- United States

- /

- Software

- /

- NasdaqGS:FTNT

Fortinet (FTNT): Valuation in Focus After Weak Guidance and Legal Scrutiny Shake Investor Confidence

Reviewed by Simply Wall St

Most Popular Narrative: 18.9% Undervalued

According to BlackJesus, the narrative around Fortinet paints a bullish picture, arguing the stock is trading meaningfully below its intrinsic worth thanks to its operational strengths and consistent profitability.

An investment in Fortinet is a bet on superior operational efficiency and disciplined, organic growth. The company offers a financial profile of outstanding and consistent GAAP profitability, with best-in-class operating margins that are a direct result of its founder-led engineering focus and proprietary ASIC architecture.

What powers this bold valuation? The secret is hiding in the numbers behind Fortinet’s robust margins and a fortress-like balance sheet. Is this efficient growth engine what Wall Street has missed? Uncover the pivotal metrics and see what drives a fair value that turns heads. This narrative holds the clues.

Result: Fair Value of $99.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including Fortinet’s reliance on hardware-driven revenue and past product security issues. These concerns could accelerate negative sentiment if not managed carefully.

Find out about the key risks to this Fortinet narrative.Another View: What Does Our DCF Model Say?

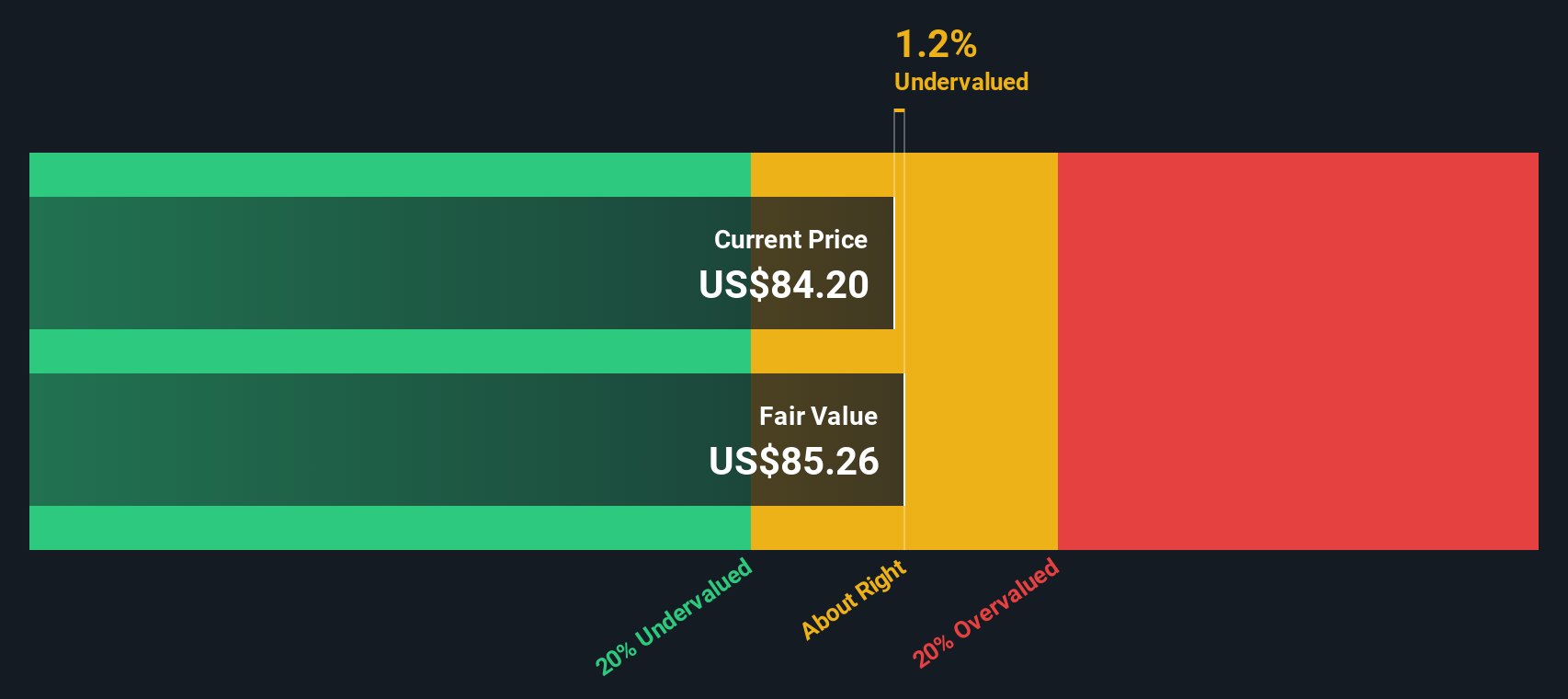

While the earlier narrative suggests Fortinet is attractively priced relative to its operational strengths, our DCF model offers another perspective. It also sees the stock as trading below estimated fair value, which points to untapped potential. However, is this enough to address doubts about the growth outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fortinet Narrative

If you see the story differently or want to dig into the numbers on your own, it’s easy to craft your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fortinet.

Looking for more investment ideas?

Your next breakthrough investment could be just a few clicks away. Don’t let opportunity pass you by. Explore fresh ideas tailored to what really matters most to you.

- Tap into the power of automation by checking out companies at the forefront of next-generation technology with AI penny stocks.

- Strengthen your portfolio’s earning potential by finding top picks with steady income and growth using dividend stocks with yields > 3%.

- Get a head start spotting companies priced well below their true worth thanks to our handpicked selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:FTNT

Fortinet

Provides cybersecurity and convergence of networking and security solutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion