- United States

- /

- Software

- /

- NasdaqGS:CYBR

CyberArk Software (NasdaqGS:CYBR) Gains SOC 2 Compliance For Secure Browser Innovation

Reviewed by Simply Wall St

CyberArk Software (NasdaqGS:CYBR) saw a 3% increase in its share price over the last quarter, potentially influenced by the achievement of SOC 2 Type 2 compliance for its CyberArk Secure Browser on April 2, which underlines its commitment to data protection. This announcement aligns with market trends where tech companies bolster security measures amid volatile markets impacted by the U.S. Government's tariffs. Despite a backdrop of declining markets, highlighted by a 4.7% drop in the Nasdaq due to trade tensions, CyberArk's developments possibly provided some investor confidence, contributing to its positive performance during a challenging quarter.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

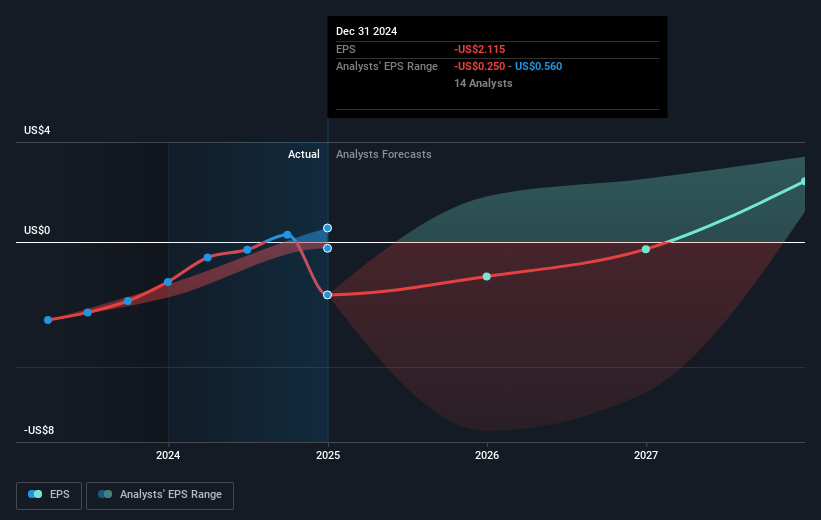

The last five years have seen CyberArk’s total return, inclusive of share price and dividends, rise by a significant 300.38%. This performance illustrates robust growth in investment value despite the challenges faced over the period. In contrast, over the past year, CyberArk has surpassed both the US Software industry's -0.3% return and the wider US market's 8.4% return. Critical to this growth were strategic acquisitions like those of Venafi and Zilla Security, enhancing their AI-driven identity solutions and offering cross-selling opportunities.

Additionally, CyberArk's commitment to broadening its product offerings was evident with the launch of solutions such as the CyberArk Identity Bridge. Enhancements were also seen in security through achieving SOC 2 Type 2 compliance for its Secure Browser, and new partnerships, like with Device Authority, focused on strengthening authentication. These developments, alongside a promising revenue growth forecast for 2025, underscore the company's focus on innovation within identity security solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives