- United States

- /

- Software

- /

- NasdaqGM:FIVN

Chief Accounting Officer & Corporate Controller Leena Mansharamani Just Sold A Bunch Of Shares In Five9, Inc. (NASDAQ:FIVN)

Some Five9, Inc. (NASDAQ:FIVN) shareholders may be a little concerned to see that the Chief Accounting Officer & Corporate Controller, Leena Mansharamani, recently sold a substantial US$1.2m worth of stock at a price of US$184 per share. That sale reduced their total holding by 28% which is hardly insignificant, but far from the worst we've seen.

Check out our latest analysis for Five9

Five9 Insider Transactions Over The Last Year

The Chairman, Michael Burkland, made the biggest insider sale in the last 12 months. That single transaction was for US$7.3m worth of shares at a price of US$73.58 each. So it's clear an insider wanted to take some cash off the table, even below the current price of US$188. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. It is worth noting that this sale was only 47% of Michael Burkland's holding.

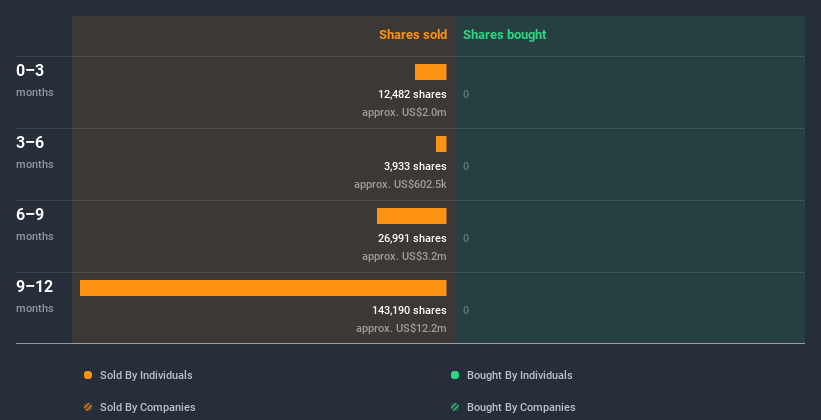

Insiders in Five9 didn't buy any shares in the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Does Five9 Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Five9 insiders own about US$142m worth of shares (which is 1.1% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At Five9 Tell Us?

Insiders haven't bought Five9 stock in the last three months, but there was some selling. And even if we look at the last year, we didn't see any purchases. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To that end, you should learn about the 4 warning signs we've spotted with Five9 (including 1 which is a bit unpleasant).

Of course Five9 may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Five9, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives