- United States

- /

- Software

- /

- NasdaqGM:FIVN

Five9 (FIVN): Evaluating Valuation Following Recognition for AI Innovation and Healthcare Integration

Reviewed by Simply Wall St

If you are following Five9 (FIVN), you probably noticed the recent headlines about its enterprise recognition and collaboration in the healthcare space. This month, Five9 drew industry attention after being spotlighted in Opus Research’s Intelliview Report for its capabilities in conversational AI and operational excellence, specifically for regulated sectors. At the same time, the company launched Five9 Fusion for Epic, bringing advanced contact center features directly into healthcare workflows. This move highlights its momentum in high-compliance industries.

These consecutive announcements have come at a time when Five9’s stock performance has been mixed. Shares saw a roughly 11% climb over the past month, while the year-to-date showing remains negative. Compared to its three- and five-year performance, where losses have been steep, recent movements suggest a shift in investor sentiment, possibly in response to Five9’s deeper push into AI-powered cloud solutions and strategic partnerships.

After several years of volatility, is the market finally seeing Five9’s upside, or is all the optimism already reflected in the price?

Most Popular Narrative: 26% Undervalued

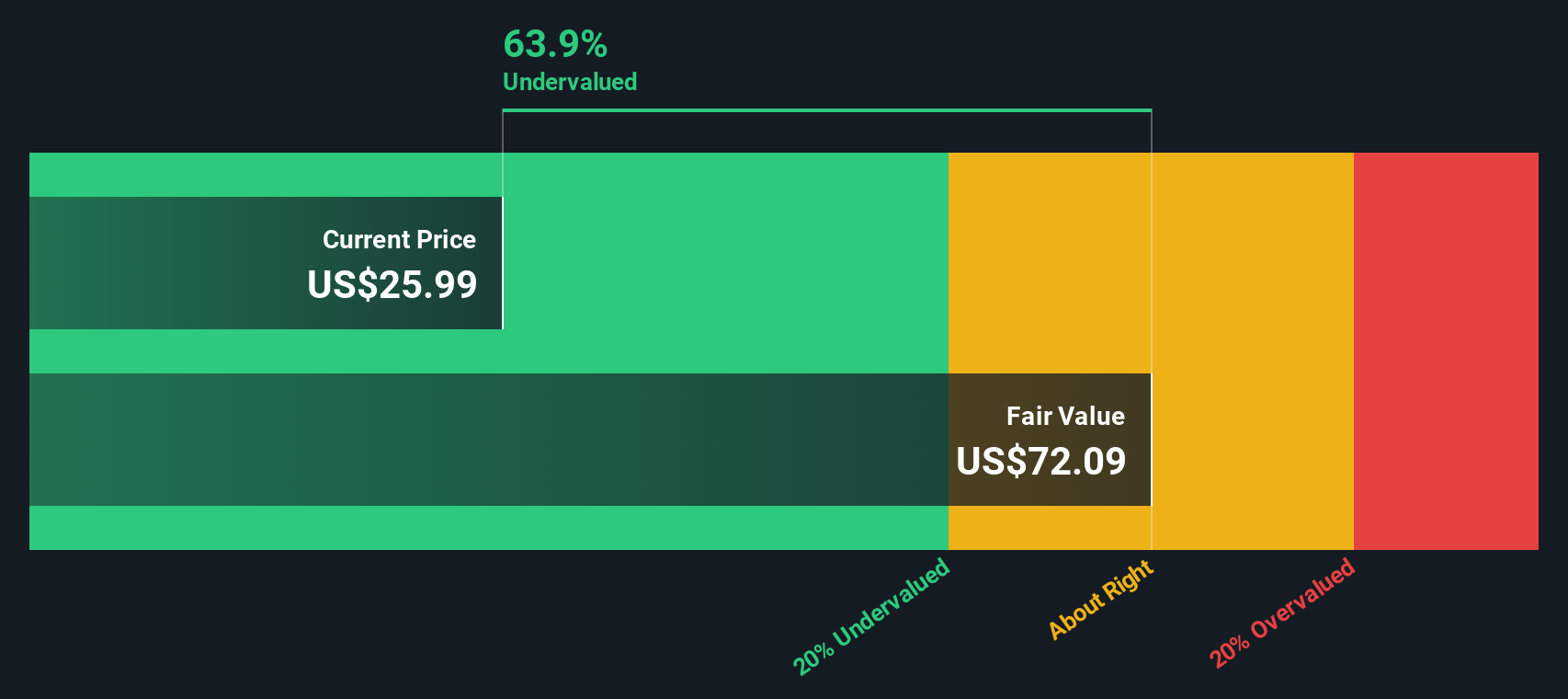

According to community narrative, Five9 is currently seen as undervalued, with a consensus fair value substantially above the prevailing market price. This perspective is driven by analysts’ future growth projections for revenue, earnings, and margin improvements over the next several years.

Ongoing large customer wins and multi-year contract expansions that emphasize Five9 as a single, comprehensive CX platform for both core and AI solutions demonstrate sustained demand for scalable, cloud-native contact center offerings. This supports continued enterprise revenue growth and improved dollar-based net retention rates.

Curious why Five9’s fair value is estimated to be much higher than today’s price? The narrative is grounded on bullish growth assumptions for both profits and sales, all incorporated into an ambitious margin target. What is their formula for expansion, and which breakthrough figures are influencing this perspective? A pivotal forecast is at play. To see the full details, it is recommended to review the full projection yourself.

Result: Fair Value of $36.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing executive transitions and heightened competition from larger software vendors could affect Five9’s growth and put pressure on future profit margins.

Find out about the key risks to this Five9 narrative.Another View: SWS DCF Model Offers a Second Opinion

While many focus on analyst expectations and future earnings estimates, our SWS DCF model takes a fresh look by projecting future cash flows and discounting them to today. Interestingly, it suggests shares could be undervalued as well. But does this model capture everything the market might be overlooking?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Five9 Narrative

If you are looking to form your own perspective or dive deeper into the numbers, you can easily put together a custom narrative in just a few minutes, all with Do it your way.

A great starting point for your Five9 research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always looking for the edge, and the right tools make all the difference. Don’t miss out on opportunities others might overlook. Put your strategy to work and get ahead of the market. Check out these hand-picked screens to help guide your next move:

- Grow your income by identifying financial leaders that stand out for reliable payments and robust yields through dividend stocks with yields > 3%.

- Uncover technology’s breakout trendsetters as artificial intelligence reshapes entire industries, all starting with AI penny stocks.

- Jump on opportunities where market pessimism has gone too far and powerful fundamentals could lead to gains. See them in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)