- United States

- /

- Software

- /

- NasdaqGS:HUT

Is Hut 8's (HUT) WLFI Token Allocation a New Chapter in Its Diversification Playbook?

Reviewed by Sasha Jovanovic

- Earlier this month, World Liberty Financial (WLFI), a crypto business affiliated with the Trump family, sold approximately 100 million WLFI tokens to Bitcoin miner Hut 8 at a 25% premium, with Hut 8 planning to hold the tokens as a long-term reserve asset.

- This move, part of a broader partnership between the two companies, signals Hut 8's intention to diversify its digital asset holdings beyond Bitcoin and expand institutional participation in the WLFI ecosystem.

- We'll explore how Hut 8's commitment to holding WLFI tokens could shift its investment narrative and influence future growth prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Hut 8 Investment Narrative Recap

To be a shareholder in Hut 8, you need confidence in the long-term viability of digital asset mining, the company's ability to manage large-scale infrastructure projects, and, most importantly, belief that Bitcoin retains value as a core asset. While Hut 8’s decision to acquire and hold WLFI tokens as part of its reserves signals deeper diversification in digital assets, it does not materially shift the dominant short-term catalyst, which remains the performance of Bitcoin and related mining economics. The business’s greatest immediate risk continues to be exposure to sharp downturns or volatility in Bitcoin’s price and difficulty levels, which can lead to revenue swings and margin pressure.

Among recent company announcements, Hut 8’s launch of Vega, the claimed largest single-building mining facility by nameplate hashrate, illustrates the company’s focus on operational scale and infrastructure. This development creates additional capacity that can enhance the company’s response to changes in Bitcoin’s value and supports the ability to benefit from surges in mining profitability, like those seen following the recent uptick in Bitcoin’s price and Hut 8’s equity.

However, in contrast to growing ambitions in digital asset diversification, investors should be aware that ...

Read the full narrative on Hut 8 (it's free!)

Hut 8's narrative projects $767.3 million in revenue and $140.6 million in earnings by 2028. This requires 76.9% yearly revenue growth and a $13.4 million decrease in earnings from $154.0 million.

Uncover how Hut 8's forecasts yield a $32.53 fair value, a 19% downside to its current price.

Exploring Other Perspectives

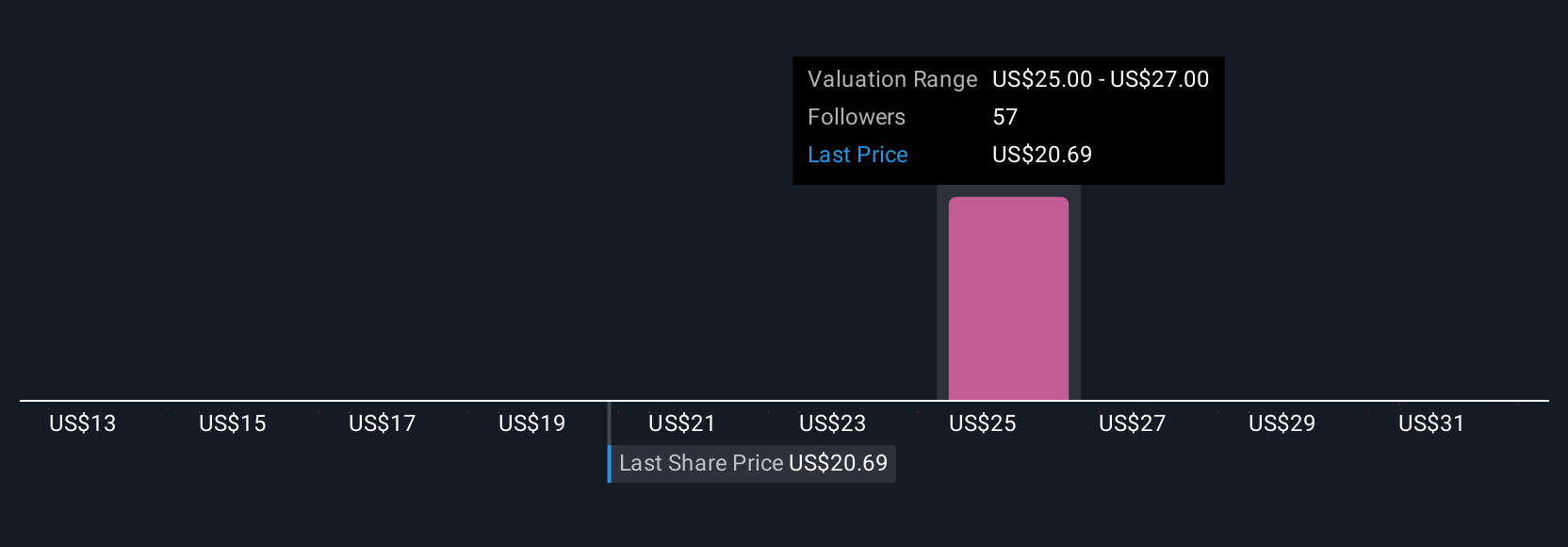

Four retail investors in the Simply Wall St Community estimate Hut 8’s fair value across an extensive US$13 to US$36 range. While optimism about expanding infrastructure is growing, your views may differ, so take time to compare diverse approaches.

Explore 4 other fair value estimates on Hut 8 - why the stock might be worth as much as $36.00!

Build Your Own Hut 8 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hut 8 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hut 8 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hut 8's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hut 8 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUT

Hut 8

Operates as a vertically integrated operator of energy infrastructure and Bitcoin miners in North America.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives