- United States

- /

- Software

- /

- NasdaqGS:EVCM

EverCommerce (EVCM): Revisiting Valuation After AI-Focused Shift, Asset Sales, Acquisitions and Capital Allocation Moves

Reviewed by Simply Wall St

EverCommerce (EVCM) is back in the spotlight after doubling down on AI powered vertical SaaS, selling noncore assets, buying focused platforms like ZyraTalk, and extending its share buyback plan alongside a fresh debt refinancing.

See our latest analysis for EverCommerce.

The market seems to be warming back up to that sharper AI powered SaaS focus, with EverCommerce’s 42.96% 1 month share price return pushing the stock near recent highs. However, the 1 year total shareholder return is still slightly negative, which suggests momentum is rebuilding after a tougher stretch.

If EverCommerce’s rebound has your attention, this could be a good moment to explore similar opportunities in high growth tech and AI stocks and see what else is starting to move.

Yet with the share price already near analyst targets and only a modest implied intrinsic discount, the key question is whether EverCommerce is still trading below its true AI powered potential, or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 2.5% Undervalued

With the narrative fair value slightly above the last close of $12.08, the story hinges on profitability inflecting even as revenues edge lower.

The divestiture of the lower-growth Marketing Technology segment and subsequent focus on core verticals (EverPro, EverHealth, EverWell) has increased operational clarity and reduced seasonality, setting the stage for improved profitability and more predictable, linear revenue patterns. Strong free cash flow generation, expanding gross margins through payments mix shift, and active share repurchases ($20.6M in Q2) improve balance sheet flexibility and EPS outlook, increasing the likelihood of rerating as secular tailwinds persist.

Want to see how shrinking top line, rising margins, and a future earnings multiple usually reserved for sector leaders all fit together? The narrative leans on aggressive profit expansion, disciplined buybacks, and a bold view on where recurring SaaS cash flows can take this platform. Curious which specific profitability leap and valuation multiple are doing the heavy lifting behind that fair value?

Result: Fair Value of $12.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on EverCommerce successfully sustaining payments-led margin gains while avoiding underinvestment in innovation that could invite faster-moving competitors.

Find out about the key risks to this EverCommerce narrative.

Another Lens on Value

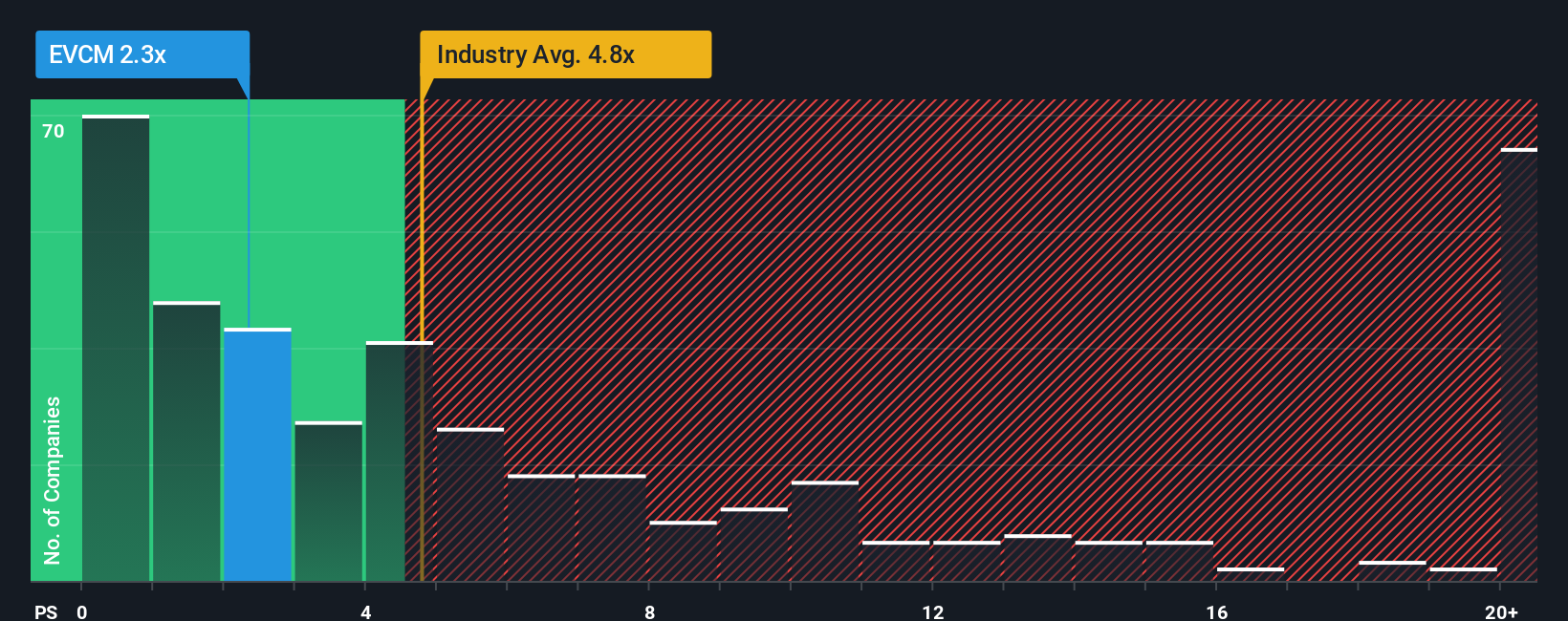

Look past the AI story and the picture shifts. On a price to sales of 3x, EverCommerce screens cheaper than US software peers at 4.9x, yet still richer than its 2.6x fair ratio, which hints at upside if momentum lasts, but also downside if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EverCommerce Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your EverCommerce research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before momentum shifts again, use the Simply Wall St Screener to uncover focused opportunities that match your strategy, instead of waiting for the next headline.

- Capitalize on early stage growth by targeting these 3614 penny stocks with strong financials that already show balance sheet strength and improving fundamentals.

- Ride structural demand for automation and data by zeroing in on these 26 AI penny stocks positioned at the heart of intelligent software adoption.

- Lock in potential mispricings with these 908 undervalued stocks based on cash flows that screen cheap on cash flows before the broader market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EverCommerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVCM

EverCommerce

Provides integrated software-as-a-service solutions for service-based small and medium-sized businesses in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)