- United States

- /

- Software

- /

- NasdaqGS:CYBR

CyberArk Software (NasdaqGS:CYBR) Announces Q1 Earnings With Revenue Up To US$318 Million

Reviewed by Simply Wall St

CyberArk Software (NasdaqGS:CYBR) recently reported its first-quarter 2025 earnings, showcasing a significant 43% increase in revenue to $317.6 million and a doubling of net income to $11.46 million. This impressive financial performance, underscored by increased earnings per share, aligns with the company's 3.4% share price rise over the past month. While this was in line with the broader market increase of 3.9%, CyberArk's positive earnings results and the release of the 2025 Identity Security Landscape Report likely added weight to its strong performance by reinforcing confidence in its strategic direction.

CyberArk Software has 1 possible red flag we think you should know about.

Rare earth metals are the new gold rush. Find out which 23 stocks are leading the charge.

The recent earnings report highlights CyberArk's capacity to enhance its financial stature with a 43% revenue surge to US$317.6 million and a doubling of net income to US$11.46 million. These results may reinforce the narrative of growth fueled by its acquisitions and strength in the AI-driven identity security sector. The company's integration of Venafi and Zilla Security suggests continued revenue enhancement and cross-selling potential, pivotal for sustained competitive positioning.

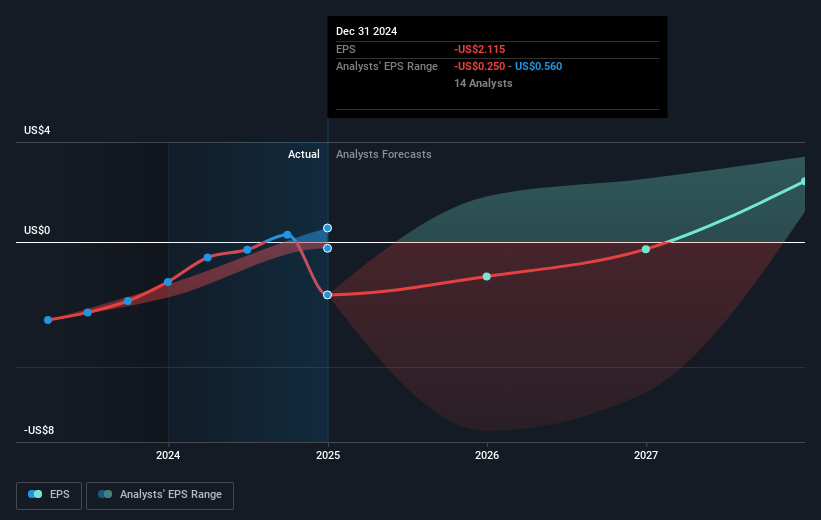

Over the past five years, CyberArk's total shareholder return surged by 276.07%. This longer-term performance reflects its ability to adapt and grow within its industry, despite being currently unprofitable. Over the last year, the company outperformed the US Software industry with a return exceeding 17.8%. This aligns with a confidence in its strategic direction, supported by a market expectation of future profitability and revenue growth. However, the company's current challenges in achieving set earnings targets might influence its valuation.

Given the company's recent share price of US$352.67, the movement aligns with analysts' forecasts, suggesting a potential appreciation toward the consensus price target of US$435.17. This target implies a 19% upside potential, contingent on meeting aggressive revenue and earnings forecasts. The integration benefits and market expansion possibilities could drive meeting this target, assuming effective management of risks associated with acquisitions and market complexities. The company’s current valuation seems high, with its Price-To-Sales ratio exceeding industry norms, highlighting the importance of realizing expected financial improvements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)