The company generates revenue primarily through its Fact-Based Sourcing Advisory Services, which amounted to $266.49 million.

Market Cap: $163.79M

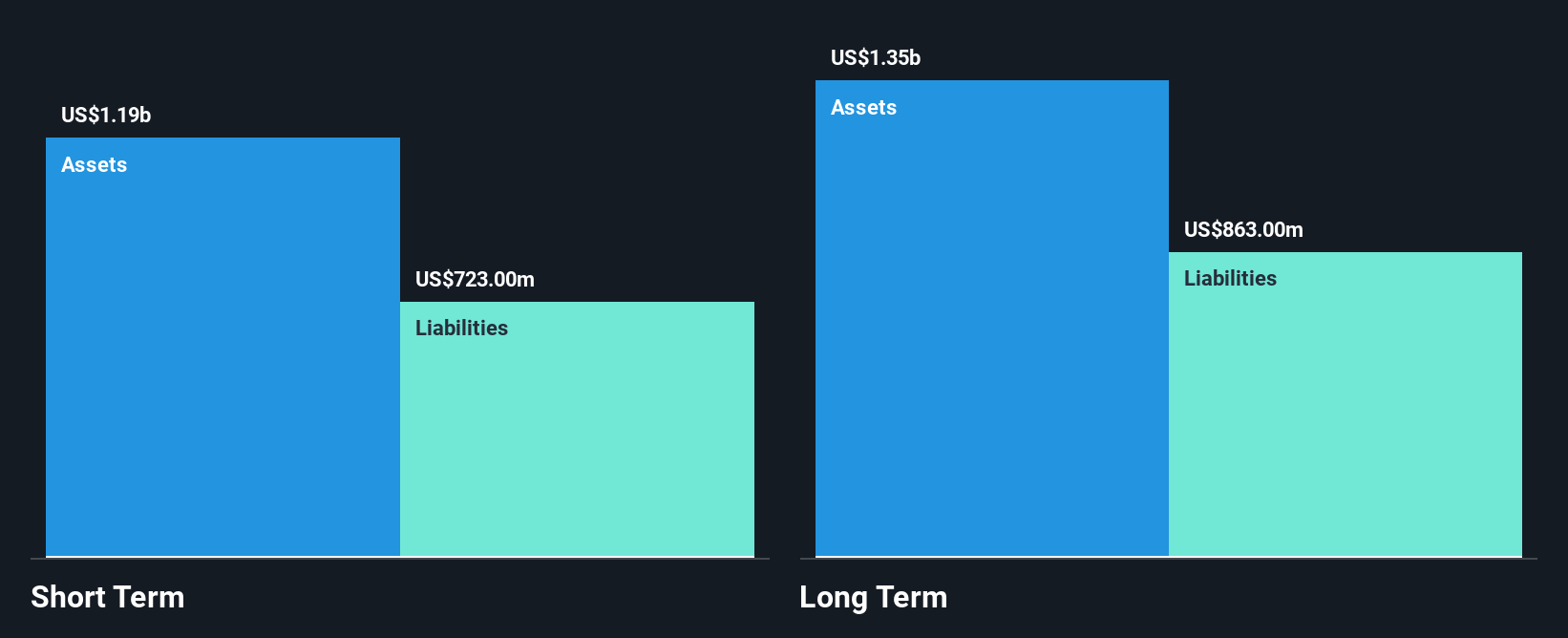

Information Services Group, Inc., with a market cap of US$163.79 million, operates in the technology research and advisory sector, generating US$266.49 million in revenue primarily through its Fact-Based Sourcing Advisory Services. The firm is currently unprofitable with a negative return on equity but has reduced losses over the past five years. Despite high debt levels and interest payments not well covered by earnings, ISG's short-term assets exceed both short and long-term liabilities. Recent initiatives include launching studies on global capability centers and mainframe modernization services, indicating strategic efforts to expand its service offerings amidst industry trends.

- Click to explore a detailed breakdown of our findings in Information Services Group's financial health report.

- Assess Information Services Group's future earnings estimates with our detailed growth reports.

Conduent (NasdaqGS:CNDT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conduent Incorporated offers digital business solutions and services across the commercial, government, and transportation sectors globally, with a market cap of approximately $660.34 million.

Operations: Conduent Incorporated does not report specific revenue segments.

Market Cap: $660.34M

Conduent Incorporated, with a market cap of US$660.34 million, recently reported improved earnings for Q3 2024, moving from a net loss to a net income of US$123 million. Despite declining sales compared to the previous year, the company has become profitable over the past five years and is trading at a significant discount relative to its estimated fair value. Conduent's strategic collaboration with AshBritt aims to enhance emergency services and payment solutions, leveraging its leadership in electronic payments across 37 states. The company's experienced management and board contribute positively to its operational stability amidst industry challenges.

- Click here to discover the nuances of Conduent with our detailed analytical financial health report.

- Evaluate Conduent's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Embark on your investment journey to our 747 US Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNDT

Conduent

Provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives