- United States

- /

- Software

- /

- NasdaqGS:FRSH

Could Executive Moves at Freshworks (FRSH) Signal a New Phase in Its Americas Growth Strategy?

Reviewed by Sasha Jovanovic

- Freshworks recently appointed Enrique Ortegon as Senior Vice President and General Manager of Americas Field Sales, tapping his more than two decades of leadership in enterprise SaaS and go-to-market strategy at DocuSign and Salesforce.

- This hire highlights Freshworks' intention to accelerate growth and market presence across North and South America through experienced executive leadership.

- We'll look at how Enrique Ortegon's experience in scaling enterprise businesses could shape Freshworks' market expansion and growth narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Freshworks Investment Narrative Recap

Freshworks appeals to those who see long-term promise in the company’s expansion into global enterprise SaaS, led by AI-powered solutions and a growing upmarket customer base. The appointment of Enrique Ortegon as SVP and GM of Americas Field Sales may enhance regional execution but does not materially change the company’s most pressing short-term catalyst (AI adoption and monetization), nor does it alleviate the biggest near-term risk, potential competitive pressures impacting revenue growth and customer retention.

The upcoming Q3 2025 earnings announcement on November 5 is likely to be the most relevant near-term event for shareholders, as it will provide insights into revenue trends and management’s confidence around AI-driven product momentum. This update could help clarify whether Freshworks’ increased investments in sales talent, such as Ortegon’s appointment, are translating into stronger customer traction or if competitive and macroeconomic risks remain front of mind for investors.

However, investors should not overlook the potential for competitive pressures to erode gains even as Freshworks invests heavily in growth and executive talent...

Read the full narrative on Freshworks (it's free!)

Freshworks' outlook anticipates $1.1 billion in revenue and $145.1 million in earnings by 2028. This requires 12.3% yearly revenue growth and an increase in earnings of $200 million from current earnings of $-54.9 million.

Uncover how Freshworks' forecasts yield a $19.71 fair value, a 77% upside to its current price.

Exploring Other Perspectives

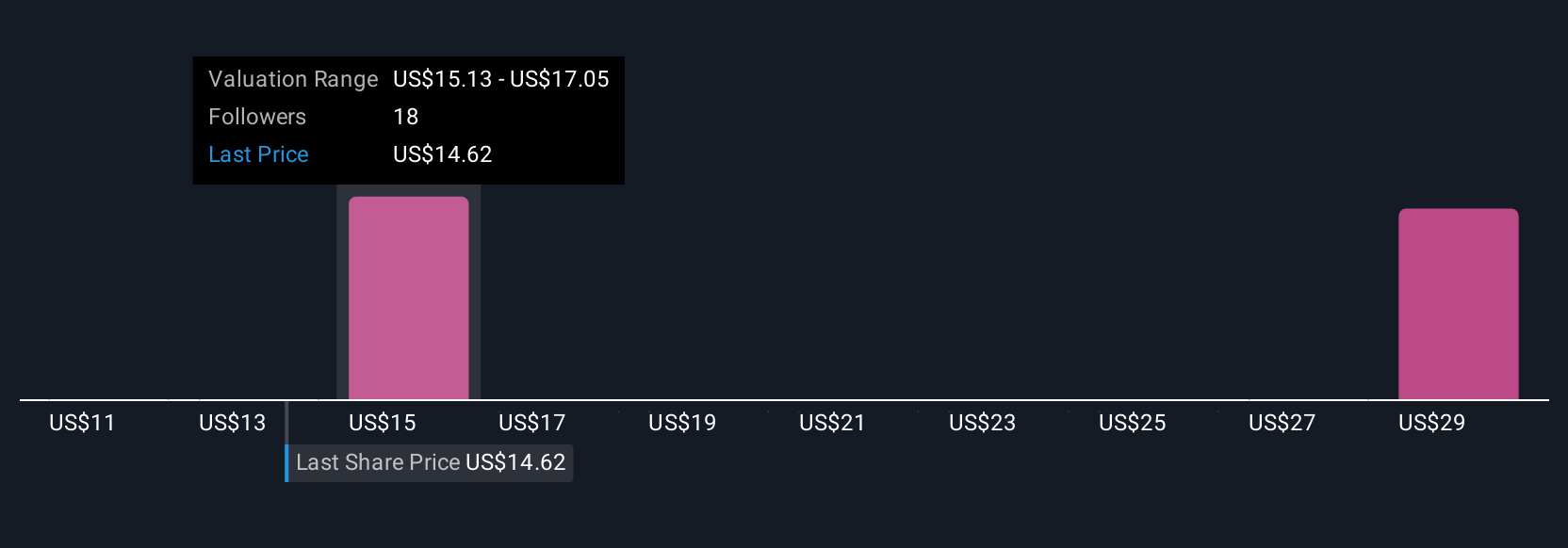

Simply Wall St Community users shared four fair value estimates for Freshworks ranging from US$15.12 to US$27.32 per share, showing substantial divergence in views. While some see upside potential, heightened competition from larger enterprise SaaS players remains a concern that could shape Freshworks’ ability to sustain revenue growth over the coming quarters, making it essential to explore multiple viewpoints.

Explore 4 other fair value estimates on Freshworks - why the stock might be worth just $15.12!

Build Your Own Freshworks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshworks research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshworks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshworks' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRSH

Freshworks

A software development company, provides software-as-a-service products in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives