- United States

- /

- Software

- /

- NasdaqGS:IDCC

Is InterDigital’s Share Price Sustainable After 650% Rise and Recent 6G Leadership News?

Reviewed by Bailey Pemberton

If you have your eye on InterDigital, you are not alone. Few stocks have been as compelling over the past few years. Just look at the numbers: the company’s share price is up 138.3% over the past year and an extraordinary 650.9% over the last three. More recently, the stock has cooled off slightly, dipping 3.2% this week after a robust 17.2% climb over the past month. For investors, these movements can spark some serious questions. Has the rally run its course, or is the market just recalibrating for the next phase of growth?

There’s no single story behind these price moves, but it’s fair to say that broader industry shifts and technology trends have helped fuel InterDigital’s ascent. Shifts in market sentiment and evolving competitive landscapes may have added a layer of risk perception, which often goes hand in hand with such rapid appreciation.

With InterDigital closing at 337.32, the real challenge now is understanding whether the stock is truly undervalued or has simply ridden a wave of momentum. When we break it down using six core valuation benchmarks, InterDigital clocks in at a score of 2, meaning it’s considered undervalued in just two out of six key areas. Before you make your next move, let’s take a tour of what these valuation approaches really reveal. Stick around, because we will wrap up with a smarter, more nuanced way to look at valuation that goes beyond the usual checks and scores.

InterDigital scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: InterDigital Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting future free cash flows and discounting them back to today’s value. It provides a forward-looking view, helping investors weigh potential long-term performance against the current stock price.

InterDigital’s most recent reported Free Cash Flow stands at $285.2 Million. Analyst estimates extend out to 2027, where FCF is projected at $257 Million, with further figures extrapolated beyond that. These projections suggest modest annual declines before stabilizing and gradually increasing again by 2032. For the next decade, Simply Wall St uses both analyst inputs and extrapolated growth rates to build out future expectations.

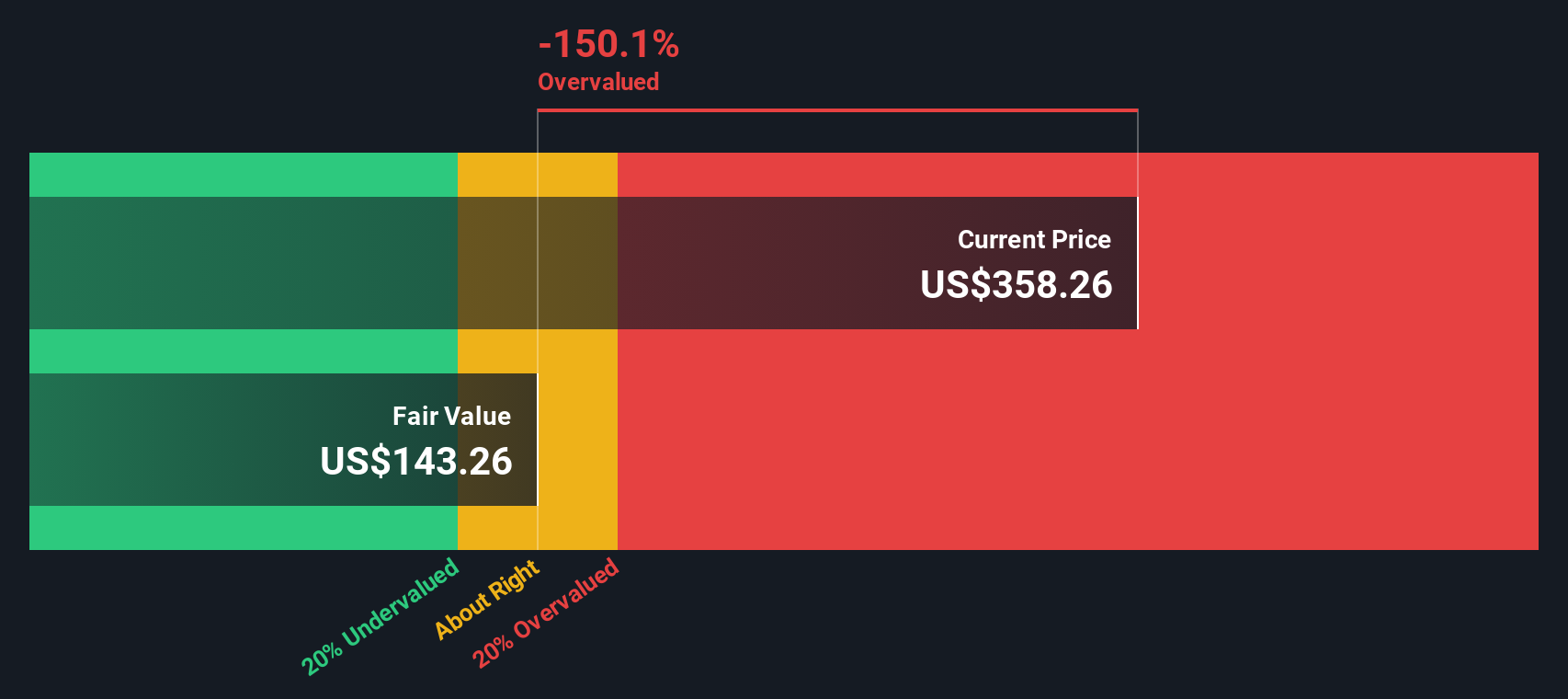

When crunching the numbers, the DCF model delivers an estimated intrinsic value per share of $142.85. With the recent market price at $337.32, the implied discount indicates InterDigital stock is 136.1% overvalued according to this approach. In summary, the DCF analysis suggests the market price has significantly outpaced the fundamental cash flow value revealed by this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests InterDigital may be overvalued by 136.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: InterDigital Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like InterDigital because it captures the relationship between a company's current share price and its per-share earnings. This makes it a practical shorthand for how much investors are willing to pay today for a slice of the company's profits.

However, interpreting the “right” PE ratio is not as simple as picking the lowest number. Growth expectations, profitability, and the degree of risk all play a part in where a company’s PE should fall. Rapidly growing tech companies or those with strong competitive advantages tend to justify higher multiples, while risky or slow growers often trade at discounts.

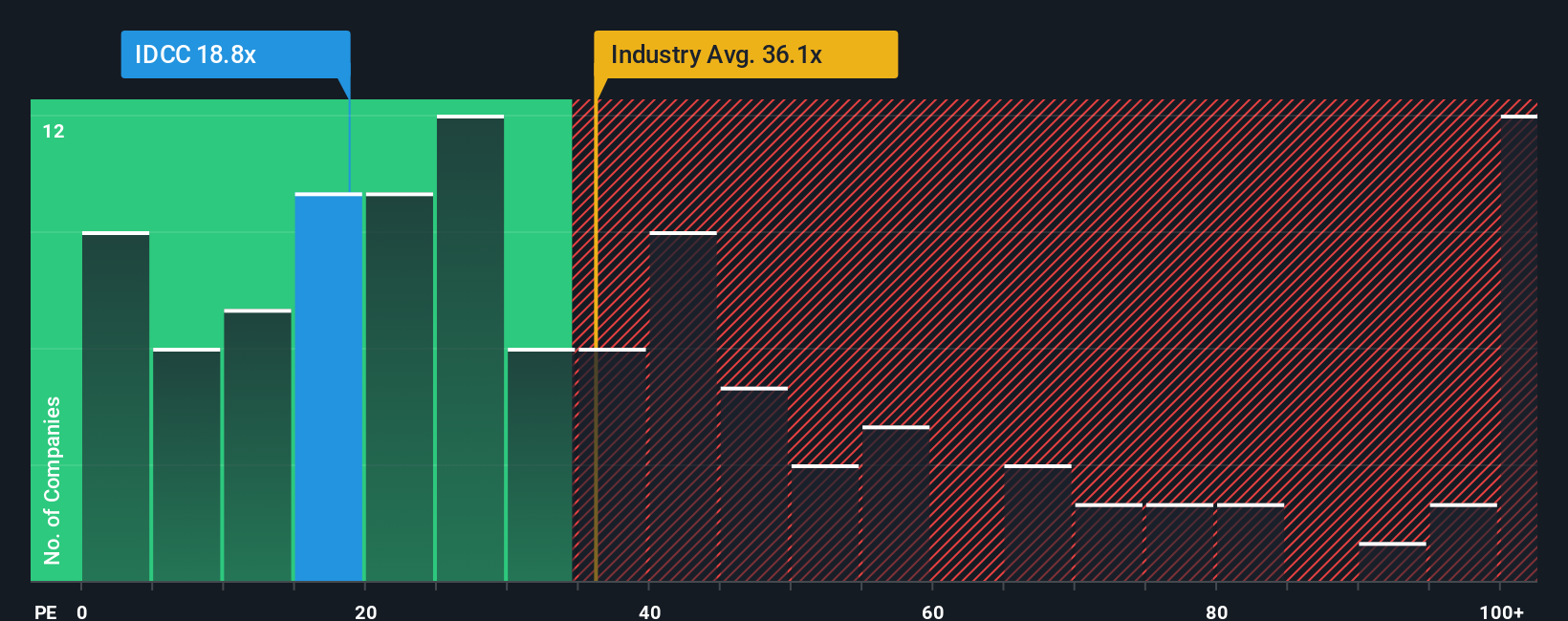

Currently, InterDigital trades at an 18.8x PE. This sits considerably below the software industry average of 36.1x, as well as the peer average of 40.8x. At first glance, that looks like a bargain, but context matters. This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For InterDigital, the Fair Ratio is 14.9x, which is based on factors such as the company’s growth outlook, margins, industry context, overall size, and risk profile. Unlike a basic comparison with industry or peer multiples, the Fair Ratio aims to give a tailored assessment of what would be a justified PE for the company.

So, with InterDigital’s PE sitting at 18.8x and the Fair Ratio at 14.9x, the stock is trading slightly above what would be considered fair based on its fundamentals and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your InterDigital Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, bridging the gap between financial forecasts and the assumptions behind them. Instead of just crunching numbers, it lets you articulate your view: how you see InterDigital's future sales, earnings, margins, and what you think is a fair value, linking it all to the company’s unique story and business context.

On Simply Wall St’s Community page, Narratives make this process accessible to everyone. Millions of investors use them to express their outlook and compare it directly to the current market price. This empowers smarter “buy” or “sell” decisions. If your Narrative’s fair value is above today’s price, you might see a buying opportunity, while the opposite may signal caution.

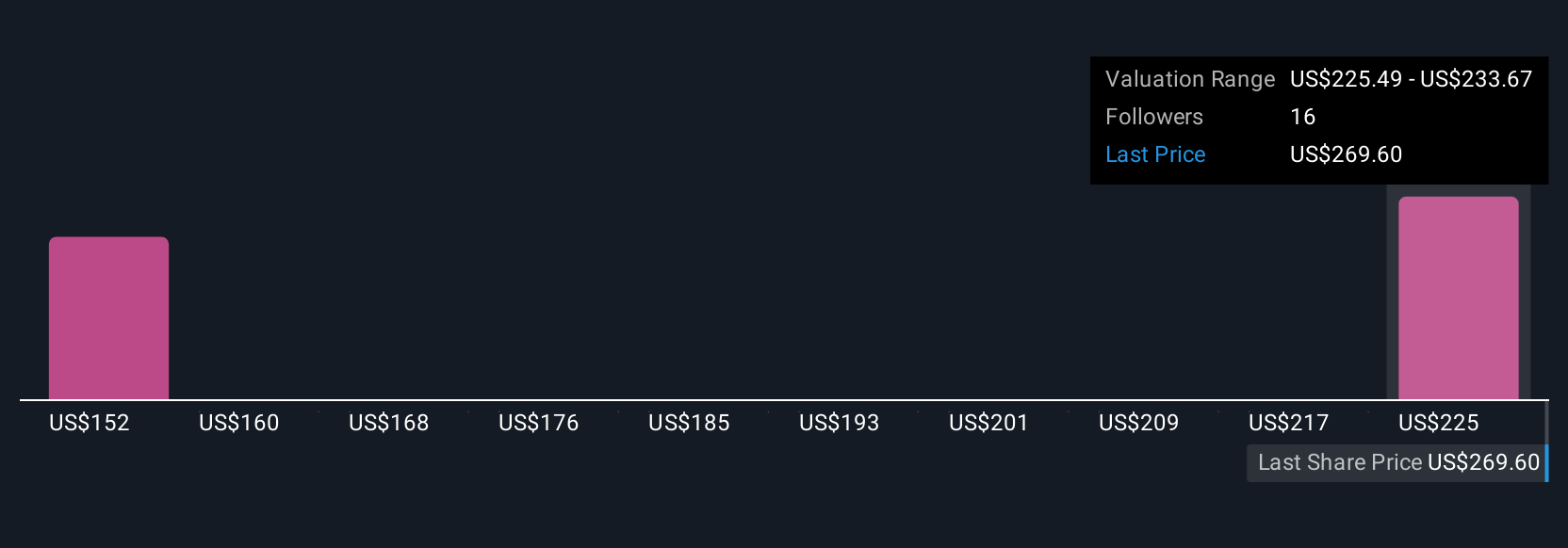

Unlike static tools, Narratives are updated automatically when news breaks or earnings are announced, ensuring your perspective stays current. For example, one InterDigital Narrative assumes earnings will shrink and sees fair value at $220, while a bullish Narrative forecasts stronger 6G leadership and stable margins, setting fair value near $311. This shows how investors' assessments and actions can differ based on their distinct stories and forecasts.

Do you think there's more to the story for InterDigital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives