- United States

- /

- Software

- /

- NasdaqGS:DOCU

DocuSign (NasdaqGS:DOCU) Jumps 15% In A Week Driven By AI Contract Agents Initiative

Reviewed by Simply Wall St

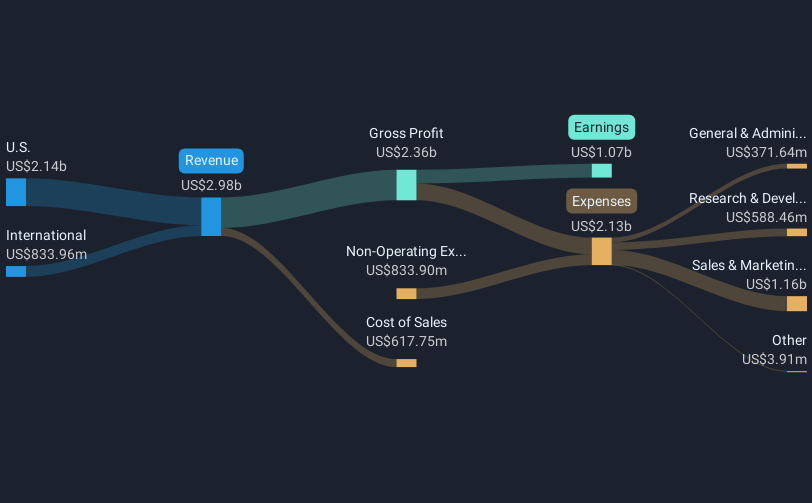

DocuSign (NasdaqGS:DOCU) witnessed a significant price increase of 15% over the last week, likely buoyed by recent developments. The company's introduction of AI contract agents and a revamped partner program signals its commitment to enhancing operational efficiencies and expanding partner collaborations. Coupled with an integration with Xakia for streamlined contract management, these initiatives align well with growth trends. Despite a challenging tech sector environment, these positive product and partnership expansions seem to have bolstered investor confidence in DocuSign, supporting its stock movement even as broader market indices experienced declines, notably in the tech-heavy Nasdaq Composite.

DocuSign has 2 weaknesses we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

DocuSign's introduction of AI contract agents, a revamped partner program, and integration with Xakia positively impacts its Intelligent Agreement Management (IAM) narrative. These initiatives may catalyze interest in its solutions, particularly in the SMB, mid-market, and international sectors. This aligns with the outlined revenue growth strategy, possibly driving enhancements in subscription-based revenues and improving operational efficacy.

Over the past year, DocuSign's total return, including both share price appreciation and dividends, was 45.03%. This performance was stronger than the US Software industry return of 7.6% in the same period, indicating relative outperformance. The company's revenue is forecasted to grow, though at a slower pace than the broader market, while earnings are expected to decline over the next three years. The AI initiatives, despite potential risks, may bolster revenue forecasts by broadening customer uptake and improving efficiency, but earnings forecasts could be pressured by competitive challenges and economic uncertainties.

The recent share price rally to US$74.2 shows investor optimism aligned with the analyst consensus target price of US$92.95, highlighting a significant potential upside of 20.2%. However, a shift from a PE ratio of 14.1x today to the projected 68.8x by 2028 will be critical to justifying this target, contingent on future earnings meet or exceed predictions amidst anticipated margin pressures and per-share reductions. Investors should thoughtfully consider these aspects in the context of market conditions and evolving company strategies.

Learn about DocuSign's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)