- United States

- /

- Software

- /

- NasdaqGS:IDCC

Should You Take a Closer Look at InterDigital After Its 138% Surge in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with InterDigital’s stock? You’re definitely not alone, and honestly, it’s never been a more interesting time to take a closer look. Over the past year, InterDigital’s share price has rocketed up an eye-popping 138.4%. If you zoom out, the longer-term numbers are just as impressive, with gains of 711.4% over three years and 573.1% over the last five years. Even in the short term, this momentum is hard to ignore, with a strong 5.5% jump just in the last week and 13.6% over the past month.

Some of this surge reflects a broader market mood, where investors are showing renewed enthusiasm for companies leveraging innovation and intellectual property, especially if they are seen as resilient against global uncertainty. InterDigital has caught the attention of many for these reasons, but are these price levels actually justified?

When we dig into valuation, things get especially interesting. By our scoring system, which checks for signs of undervaluation across six key methods, InterDigital is scoring a 2 out of 6. This suggests there are some bargains here, but it’s not a slam dunk. What do those “checks” really say, and how should you think about valuation for a company like this? Let’s walk through it step-by-step and then take a look at what may be an even more useful way to make your call on InterDigital at the end.

InterDigital scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: InterDigital Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a standard tool for estimating a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. Essentially, it helps investors ask: based on realistic future cash flow estimates, what is the company worth right now?

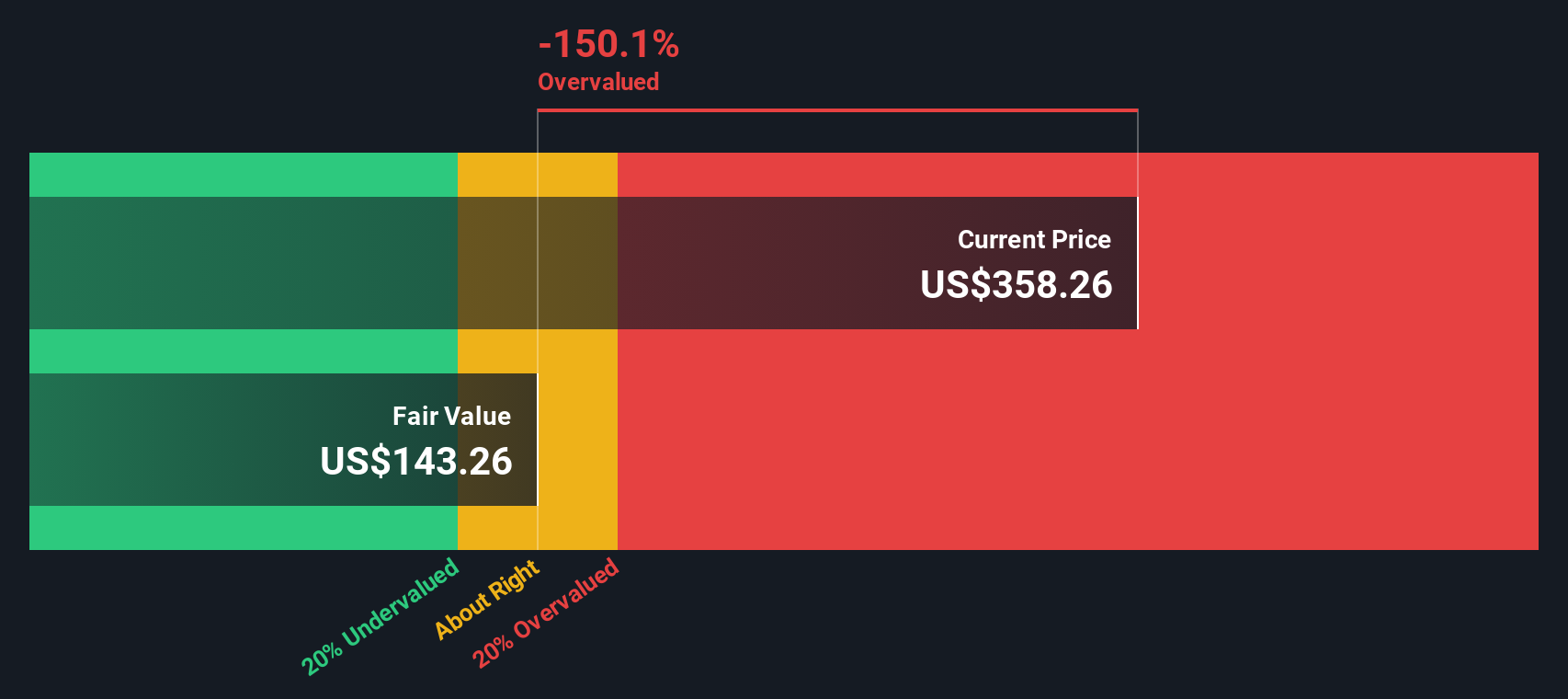

For InterDigital, the current free cash flow stands at $285.2 million. Analysts forecast that by 2027, free cash flow could be around $257 million. From there, Simply Wall St further extrapolates growth for the next several years, projecting free cash flows that fluctuate just above $230 million, reaching $252.1 million by 2035. All estimates remain well below the $1 billion mark, so everything is assessed in millions of dollars.

Using a 2 Stage Free Cash Flow to Equity model, InterDigital’s calculated fair value comes to $143.43 per share. However, this figure is currently at a 156.1% premium to the market price, which implies that the shares are trading well above even optimistic projections.

This means the DCF approach, based on cash flow projections and reasonable discount rates, signals that InterDigital is overvalued at its present share price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests InterDigital may be overvalued by 156.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: InterDigital Price vs Earnings

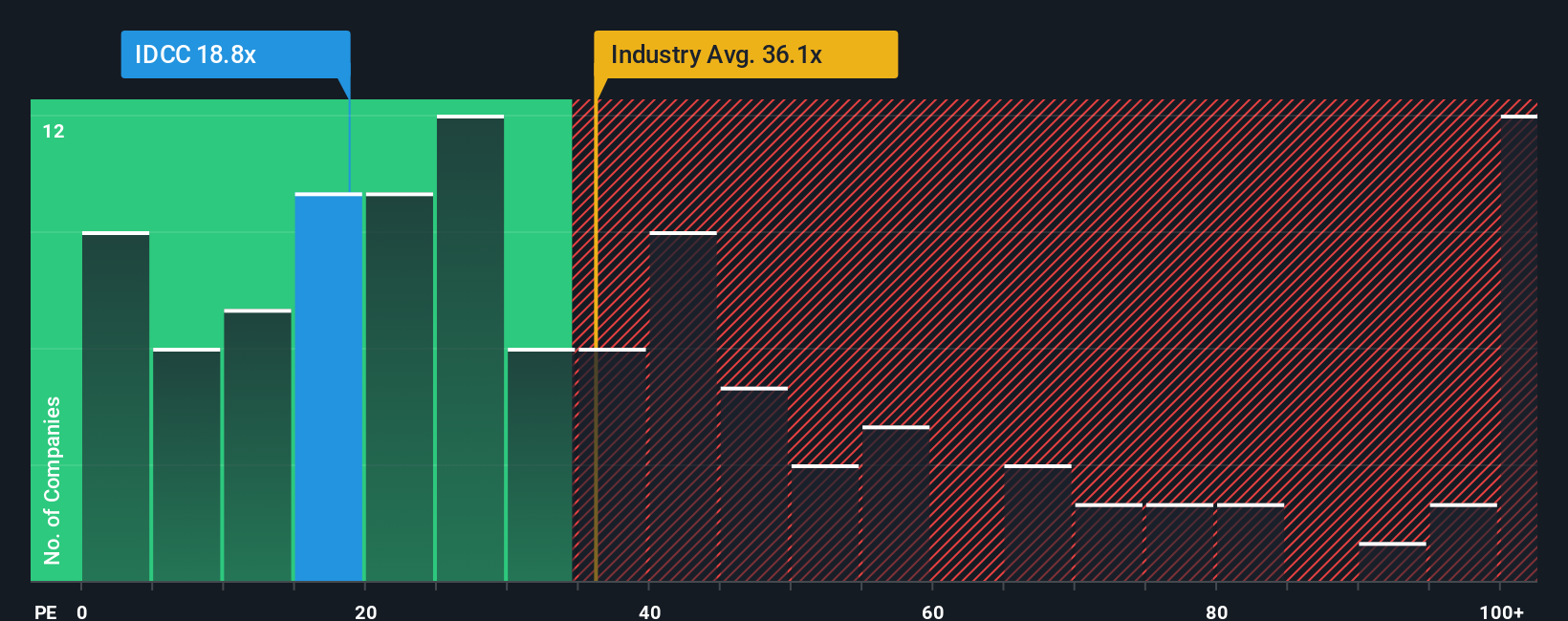

For profitable companies like InterDigital, the price-to-earnings (PE) ratio is often the go-to metric for valuation. It reflects how much investors are willing to pay for each dollar of current earnings, and it is especially useful because it naturally adjusts for the bottom-line health of the business.

Growth expectations and risk play a huge role in shaping what should be considered a “normal” or “fair” PE ratio. Rapidly growing companies or those with lower risk profiles usually command higher PE ratios, while slower growers or riskier plays tend to trade at lower multiples.

Currently, InterDigital trades at a PE of 20.45x. That is noticeably below both the software industry average of 34.89x and the peer group average of 39.44x. However, raw comparisons can be misleading, which is where the Simply Wall St Fair Ratio comes in. The Fair Ratio, at 14.97x for InterDigital, takes into account the company’s earnings growth, margins, industry positioning, market cap, and risk. This makes it a more accurate reflection of what InterDigital’s PE should be compared to just holding it up against sector or peer averages.

With InterDigital’s current PE above its Fair Ratio, the shares look a bit expensive by this measure, though not wildly so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your InterDigital Narrative

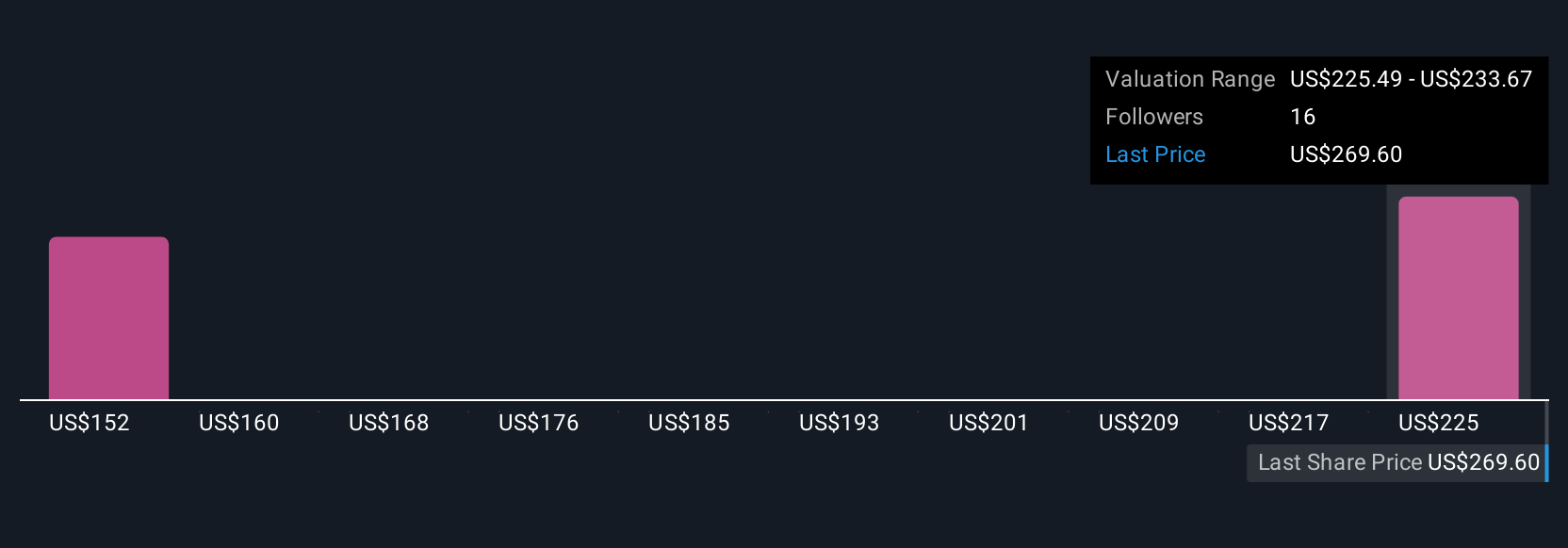

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your perspective, the story you believe about InterDigital’s future, and it connects your view of the company’s business prospects directly to your own financial forecasts and a personalized fair value.

Rather than just relying on standard ratios or analyst consensus, Narratives allow you to build your valuation from the bottom up by outlining your specific assumptions around revenue growth, margins, and future risks. Those numbers feed straight into a fair value calculation. This approach links the company’s unique story to dollar figures, turning opinions into actionable forecasts.

Narratives are easy to use and available to everyone within Simply Wall St’s Community page, where millions of investors share, compare, and refine their own outlook on stocks. When you create or follow a Narrative, it automatically updates if new information, such as earnings results or breaking news, changes the company’s outlook. This keeps your view current without extra work.

For example, with InterDigital, the most bullish investor may see the company leveraging 6G technology and diversified licensing to reach a $311 price target, while a more cautious Narrative, factoring in tougher regulatory and margin headwinds, might peg fair value closer to $220. No matter your take, Narratives help you decide what price you would buy or sell at based on your own expectations rather than just market noise.

Do you think there's more to the story for InterDigital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)