- United States

- /

- Software

- /

- NasdaqGS:CYBR

CyberArk Software (CYBR): Assessing Valuation After Optiv’s Major Workforce Identity Security Deployment

Reviewed by Simply Wall St

Most Popular Narrative: Fairly Valued

CyberArk Software is viewed as fairly valued according to the most popular analyst narrative, with the current share price closely aligned to consensus estimates for fair value based on financial projections and future growth expectations.

The integration of Venafi and Zilla Security into CyberArk is expected to enhance its competitive position in identity security. This integration is anticipated to provide opportunities for revenue growth through cross-selling within its existing customer base and expanding its total addressable market. The acquisition of Zilla Security aims to address longstanding inefficiencies in identity governance administration (IGA), which is expected to reduce operational complexity and improve CyberArk's net margins by offering faster deployment and integration than traditional IGA solutions.

Want to know what powers this lofty valuation? The blueprint behind the analysts’ target is a bold leap in future profit margins and a bet on revenue expansion that goes well beyond the industry norm. One element is a projected turnaround that hinges on sustained earnings growth, but the assumptions behind these forecasts may surprise you. If you're curious about the financial engine fueling this fair value call, the real numbers are the real story.

Result: Fair Value of $462.53 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, integration risks with recent acquisitions and growing market competition could quickly shift CyberArk’s outlook if these factors are not managed effectively.

Find out about the key risks to this CyberArk Software narrative.Another View: Discounted Cash Flow Perspective

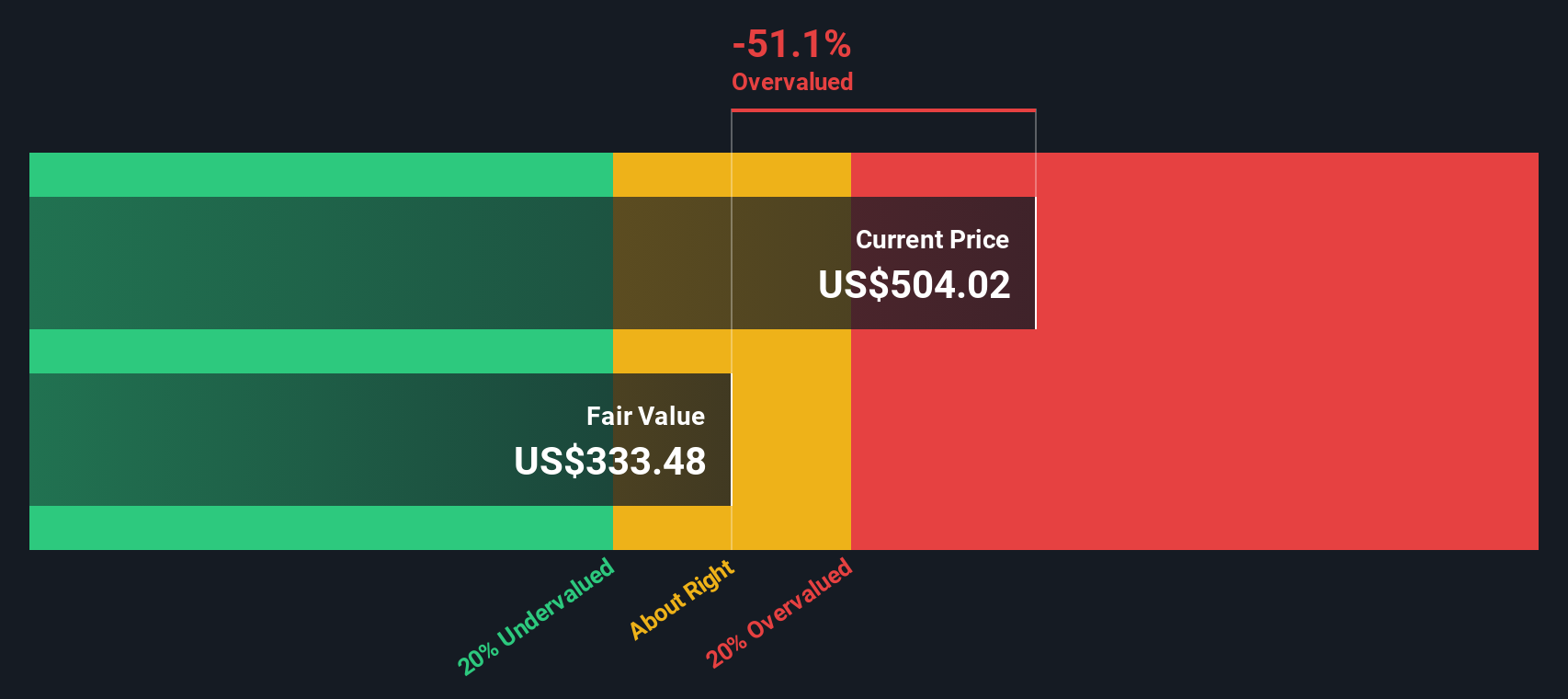

A different angle comes from our DCF model, which looks at future cash flows instead of what analysts expect or multiples. This method actually sees CyberArk as overvalued. Does the real answer lie somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CyberArk Software Narrative

If you want to dig into the data yourself or question these conclusions, you can craft your own view of CyberArk in just a few minutes. Do it your way.

A great starting point for your CyberArk Software research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss the opportunity to spot new trends and seize potential winners. Simply Wall Street’s screener helps you zero in on hidden value and tomorrow’s standout stocks.

- Uncover fast growers with solid financials and see which companies are shaking up the market with penny stocks with strong financials.

- Tap into the rise of artificial intelligence by checking out up-and-coming innovators through our AI penny stocks.

- Find undervalued gems before the crowd catches on using our unique screen for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion