- United States

- /

- Software

- /

- NasdaqGS:FRSH

Does Freshworks Offer Opportunity After Recent 8% Dip and Cloud Software Sector Weakness?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Freshworks stock right now? You are not alone. Many investors are wondering if the recent dip spells opportunity or risk. Over the past month, Freshworks shares have dropped 8.3%, and if you zoom out, the year-to-date return is down 21.5%. However, it is not all red. Those who have held on for the full year are still looking at a 9.1% gain. This kind of performance jumpiness is exactly why valuation matters more than ever when deciding your next move.

Part of what is driving the share price swings for Freshworks could be larger market currents, including shifts in how tech stocks are being perceived amid changes in interest rates and sector rotation, rather than any company-specific major news. Sometimes, investors pull back from growth-oriented names, only to crowd back in when confidence returns. For Freshworks, this ebb and flow has highlighted its growth potential, but has also led to questions about just how much to pay for that potential right now.

To help cut through the noise, let us talk numbers. Using our standard valuation framework, Freshworks clocks in with a value score of 5 out of 6 possible checks for being undervalued. That is a strong showing and suggests the market could be overlooking some value here. In the next section, we will break down exactly which valuation approaches are sending the strongest signals about Freshworks. Plus, stick around for a smarter way to weigh what all this actually means for your own investing decisions.

Why Freshworks is lagging behind its peersApproach 1: Freshworks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. It aims to determine what the business is worth if you owned every future dollar it will generate, adjusted for the time value of money.

For Freshworks, the most recent reported Free Cash Flow (FCF) stands at $185.1 Million. Analysts provide annual FCF projections for the next five years, with further estimates extending out to 2035. By 2029, Freshworks is expected to generate $424.7 Million in FCF per year. These projections imply solid growth ahead, and Simply Wall St’s proprietary model incorporates these expectations to establish a fair value.

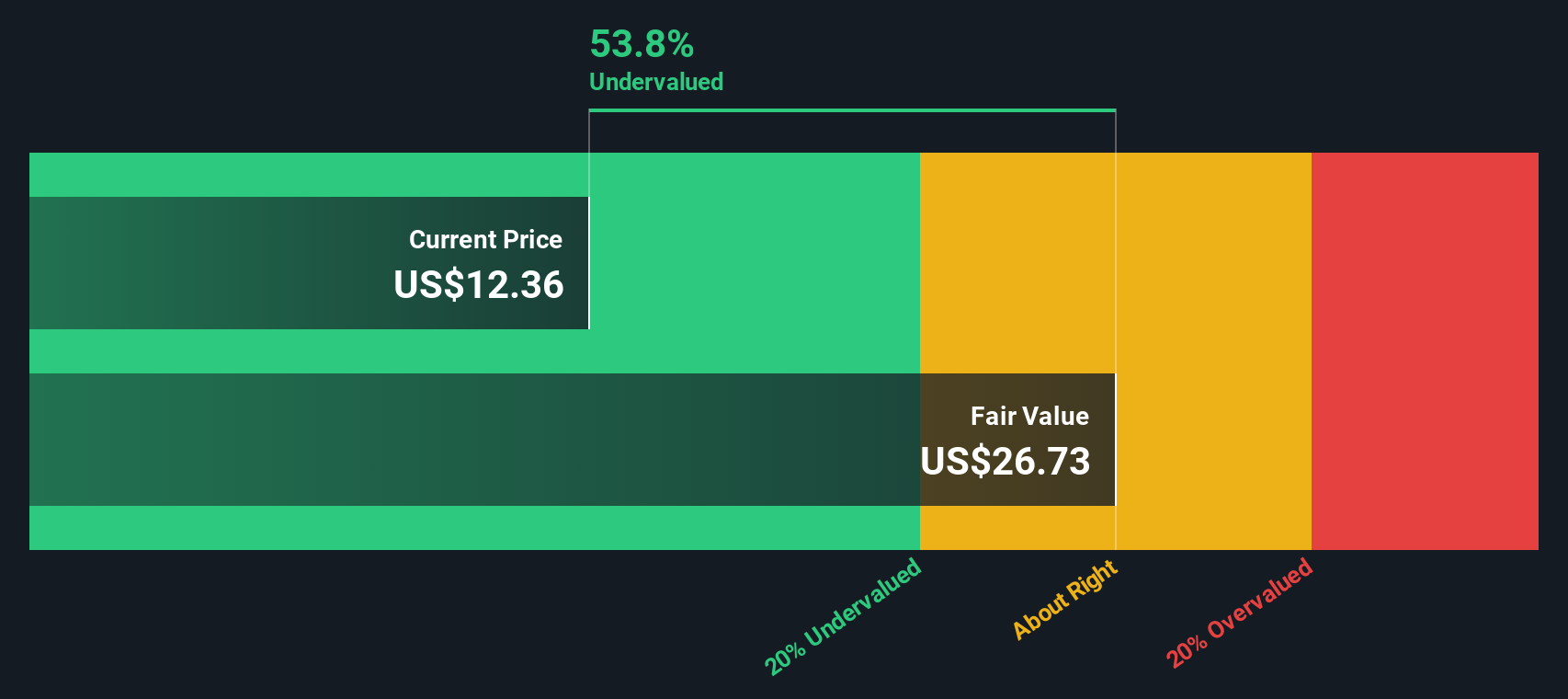

After running the numbers, Freshworks’ intrinsic value comes out to $28.35 per share using this DCF approach. This represents a 56.0% discount to the current market price, indicating considerable upside potential if these growth projections materialize.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Freshworks.

Approach 2: Freshworks Price vs Sales

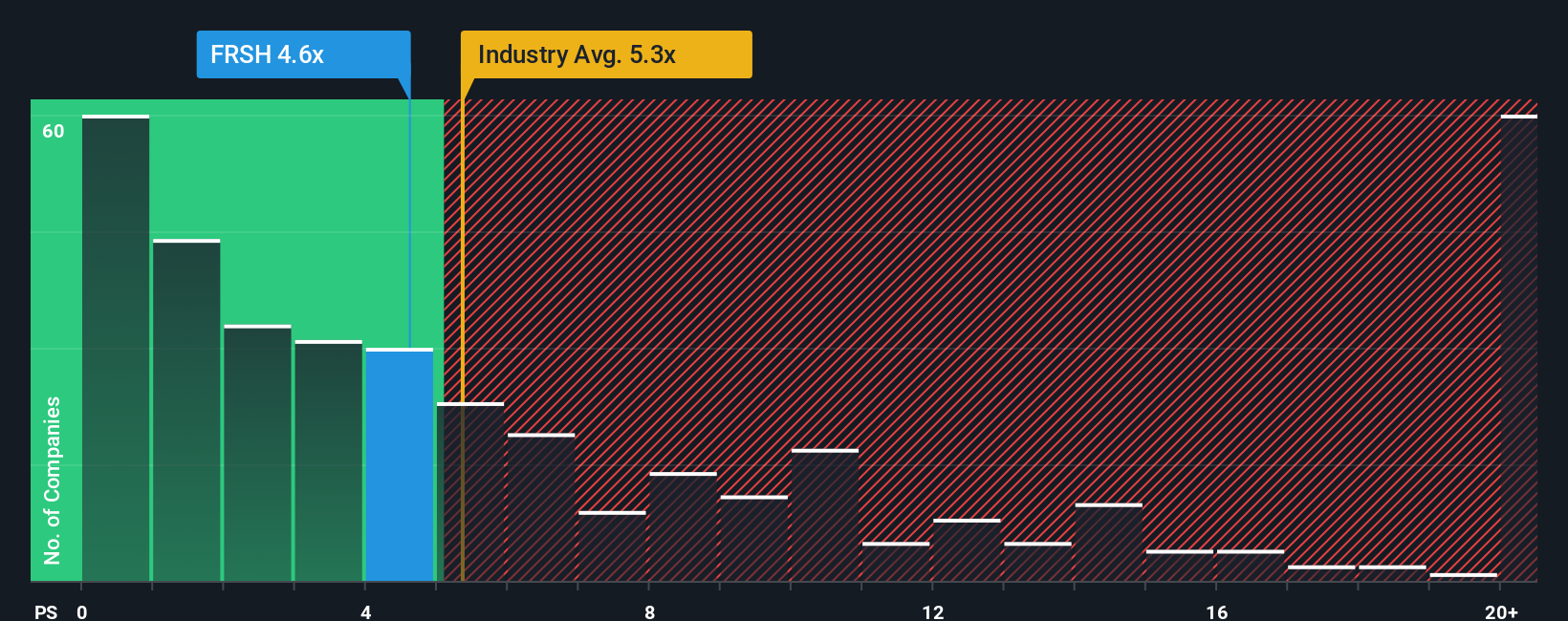

The Price-to-Sales (P/S) ratio is often a preferred valuation metric for software and growth companies like Freshworks, especially when profitability metrics such as earnings can be temporarily distorted by ongoing investment in growth. The P/S ratio helps investors assess how much they are paying for each dollar of the company's revenue. This is especially relevant when earnings are negative or volatile.

Growth prospects and risk profiles play a big role in what a “normal” or “fair” P/S ratio should be. Higher growth companies typically command higher multiples, while companies with elevated risks or slower expansion might trade below the industry average.

Currently, Freshworks trades at a P/S ratio of 4.65x. For context, this is below both the peer average of 7.93x and the industry average of 5.34x for the Software sector. However, Simply Wall St's proprietary Fair Ratio for Freshworks is estimated at 6.47x. The Fair Ratio calculates a company’s “deserved” multiple by factoring in specific elements like its earnings growth rate, risk, profit margins, industry group, and market cap. Rather than relying on broad peer averages or industry numbers, this approach better contextualizes valuation relative to what matters most for Freshworks specifically.

With Freshworks’ actual P/S ratio at 4.65x and the Fair Ratio at 6.47x, shares appear undervalued using this approach and may offer an opportunity for investors who believe in the long-term growth story.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Freshworks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story or perspective on a company, connecting the business’s outlook to a set of financial forecasts and, ultimately, a fair value estimate. It is a simple, approachable tool available on Simply Wall St’s Community page, used by millions of investors, that allows you to bring the numbers to life with your own assumptions about Freshworks’ future revenue, earnings, and margins.

Narratives link what you believe about a company, such as Freshworks benefiting long-term from AI adoption, accelerating revenue, or facing increasing competitive risks, directly to a transparent fair value calculation. They make the “why” behind your investment decisions clear and actionable by showing how your views add up to a buy or sell signal when you compare fair value to today’s share price.

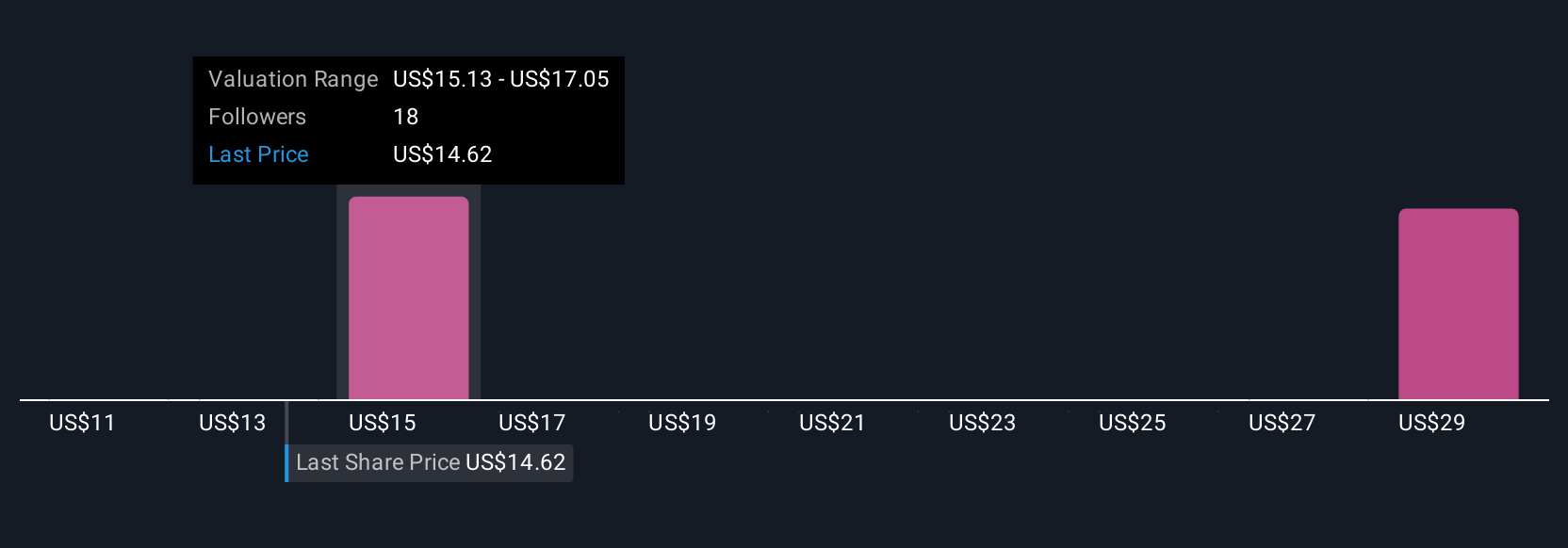

A key strength of Narratives is that they update in real time when new information comes out, like company reports or market news, so your perspective and fair value always reflect the latest facts. For example, one investor may focus on Freshworks’ rapid global partnerships and set a higher fair value of $27.00, while another may emphasize margin challenges and choose a more cautious value of $18.00. Each Narrative expresses a unique outlook, helping you sense-check analyst targets and decide for yourself if now is the right time to invest.

Do you think there's more to the story for Freshworks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRSH

Freshworks

A software development company, provides software-as-a-service products in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives