- United States

- /

- Software

- /

- NasdaqGS:IDCC

Assessing InterDigital (IDCC) Valuation After 2026 Outlook And New LG Patent Agreement

What triggered the latest move in InterDigital stock?

InterDigital (IDCC) shares reacted to the company’s 2026 financial outlook, which outlined revenue guidance of US$675 million to US$775 million and diluted EPS of US$5.77 to US$8.51, alongside a fresh patent deal with LG Electronics.

See our latest analysis for InterDigital.

Despite a 0.9% one-day share price decline to US$330.12 after the 2026 outlook and LG agreement, InterDigital still has a 1-year total shareholder return of about 91% and a 5-year total shareholder return of more than 4x. This suggests that long-term momentum remains far stronger than the recent 90-day share price pullback of around 13%.

If this kind of licensing news has you thinking beyond a single name, it might be worth checking out high growth tech and AI stocks as a way to spot other technology ideas on your radar.

With the shares pulling back about 13% over 90 days yet still sitting on a roughly 91% 1 year total return, the key question now is whether InterDigital is still mispriced or if markets are already factoring in its future growth.

Price-to-Earnings of 17.1x: Is it justified?

On a P/E of 17.1x at the last close of US$330.12, InterDigital trades at a lower earnings multiple than both the wider US market and its software peers. This points to a relatively restrained price tag for each dollar of current earnings.

The P/E ratio compares the share price to earnings per share, so it is a quick way to see how much investors are paying for the company’s current profit stream. For a profitable, IP heavy software business like InterDigital, this is a commonly used yardstick because earnings are a direct output of its licensing model.

Here, the stock’s 17.1x P/E sits below the US market average of 19.5x and well below the US software industry average of 30.1x. This suggests the market is pricing InterDigital’s earnings more conservatively than many peers. At the same time, that 17.1x is only slightly above the estimated fair P/E of 17x, which indicates that the current multiple is already close to the level our work suggests the market could gravitate toward.

Explore the SWS fair ratio for InterDigital

Result: Price-to-Earnings of 17.1x (ABOUT RIGHT)

However, the recent 10% revenue and 26% net income declines, along with any shift in licensing demand from key device makers, could quickly challenge that “about right” P/E story.

Find out about the key risks to this InterDigital narrative.

Another View: What Does The DCF Say?

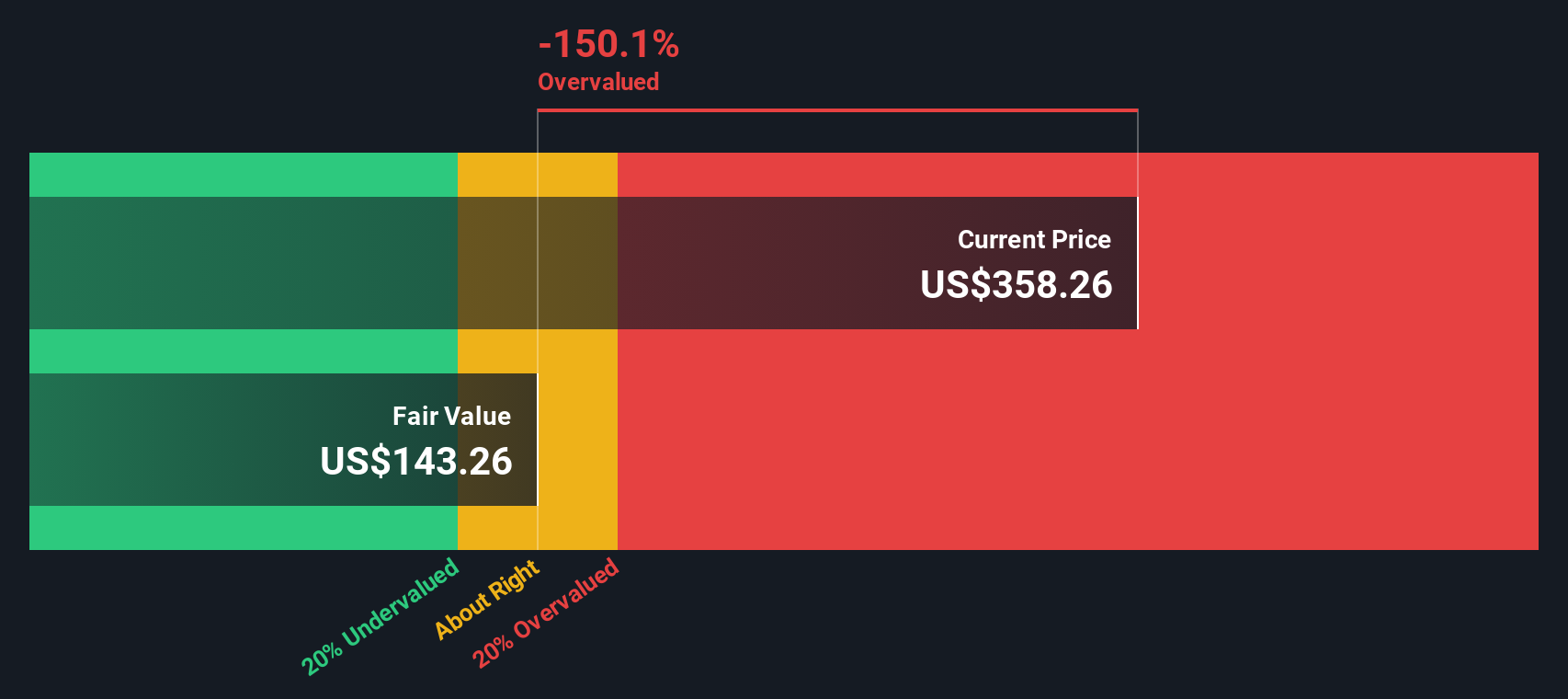

While a 17.1x P/E points to a roughly fair price tag versus the US market and software peers, our DCF model takes a far tougher stance. On that measure, InterDigital at US$330.12 is trading well above an estimated future cash flow value of US$73.24, implying the shares screen as expensive.

For you, that creates a clear tension. One common earnings metric suggests the current price is about right, while our DCF model flags a wide gap between price and projected cash flows. Which lens you lean on will probably come down to whether you trust near term earnings strength or are more focused on long term cash generation risk.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InterDigital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InterDigital Narrative

If you see the numbers differently, or simply prefer to test your own assumptions, you can build a complete view in just a few minutes with Do it your way.

A great starting point for your InterDigital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at a single stock. Use the Screener to quickly surface clear, data driven ideas worth your attention.

- Target higher income potential by scanning for these 12 dividend stocks with yields > 3% that might fit a yield focused strategy without sacrificing financial quality.

- Spot future facing themes by reviewing these 24 AI penny stocks that are tied to artificial intelligence trends you want direct exposure to.

- Hunt for mispriced names by filtering for these 878 undervalued stocks based on cash flows that align with your own views on risk, quality, and return potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDCC

InterDigital

Operates as a global research and development company focuses on wireless, visual, artificial intelligence (AI), and related technologies.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

AGAG still in exploration, in bull market, such company will be the last to participate. It's high risk but can results in 20-30 baggers potential. The best play with current bull are with producers or near-producer miners, you can get 5-10 baggers with much lower risk. See my analysis on santacruz silver, andean silver.