- United States

- /

- Software

- /

- NasdaqCM:FUFU

The recent 15% gain must have brightened CEO Leo Lu's week, BitFuFu Inc.'s (NASDAQ:FUFU) most bullish insider

Key Insights

- Significant insider control over BitFuFu implies vested interests in company growth

- Leo Lu owns 82% of the company

- Ownership research along with analyst forecasts data help provide a good understanding of opportunities in a stock

If you want to know who really controls BitFuFu Inc. (NASDAQ:FUFU), then you'll have to look at the makeup of its share registry. We can see that individual insiders own the lion's share in the company with 82% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As a result, insiders scored the highest last week as the company hit US$635m market cap following a 15% gain in the stock.

Let's delve deeper into each type of owner of BitFuFu, beginning with the chart below.

Check out our latest analysis for BitFuFu

What Does The Lack Of Institutional Ownership Tell Us About BitFuFu?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

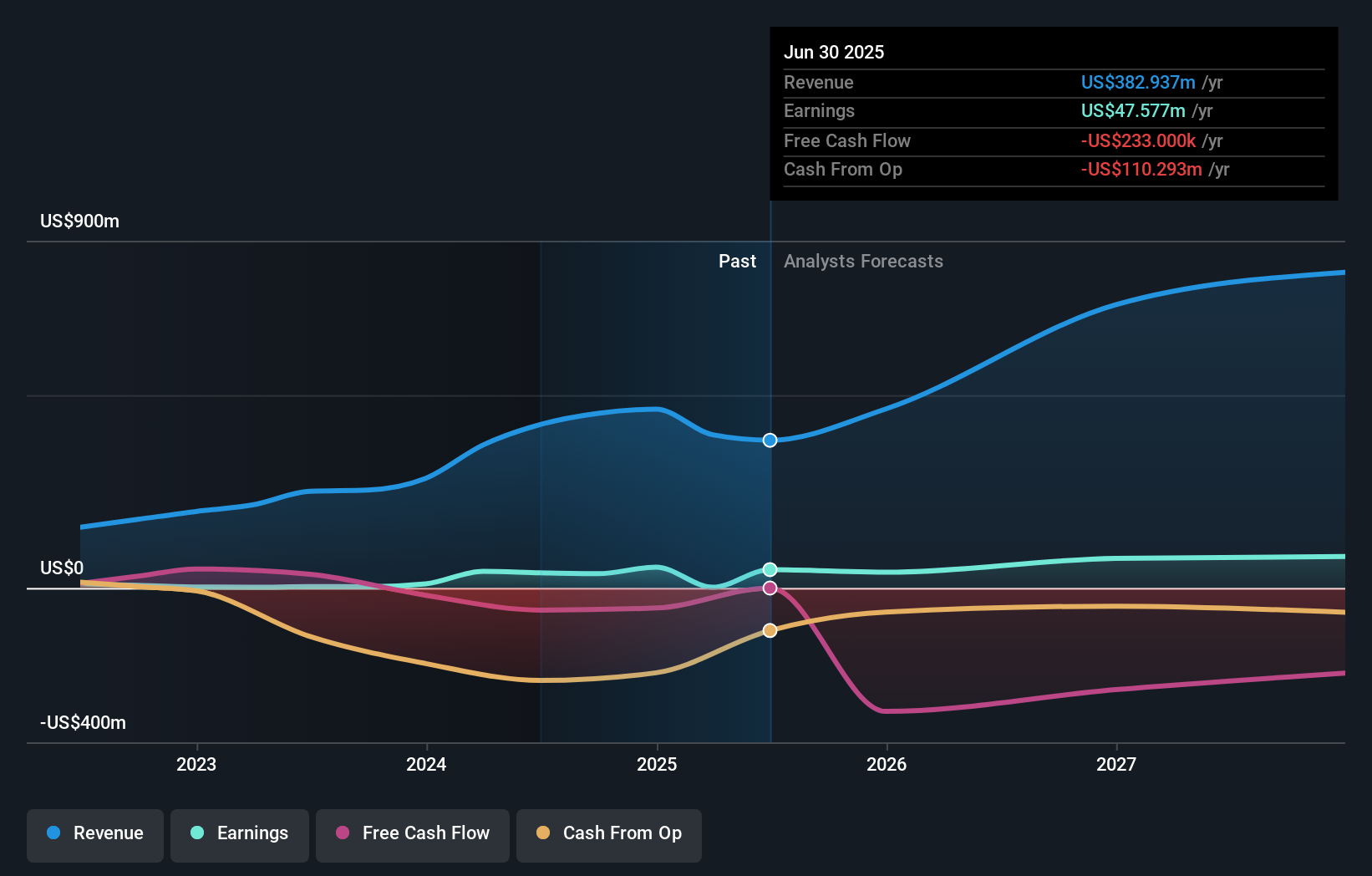

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. Alternatively, there might be something about the company that has kept institutional investors away. BitFuFu's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

BitFuFu is not owned by hedge funds. The company's CEO Leo Lu is the largest shareholder with 82% of shares outstanding. This implies that they possess majority interests and have significant control over the company. Investors usually consider it a good sign when the company leadership has such a significant stake, as this is widely perceived to increase the chance that the management will act in the best interests of the company. For context, the second largest shareholder holds about 7.0% of the shares outstanding, followed by an ownership of 0.1% by the third-largest shareholder.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of BitFuFu

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that insiders own more than half of BitFuFu Inc.. This gives them effective control of the company. Given it has a market cap of US$635m, that means they have US$522m worth of shares. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 10% ownership, the general public, mostly comprising of individual investors, have some degree of sway over BitFuFu. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

We can see that Private Companies own 7.0%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with BitFuFu , and understanding them should be part of your investment process.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BitFuFu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FUFU

BitFuFu

Provides digital asset mining solutions in North America, Asia, Europe, and internationally.

Outstanding track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)